Banking in 2022 has a number of forecasters. Deloitte claim that banks are at a make-or-break moment.

I agree. My feeling is that banks are dealing with digital transformation – a thing they should have dealt with a decade ago. For the next decade, they need to deal with investment transformation. Why? Because of the link between banks, investing, corporations, fossil fools and climate.

Another report talks clearly about the connection between banks and climate impact, and this is another key area of change (it’s all in my new book Digital for Good, coming out in March). The report states that “if the financial-services industry was a country, it would rank as the world’s fifth-largest emitter of greenhouse gases.”

Wow!

The report is authored by the Sierra Club and the Center for American Progress and shows that eight of the biggest U.S. banks and 10 of its largest asset managers combined to finance an estimated 2 billion tons of carbon dioxide emissions, based on year-end disclosures from 2020. This is a theme that has risen to the top of my agenda over the last five years, and will continue for the next decade I expect. In fact, I reckon 2022 will be the year that green finance and renewable securities rises to the top of markets. Interestingly some forecasters, like ING (a bank), agree with me:

Banks take up gauntlet against climate risks

The European banking sector will continue to have its work cut out next year as it strives to meet the sustainability disclosure requirements set by European law. These disclosures will give market participants more insight into the environmental and social efforts made by banks. The 'E' in ESG, in particular, will remain in the spotlight, as banks take their first steps towards reporting on the taxonomy compliance of their balance sheets. Meanwhile, the anticipated proposals to expand the taxonomy regulation by social objectives will offer banks new opportunities to direct capital to socially sustainable activities.

Moving along, Standard and Poors (S&P) produced an interesting report about the ideas of what will happen. Their takeaways are that banks are scure and stable (but isn’t that what banks should be?):

- about 74% of banks are on stable outlook, with 12% on negative outlook, and 14% on positive outlook.

- the net outlook bias for banks is unlikely to sustainably improve.

- a key risk is that the economic recovery envisaged in our base case stalls because of omicron or potential new variants, or vaccination progress, which is lagging in some jurisdictions.

- other key risks include the potential for spillover from high debt leverage in the corporate and government sectors, disorderly reflation, property sector challenges, and bank business models. These risks could still make it tough for banks in 2022.

- all said, bank balance sheets are in reasonably good shape heading into 2022. This will buffer headwinds. Bank capital has strengthened materially since the global financial crisis, and asset quality has improved.

The report identifies five key risks to watch:

- the possibility of the economic recovery stalling.

- high debt leverage in the corporate and government sectors resulting in higher corporate insolvencies and less government support for banks than anticipated.

- disorderly reflation and market disruption.

- property sector challenges, notably the stress in China and spiking house prices in many markets.

- the risk that the low rates environment and the fintech evolution challenge banking business models.

RFI Global highlight five big trends:

- an increase in mobile migration (apps are now the key access for consumers)

- the rise of hybrid banking, where chat and video are as, if not more important, as phone and branch

- online and mobile shopping and payments will be even bigger

- as will BNPL (Buy Now, Pay Later); and

- consumer trust in FinTech is now mainstream.

Karl Dahlgren, who heads the research group at US-group BAI, talks about emerging issues and ongoing trends that stand to affect the industry in 2022. A few takeaways include:

- figuring out the new customer normal, finding and keeping talent, and adjusting to changing macro conditions

- BAI research indicates that banks and credit unions have worked hard to connect with consumers, and that their efforts are creating more loyalty

- half of millennials and Gen Z have some form of crypto investment, but bankers plan to keep moving slowly on that asset class

I could go on and on, bringing report after report to you (Jim Marous makes some interesting observations here), but the over-riding themes are that:

- the pandemic is still there;

- fintech threatens bank structures;

- banks are thinking about crypto (I don't see many doing much);

- dealing with climate funding is becoming a bank priority; and

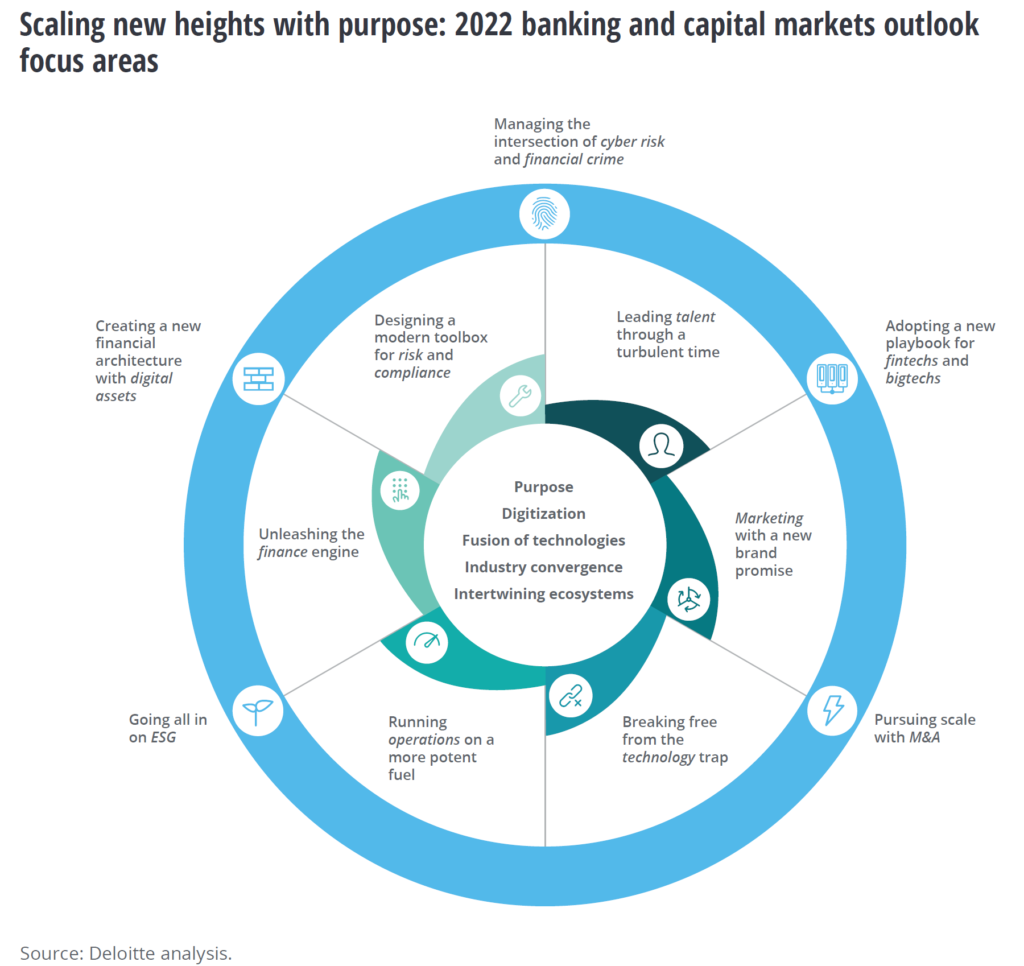

- banks need to realize their purpose.

On that last point, the subtext of my new book is if you don’t stand for something, you fall down. In 2022, I think all bankers should be asking what they stand for; what is our purpose; what do banks do to make the world better? We should have been asking those questions years ago tbh, but it’s 2022 and now we have to. After all, it’s the millennials, GenZs and more that have forced us to face the fact that if we don’t ask those questions, the next generations won’t be able to. That should be the priority for all of us in 2022.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...