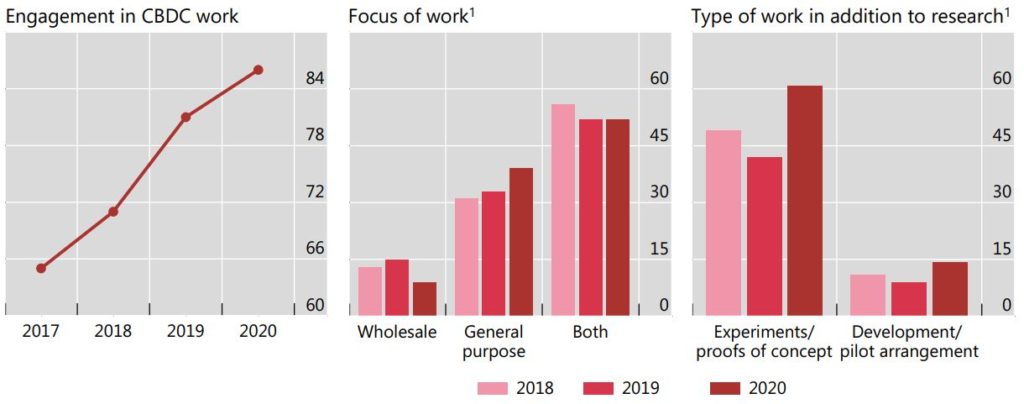

I’m very aware that central banks are investigating the use of digital currencies, particularly as they can now see bitcoin gaining more and more traction (Tesla, Square and more committed – next is Apple?), but had not realised how extensive are those investigations. According to the Bank of International Settlements (BIS) latest paper, 86% of the central banks surveyed are investigating issuing digital currencies.

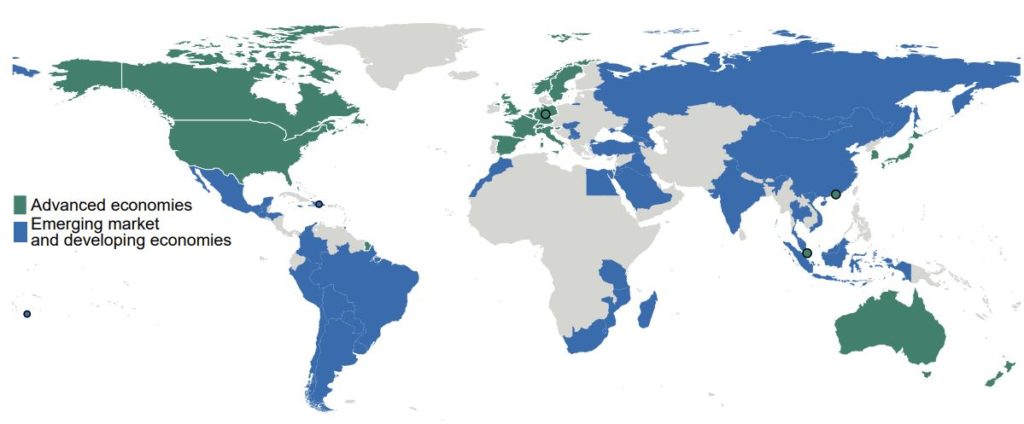

Interestingly, it is the less advanced economies that see CBDCs (Central Bank Digital Currencies) as more important. 7 out of 8 central banks in advanced stages of CBDC work are in what the BIS classify as ‘emerging or developing economies’.

This is because they believe it will promote more financial inclusion. Equally, creating more efficiency in the domestic payments system is a key, along with financial stability.

The majority of central banks are focused upon retail digital currencies, whilst wholesale is less of a priority except for cross-border transactions.

Interestingly, from a legal and regulatory perspective, a lot of CBDC work cannot happen until laws are changed. A quarter of the banks surveyed are now moving to a position where they can launch CBDCs with legal authority, but that leaves 26% who do not have the authority and 48% who remain unsure. This reflects the fact that most countries are in research and experimentation mode, with few ready for pilots or live production systems … yet.

I say yet, as the survey also found that central banks collectively representing a fifth of the world’s population are likely to issue a general purpose CBDC in the next three years. Having said that, 60% of central banks surveyed do not expect to issue a CBDC for the foreseeable future.

Interestingly central banks are using cryptocurrencies when their economies become financially unstable – think Venezuela – whilst the majority avoid such currencies and prefer stablecoins. Two thirds of central banks are studying the impact of stablecoins on monetary and financial stability.

Interesting timing of this report (January 2021) and the fact that a few days later Fabio Panetta, a member of Executive Board of the European Central Bank, makes a speech titled:

Evolution or revolution? The impact of a digital euro on the financial system

In the speech, Panetta makes a point of the fact that digital euros could come with a penalty if you don’t spend them.

A digital euro would give access to a safe liquid asset which could potentially be held in large volumes and at no cost. Indeed, if not properly designed, in times of crisis, a digital euro could accelerate “digital runs” away from commercial banks towards the central bank. This risk could even be self-fulfilling, leading savers to reduce their bank deposits and amplifying volatility in normal times too ... a digital euro should therefore be designed in a way that enables this risk to be strictly controlled.

What would that be?

It would be punitively unattractive interest rates of more than minus two percent on larger digital euro holdings. In other words, to make it more like cash, the aim would be to stop people holding large amounts of digital euros.

… set a penalising remuneration on individual users’ digital euro holdings above a certain threshold. Up to that threshold, amounts held in digital euro would never be subject to negative interest rates and would thus never be treated less favourably than cash. Above that threshold, remuneration would be set so that larger digital euro holdings are only worthwhile to make larger payments and not on an ongoing basis as a form of investment … as a yardstick, a threshold of €3,000 would be more than the amount of cash most citizens hold today and would be above the average monthly wage in most euro area countries.

At a separate event, ECB President Christine Lagarde said that a central bank digital currency could be in place within four years.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...