Over the past week or two, the neobank and challenger bank sector has been issuing financial reports. If you haven’t noticed: WHERE WERE YOU?

Monzo got a particular hammering for warning that the coronavirus pandemic could impact the company as a going concern. Some argue this is just accounting and auditing speak to warn of long-term issues if the pandemic continues; others say it shows Monzo is vulnerable and not stable.

I personally don’t argue either way, as I’m not an auditor or accountant. However, I can point to issues out there that the media are picking up on.

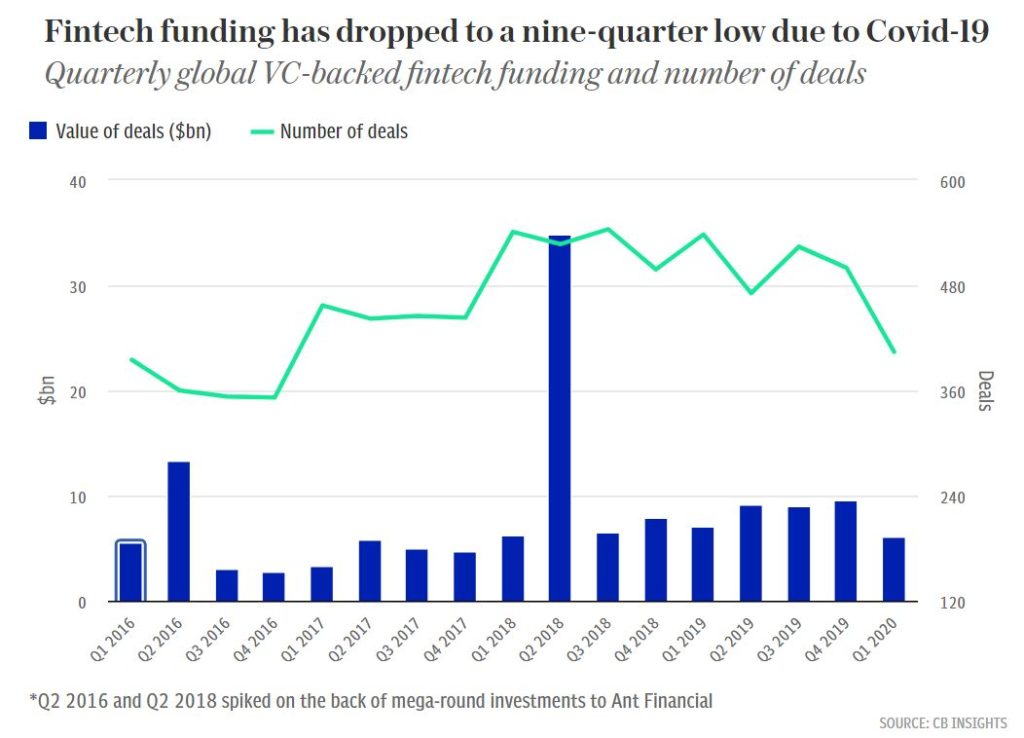

One issue is that funding is drying up for FinTech innovation. According to The Telegraph, funding is at an all-time low as is interest in challenger banking.

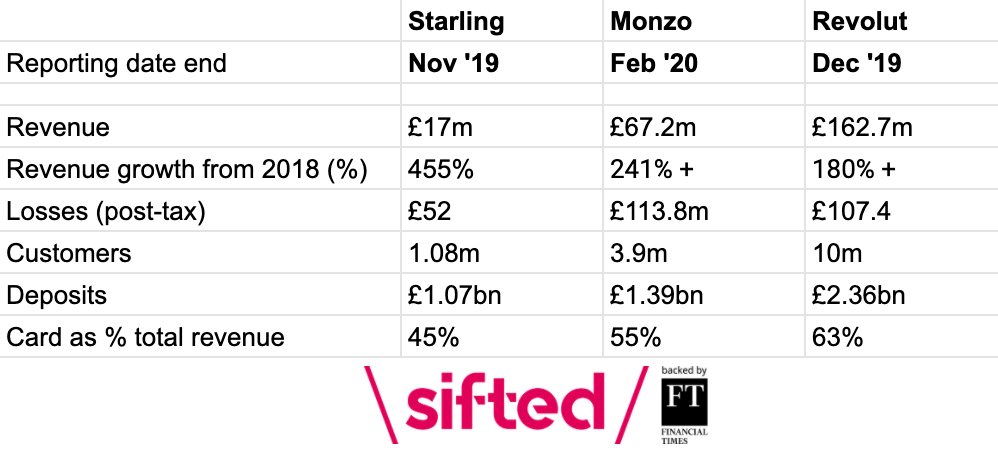

Monzo’s annual report, which covers a 12-month period to February, saw the start-up’s losses rise from £47.1 million to £113.8 million …

[Starling Bank] reported losses of £52 million in 2019, up from £25 million for the previous year. Despite this, chief executive Anne Boden remains optimistic about the company’s prospects based on its performance during lockdown …

Revolut’s losses rose to £106.5 million last year https://www.telegraph.co.uk/technology/2020/08/11/losses-monzo-rival-revolut-rise-105m/, although revenues increased sharply from £58 million to £163 million in 2019.

Sifted gets into this thorny issue in more depth.

And highlighted this tweet from Marc Rubenstein:

UK challenger bank annual reports are all in.

A few highlights 👇 pic.twitter.com/BxHJuVIIVP

— Marc Rubinstein (@MarcRuby) August 11, 2020

Well spotted. The issue for Monzo is high growth at what cost? Starling has grown more slowly and, in light of where we are now, some would say more surely.

Anne Boden, founder of Starling, certainly would. Bearing in mind that Tom Blomfield, founder of Monzo, originally worked on the Starling start-up, there’s some history here. This issue and friction was highlighted well by Wired:

Is Starling the Darling? https://t.co/Gktr0zLqKX@WIRED contemplates

— Chris Skinner (@Chris_Skinner) August 7, 2020

Starling announced that it generated £6.7 million for the month of July 2020, meaning that it could make an annual revenue of £80 million. This would make it the first major UK neobank to turn a profit.

These new results contrast with those of rival Monzo, which last month expressed “significant doubt” over its ability to continue after doubling its losses during the pandemic. Monzo's annual accounts showed losses widening from £47.2 million to £113.8 million amid a hiring spree, marketing and US expansion. Revenues more than tripled in the same period, from £19.7 million to £67.2 million.

The challenge with Monzo is that it’s not lending effectively. As pointed out by Josh Williams, MD of The Draft, in City AM:

The reason for Monzo’s ill-fortune is that the bank has lent so little and found no other way to make money. Last year, its lending amounted to just seven per cent of its asset base, and most of that was overdrafts. It was only last year that Monzo began lending properly at all.

Similarly, Revolut has a big issue as 60% of its income comes from interchange fees. With foreign travel and everyday spending curtailed by the pandemic, they are also cash-starved right now, although their funding round just before the pandemic kicked in helps, as does Monzo’s.

The biggest issue for these companies is not losses but growth. Investors expect them to lose money as they grow; however, if the companies are not growing, there’s the issue and, in my own terminology, I describe many of these neobanks as lifestyle banks. My boring old bank gets my boring old bills – utilities, loans, mortgages, etc – whilst my brand spanking new neobank gets my everyday spending – shopping, entertainment, food, drink, going out, etc.

There’s the issue: I’m not going out. Their customers are not going out. Their customers have no lifestyle everyday spending, because they’re staying at home.

As David Brear says, quoted in The Telegraph article:

“Day to day banking just hasn't happened for three months.”

That’s the issue right there. Then the question is: when will day-to-day banking or, rather, day-to-day life start up again?

Until it does, many neobank and challenger bank firms are fundamentally on the back foot and how long can they stay on the back foot?

As long as they are still getting deposits.

And that’s the final point that Sifted looks into well.

Collectively, the three challenger banks held £4.8 billion of customer deposits at the last count. That still makes them very small. By comparison, Virgin Money, one of the previous crop of “challenger” banks, has around £64 billion in customer deposits; and Metro Bank has customer deposits of £14.5 billion [Lloyds Banking Group has £250 billion].

Still, one important point of comparison for Starling, Monzo and Revolut is how much money users deposit on average.

Starling leads here, pulling in £999 per user at the last count; largely due to its headstart in business banking, where deposits tend to be larger.

Monzo is now in second place, increasing its average user deposit rate to £357 from £142 in 2018.

Meanwhile, Revolut has dropped from having an average deposit of £251.66 per user in 2018, to £236.

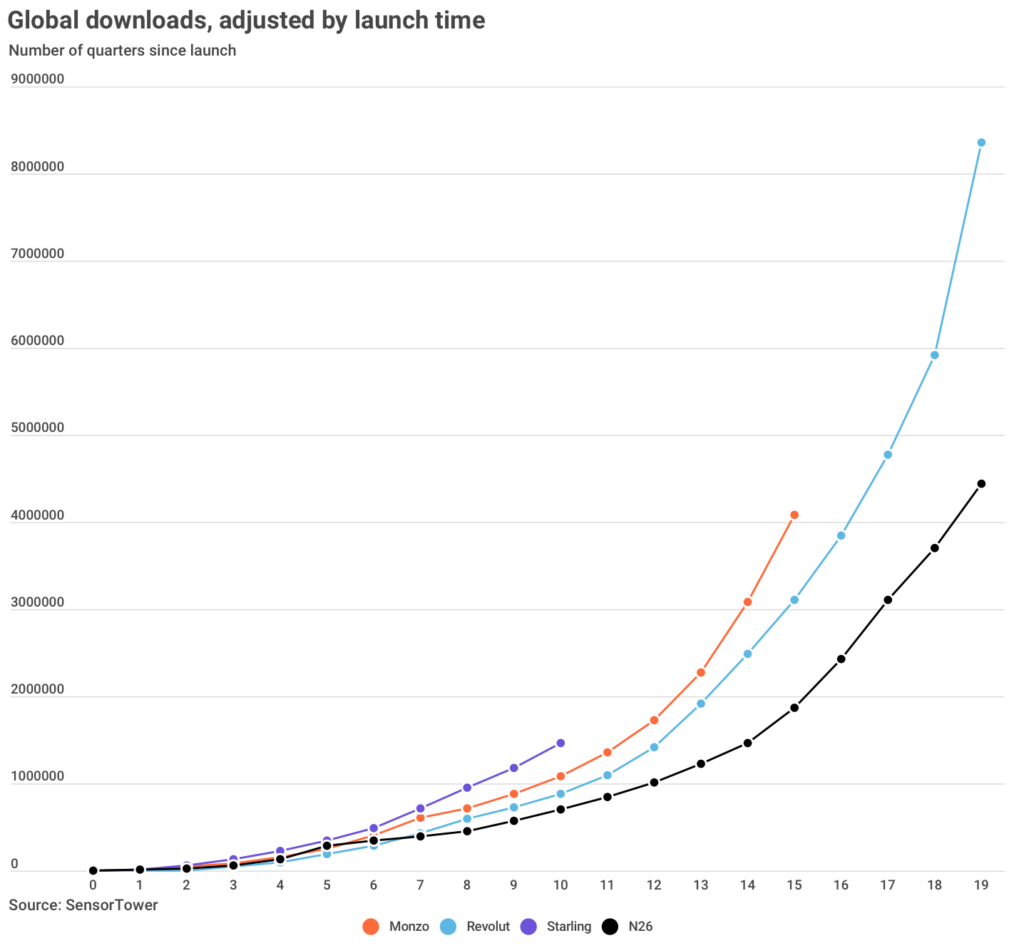

Starling is also technically acquiring customers the fastest in the UK, when adjusting for its age, as shown in the graph below. This reflects the fintechs’ pace of growth in their’ home markets from their launch date.

Maybe this is why Anne Boden predicts that Starling will be profitable by the end of this year … unlike others. As she says in her investor letter:

I’m reminded of what Warren Buffet said at the time of the financial crisis, “Only when the tide goes out, do you discover who has been swimming naked.”

Too true.

Meantime, a couple of useful slide overviews over here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...