I haven’t written about blockchain for a while. I guess it’s because I got bored of it. I’m not bored of the promise of blockchain and distributed ledger technologies. Just bored of how much hype there has been and of so many companies claiming to have the latest blockchain breakthrough.

However, when I saw this morning’s Bloomberg headline about using blockchain to sort out vote rigging, I had to clickthrough. The story is about trying to stop vote rigging in the midterm elections in the USA by registering votes through an app on a blockchain. The app allowed “an Army first lieutenant in Vicenza, Italy—to cast a ballot with his smartphone. ‘In the same amount of time that I could’ve pulled up and watched a YouTube video,’ Scott Warner says, ‘I actually got to go perform my civic duty.’”

Great.

I’ve blogged before about the use cases for blockchains in financial services (see end of blog), as well as dedicating most of the book ValueWeb to the subject, but that was in 2015/16 and times move on. Since then, I’ve blogged about how the technology is slowly developing, and how firms need business model change before applying such technologies.

Now, I’m interested in some other use cases outside finance, such as avoiding vote rigging. Another is a presentation I attended recently in Finland, talking about using R3’s Corda for building a live land deeds registry system which will be in production next year. Note, that R3’s Corda is not a blockchain system, but a “blockchain-inspired” system. This is because there have been so many companies focused upon blockchain technologies since bitcoin arrived, that many discovered you don’t actually need a blockchain to create a shared ledger. Hence, why we now talk about distributed ledger technology (DLT), as DLT can operate with or without a blockchain. In fact, you don’t need a cryptocurrency to run a blockchain or a blockchain to run a DLT. No wonder it is confusing, as blockchain brings together all the things we don’t understand about technology with all the things we don’t understand about finance.

Anyway, one of my favourite blockchain companies is Everledger, who I blogged about a while ago. The key to Everledger is proving the provenance of diamonds, and now fine art and fine wine. The key to blockchain is proving the provenance of anything, and building an internet of trust.

This is related to another of my favourite blockchain use cases: charity. This idea came from Ant Financial, who I reported earlier this year claim more blockchain patents than any other company in the world. Ant Financial has a charity called Ant Love, and they are using blockchain to track and trace exactly what money donated goes where. In other words, they are bringing transparency to charity, something that I’m all for having seen several charity leaders lining their pockets with money that was meant for front line services.

Alibaba also has some interesting blockchain projects, such as using the technology to bring transparency to food. Ever wondered if that tuna your local supermarket claims has been ‘line-caught’? Now you can find out if it’s true.

These are all good examples of how the technology is developing.

Intellectual copyright is another, as illustrated well in the music industry. Not only can blockchain records prove who wrote the song and owns the copyright, but equally who is downloading the music and how to ensure that payments for downloads are given directly back to the artist. As Wired https://www.wired.co.uk/article/blockchain-disrupting-music-mycelia reports:

One of the early innovators in this area is Grammy-winning British singer and songwriter Imogen Heap, who in 2015 used the Ethereum blockchain-based Ujo platform to launch the song "Tiny Human" for $0.60 (45p) per download. Now she is working on her own blockchain-based offering, Mycelia, a fair-trade music business that gives artists more control over how their songs and associated data circulate among fans and other musicians.

In fact, there are many blockchain related developments taking place although, as mentioned, not all are blockchain-based. Some are blockchain-based, whilst others are blockchain-inspired. Unfortunately, they all get lumped into being called blockchain, which is why it gets confusing and why blockchain appeared to be able to automate everything from homelessness to poverty. I’m not saying it cannot assist in such project areas, but the difficulty is working out when and why you need to use a blockchain or not.

Source: David Birch

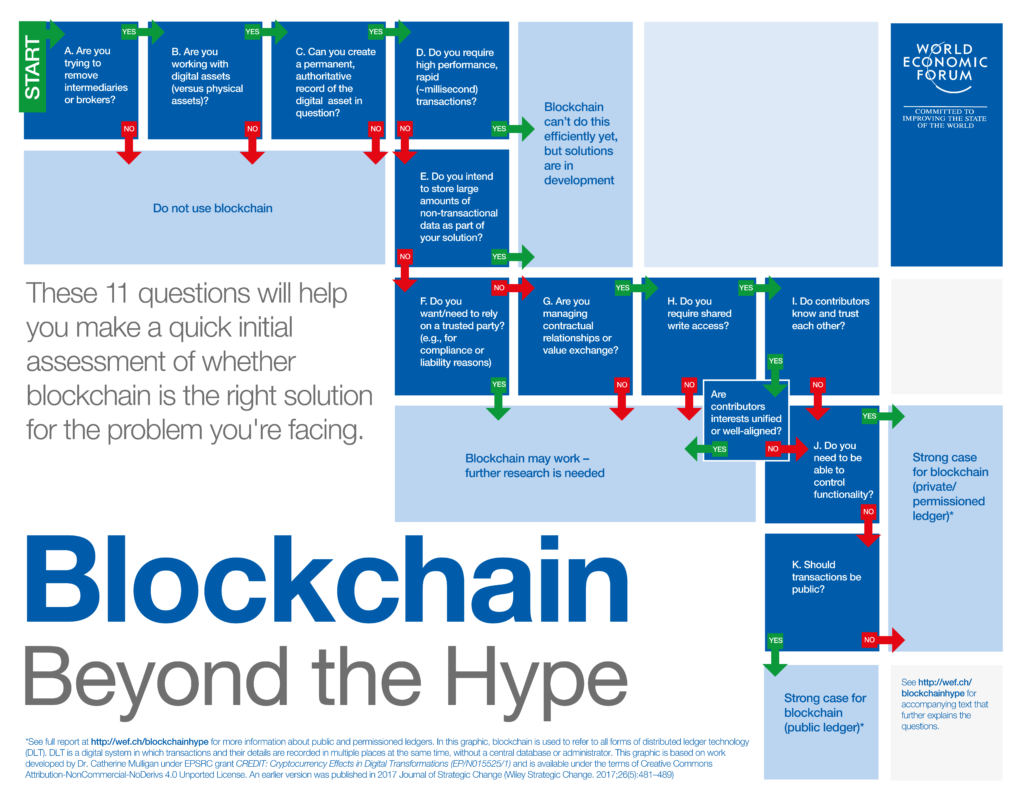

To answer this question, I refer to Sebastian Meunier’s blog and this chart from the World Economic Forum that cites a number of questions you should ask before going down the blockchain route (click chart for larger version).

All in all, it’s an interesting space, but not a panacea for everything. In fact, it’s the reason why I keep saying we have the horse – blockchain and DLT – but we need to design what the horse is pulling, the cart, and get all of the key players to sign-off on that design, before we can attach the horse to the cart.

We need reality here which is that yes, blockchain and DLT will help many areas where trust is needed, but not everything, everywhere. Meantime, one of the best areas of development is in Dubai, who aim to be one of the world’s first blockchain-powered governments; although they have competition from China which I would say is leading the race to governmental blockchain projects.

All in all, yes, we see massive change and developments taking place, which is why the Harvard Business Review calls it a foundational technology:

Blockchain is a foundational technology: It has the potential to create new foundations for our economic and social systems. But while the impact will be enormous, it will take decades for blockchain to seep into our economic and social infrastructure.

As long as it can resist quantum computing of course.

From my blog in 2016:

THE USE CASES FOR BLOCKCHAIN IN FINANCE

Applying Blockchain to Clearing and Settlement

I’ve talked a lot about blockchain, but not much lately about the use cases, of which four stand out in terms of real activity: Clearing and Settlement, Trade Finance, Payments and Digital Identity. I thought I’d do a deeper dive into these during the quietness of …

Six Standout Start-ups Focused Upon Blockchain Clearing and Settlement

After yesterday’s blog generally about blockchain use case implications in Clearing and Settlement markets, here are the six companies I see as being at the forefront of changing the game: Digital Asset, SETL, tO, Clearmatics, Symbiont and itBit. Digital Asset Digital Asset – also known …

Applying Blockchain to Trade Finance

After Clearing and Settlement as a blockchain use case, the next big area of interest is Trade Finance. This is primarily because it’s an area full of inefficiencies and open to fraud. Bills of Lading and Letters of Credit are old world methods of managing …

Five Standout Start-Ups Focused Upon Blockchain Trade Finance

In Trade Finance there’s a lot of activity. As mentioned yesterday, you have HSBC and Bank of America working with HyperLedger; R3 trialling with 15 banks based upon Corda; Ripple working with Standard Chartered and DBS; and JPMorgan have been developing a trade finance trial …

Applying Blockchain to Payments

I’ve blogged for over a week about blockchain based developments in Clearing & Settlement and Trade Finance, and will continue for another week talking about the developments in Payments and Digital Identity. However, at this point, I should clarify that I use the term blockchain …

Nine Standout Start-ups Focused Upon Blockchain Payments

There are a number of base blockchain platforms that are important in the payments sphere, with the three leading players being Bitcoin, Ethereum and Ripple. These are the base development platforms, rather than a payments service per se, and choosing which to use is intriguing …

Applying Blockchain to Identity

In my final deep dive into blockchain use cases, I come to digital identity. Now this is a thorny area for three reasons. First, we need to understand what we mean by identity before we can talk about how blockchains could help. Second, we need …

12 Standout Start-ups Focused Upon Blockchain Identity

Digital identity is a complex area, as discussed yesterday. First, it is focused upon shared ledgers and blockchain, not just blockchain; second, it needs to have some permission basis; third, we need to have a structure agreed for who is providing permissions; and fourth, it …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...