Building on my recent thoughts, I cannot for the life of me understand how a bank can spend so much on technology and yet be so inefficient. By way of example, let’s take a bank cost-income ratio. That’s the measure of how much a bank spends to operate, and the profit it then makes.

In 2000, German banks spent €0.777 to every €1 of income which, by 2017, had risen to €0.85 to every €1. French banks spent €0.709 in 2000 falling slightly to €0.67 by 2017. US banks spent $0.605 to operate for every $1 made and, by 2017, that was $0.57. Meantime, UK banks spent £0.48 for every £1 of income in 2000, rising to £0.687 in 2017.*

The big US banks talk grandly about spending more than $10 billion a year on tech, and yet where’s the returns. Reading the results, they’re not there.

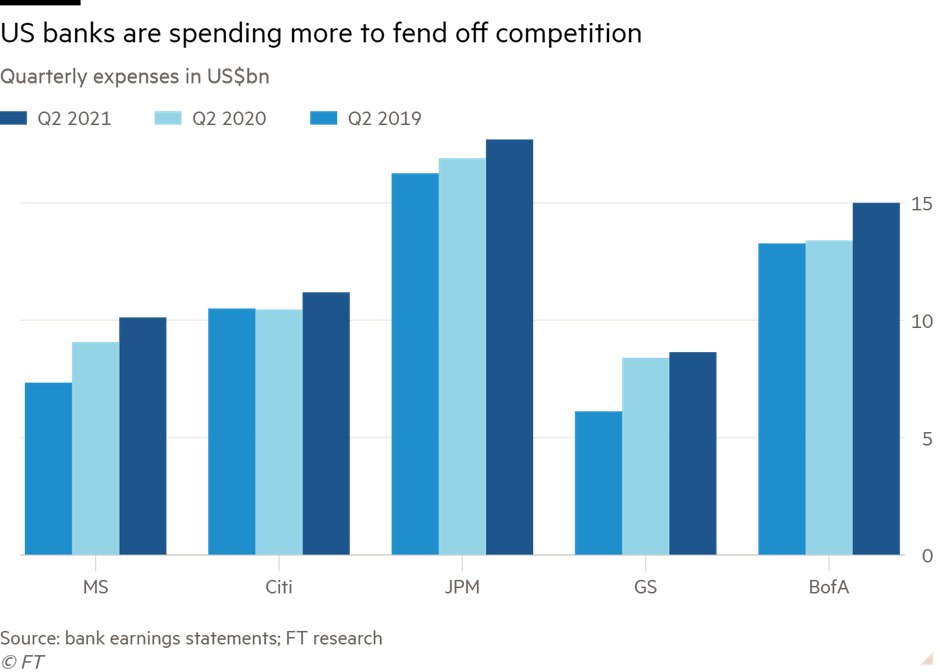

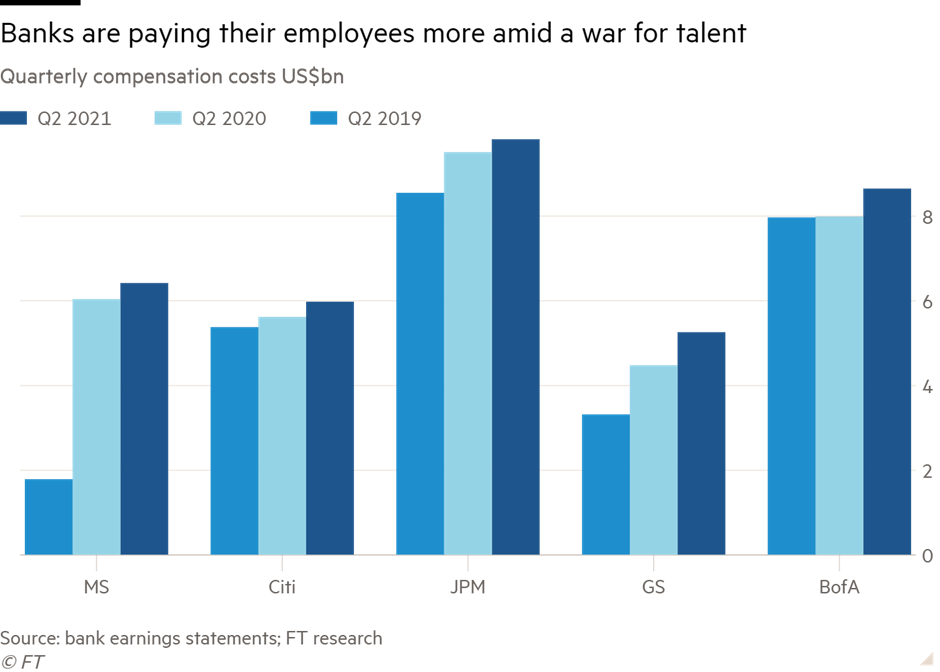

Costs at the top US banks jumped more than $6.6bn in the most recent quarter, as the intensifying battle for talent and the growing threat from new fintech rivals forced executives to step up spending.

The 10 per cent increase in costs compared with last year at JPMorgan Chase, Goldman Sachs, Morgan Stanley, Bank of America and Citigroup surprised analysts. Many had predicted that expenses would fall modestly this year as the extra spending associated with doing business during the pandemic faded away …

Cost increases at most US banks are outpacing revenue growth while banks grapple with historically low interest rates and a sharp slowdown in lending.

Expenses at the five banks were 21 per cent higher in the second quarter compared with 2019, before the pandemic hit, according to the latest earnings releases. But second-quarter revenues just rose 10 per cent compared with 2019.

What I don’t understand is how banks can spend so much on tech and yet deliver such meagre improvements. Or maybe I do understand. It’s all about power bases, silos, protecting turf and baronial battles politically internally.

Maybe that’s why banks are gearing up for more investing in FinTech companies than dealing with their own internal issues. By way of example, Pitchbook and Sifted estimate that banks tripled their investments in start-ups in the last five years.

[CVC: Corporate Venture Capital]

Whatever the situation, my belief is that banks are hugely inefficient machines. They take profit from basis point differentials that are unsustainable, are challenged by many new entrants and see change as inevitable but too difficult. It’s just lucky their customers are scared of change, happy to pay more to not change and don’t care about efficiency. All they care about is security and safety.

A perfect marriage.

* all figures based upon statistics found at https://www.theglobaleconomy.com/rankings/bank_cost_to_income/

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...