I picked up a few amazing quotes this week. The first was someone telling me about the payments conference they attended where one of the large UK banks (HBOS, part of Lloyds Banking Group) said that their customers were now moving to mobile only. Apparently, in the last yaer, one in five of their customers have only accessed the banks’ service via mobile. They haven’t used branch, call centres or even internet banking. Just mobile only.

That shows how banking has changed.

The second quote is from Ross McEwan, CEO of the Royal Bank of Scotland, who states that:

“our busiest branch in 2014 is the 7:01 from Reading to Paddington - over 167,000 of our customers use our Mobile Banking app between 7am and 8am on their commute to work every day.”

Add some US research papers such as the 2015 Bank of America Trends in Consumer Mobility Report , which found that more than half (51%) of Americans are using mobile or online as their primary method of banking.

Another study by JP Morgan Chase and Braun Research finds that 47% of American consumers prefer using the banks’ app on a mobile phone or tablet, rather than alternative access mechanisms.

More worrying perhaps is Accenture’s 2015 North America Consumer Digital Banking Survey, which discovers that 81% of consumers would not switch banks if their local branch closed. Only two years ago, that number was 48%. In other words, 52% of consumers would switch two years ago whilst only 19% would switch today, mainly because they have mobile access 24*7.

Add these to other quotes I’ve used in the past:

It took 13 years to get two million customers using Internet banking; it took just two months to reach that number for mobile banking. [Barclays Bank]

It took 10 years to get twenty million contacts per month through Internet banking. It took 18 months for mobile. [Société Générale]

and you can see why some people think a mobile-first, or mobile-only, strategy will succeed. And it will succeed for some, but one size does not fit all. For example, I found this article from the Financial Brand interesting, which covers a recent study by a recent study by CFI Group:

When asked how important it is to have a branch nearby, 64% said it was either important or very important. Only 10% of bank customers told us the branch location was of little or no importance. 68% of respondents said they live less than three miles from the nearest branch. This is true for both new and long-time customers.

And yet ...

Only 37% say they are going into a branch more than once a month according to the CFI survey. Nearly a third (31%) say they are using the branch less often than just three years ago, compared to only 17% who use it more.

Seems to me there is much confusion here and what we will end up with is a myriad of financial providers, some with physical access, some without; some with digital only, some with access in any form you want.

In fact, the only thing all of these quotes and stats clearly show is that customers want to have their cake and eat it, and banks are indulging too many of them by giving them not just flour and milk, but sprinkling a good bit of cream, jam and butter in there as well. What I mean by this is that banks are great at launching new things but they’re really feeble when it comes to closing old things. Why do we have so many branches and so much use of cash and cheques in an age where all can be digitised?

Banks have to start getting their ingredients right if they are to succeed in the future. This is born out by a World Economic Forum report http://reports.weforum.org/future-of-financial-services-2015/ , which came out yesterday detailing the most likely near-term future for the financial markets The report shows that the greatest danger to banks is not a Kodak moment http://thefinanser.co.uk/fsclub/2015/03/are-we-going-through-a-kodaknokia-moment-in-banking , but a commoditisation of the whole marketplace.

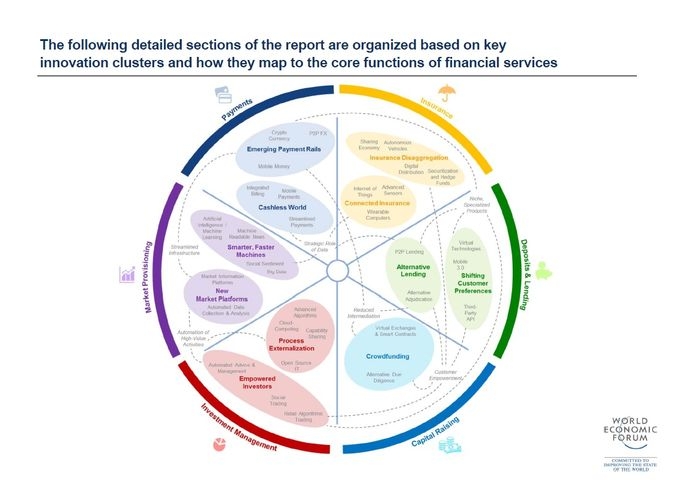

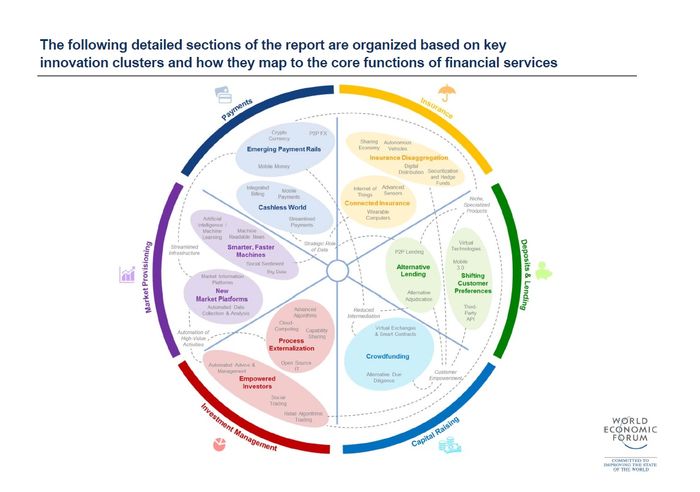

The 179-page report makes for interesting reading and is best summarised by this chart:

However, if you don’t get the chart and don’t want to read 179 pages, then our friend Anna Irrera at eFinancial News summarises the seven big headlines well:

Distributed ledger systems—such as the blockchain technology underlying bitcoin—and mobile payment systems provide “compelling alternatives” to traditional banking, according to the report. Global settlement infrastructure and emerging markets are seen as the most immediate opportunities for developing alternative payment systems. These innovations will make the future of value transfer and settlement systems more global, more transparent, faster and cheaper. They may also weaken the role of today’s intermediaries—such as the payment networks—and reduce margins for incumbents. Industry collaboration will be the key to ensuring that new initiatives are successful, the report says.

Peer-to-peer lending will erode deposits

The report suggests that the growing popularity of alternative lending platforms including peer-to-peer lenders—will erode traditional deposits, as savers switch to the new platforms as a form of short and medium-term investment. Ultimately, this could cause bank balance sheets to shrink. Traditional institutions need to diversify their products to compete against the new entrants, switching away from a “one-size-fits-all” approach, the report says.

Crowdfunding puts pressure on intermediaries

The growth of crowdfunding platforms, which connect start-ups with potential investors, is offering individuals the potential for higher returns, which could lead them to shift their investments from traditional wealth management, the report says.

Innovations in this sector may also put pressure on existing intermediaries such as venture capital funds looking to raise funds, although it could also work to the advantage of some incumbents such as hedge funds because it offers them smaller investments with less hassle, according to the report.

Robot advisers turn up the heat

As more customers switch to automated wealth management services, financial institutions will struggle to sustain their traditional “one-stop” model of distributing wealth products through their advisory channels, the report says.

New entrants will also force wealth management services to become more “commoditised”, making several segments less profitable and intensifying competition among traditional players in more specialist areas, according to the report. To differentiate themselves from the new entrants, the report says that the traditional institutions will have to leverage the customer trust in their brand.

Loss of skills

Investment firms are increasingly relying on services offered by young fintech companies to carry out several processes such as risk modelling, transaction monitoring or data collection. While this is more efficient, it does mean that finance firms are more dependent than ever on third parties to keep their systems running reliably, the report says. It also argues that this could lead to potential loss of core skills in their workforce, leaving finance institutions less able to offer a “holistic”, all-encompassing service.

Trading gets riskier as it becomes more electronic

The report paints a vision of a trading environment where “intelligent machines will replace largely human activities”. Machines will become smarter and faster, helping develop trading strategies and leaving humans to take a back seat in execution, the report says. But there are dangers, too. As machines take a bigger role, errors will have a large impact, with even small errors in data having large consequences. The increasing automation of trading could also marginalise returns, as strategies become more based on big data and computer technology.

New market platforms make institutional products less sticky

The report notes that the growth of the new platforms which use technology to connect buyers and sellers in traditionally illiquid markets—such as trading of shares of private companies—is diminishing the role of intermediaries, such as banks. As some of their institutional clients choose to trade directly via these platforms, the incumbents might struggle to maintain their other institutional footholds such as investment banking. The result is that established players will try to acquire new platforms, the report says.

Now, if that’s not enough reading for a Thursday to get you all geared up for a knowledge dump, then I don’t know what is.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...