I’m often asked how quickly the changes I outline will take place, and my answer is between 10 and 20 years. The building of the real-time, almost free financial network on the internet using blockchain and mobile will take about a decade at least before it becomes mainstream. Oh, some go. That’s a way off. Can we talk about something happening sooner?

That’s an interesting reaction, as sure we could talk about how Apple Watch Payment apps aren’t working or the big deal with Chase Pay, but c’mon. I’m not talking about incremental innovations here, but fundamental ones. The rebuilding of the whole financial markets using shared ledgers. The inclusion of 7 billion people in the financial network through mobile. Those are the big ticket items. Another user of Stripe is interesting, but it’s not the massive change we can see coming downstream.

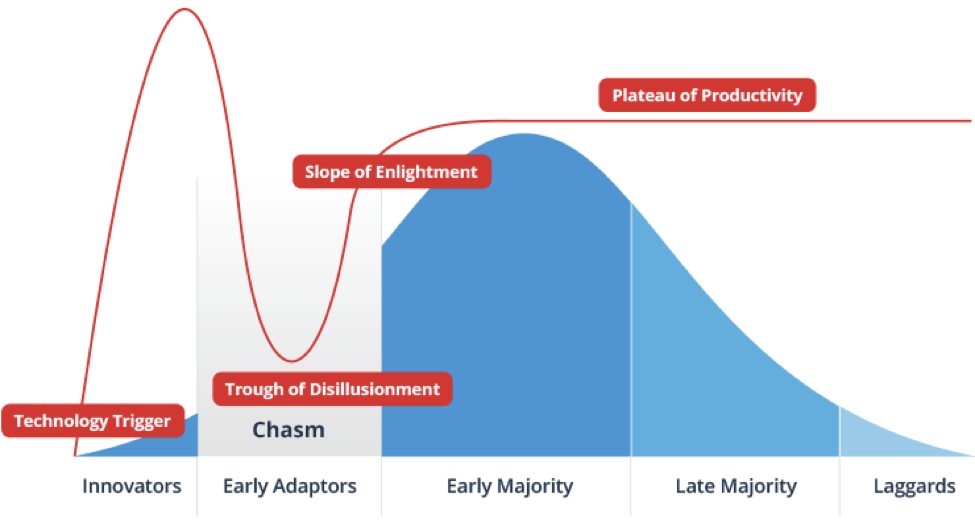

So why is this fundamental change going to take ten years, at least? Because that’s how long any major change takes to become mainstream due to The Waterfall Effect.

The Waterfall Effect is exactly that: the cascade of flowing change from idea to implementation to acceptance to mainstream; and you have to remember there are many players in play here. It starts with a new technology, such as the blockchain shared ledger protocol.

The technology then has to be built into something robust and new providers are created to innovate – Blockapps, Chain, Chainalysis, Choosecase, Circle, Coinbase, Consensys, Epihpyte, Erethreum, Eris, Ledger X, R3CEV, Ripple, Symbiont, Tradeblock and more – and to allow this technology to be adopted.

Then the large incumbent technology providers start their programs to join these new innovators and bring them into an architecture that works for their bank clients. Some say the incumbent technology companies move too slow. In fact, some believe that the real problem is not the banks’ legacy systems but their legacy providers, but hey, let’s not go there. Eventually, the providers get it, and adapt and adopt the technologies into their frameworks and architectures.

Eventually it’s ready for bank prime time.

Then that’s another story, as now the banks have to adapt and adopt the frameworks and architectures from their incumbent providers and innovative start-up partners. That takes time, and different banks move at different speeds dependent upon the use case and ability to change.

Let’s say this has taken about six years, and that’s how long it’s taken to get shared ledgers from Satoshi Nakamoto’s white paper to serious use cases being adopted by banks as proof of concept (POC). That’s still a way off from POC to implementation and mainstream use. The latter is still 3-5 years away in many cases. For the sake of argument, let’s say it takes a decade to get from the white paper to mainstream incorporation.

OK, so now we’re getting somewhere, but we’re still not there as the corporations and consumers haven’t been touched yet. Often a bank can innovate and sometimes even innovate fast, but then their customers have to change too. Corporates will adapt and adopt a technology that will reduce costs and improve straight through processing but, a bit like the banks and their incumbent technology providers, the corporates also have legacy systems and legacy providers who also have to adapt and change.

Give that another five years and then, finally, consumers can have the service. But do they want it? According to many of my bank friends, every time they update their bank apps with new features and changed interfaces, their Net Promoter Score (NPS) goes down. This is because 80% of customers don’t like change. Shoot. So the consumer takes another year or two before they switch onto the new cheaper, faster service. And hey. We’ve got there.

But this waterfall effect – new technology, start-up developers, incumbent providers, main markets of usage, clients of main market users and, finally, customer of clients – means that nay major technology change takes at least a decade to maybe three decades before it gets mainstream. After all, the mobile telephone was invented in 1973 but took almost thirty years to become mainstream. We talk about how things are moving faster – apps go viral in seconds – but these are things that move once you’ve changed the underlying architecture, and that’s why ground-breaking change takes decades. Once you’ve made the change however, everything that sits on that underlying architecture can move at light speed.

This is why the blockchain will take another decade before it is mainstream, as it’s changing the foundations, the rails, the roads of finance. It’s not just a bit of froth on the foundation, like most of the apps out there.

The blockchain is a foundation, not a bit of froth