We recently hosted Vernon Hill at the Financial Services Club.

Vernon is the charismatic founder of Metro Bank UK and successful bank veteran in the USA, having built Commerce Bank from just one branch in the 1970s to a 435 branch behemoth that was sold for $8.5 billion in 2007.

Vernon Hill was a fast-food restaurant franchise owner by background and, bringing his fast food convenience to banking, made a success in banking based upon the philosophy of being a retailer, not a banker.

And that's what Vernon's presentation focused upon: what makes a great bank work.

Vernon began by talking about Metro banks' marketing, brand and philosophy, underscored by the slogan: "Love your bank at last". That's because consumers in Britain are not that happy with their banks.

His theme developed around how to build a growth company in a slow growth world which, considering Metro Bank opened in 2010 as Britain entered its hardest recession for forty years, was an interesting time to launch.

Metro Bank is Britain's first new high street bank for over a century and it's a seven days a week bank. The bank only closes four days a year, and is open 78 hours a week. That's because they are in the account opening business, which means taking business away from the competition.

Every call in the call centre is answered by the second ring and the whole technology operation is run on a pay-as-you-use basis from Temenos.

The bank opened its fifth store (Vernon speak for branch) just the other day, and plans to have 12 stores operating by the end of this year thanks to its full capitalisation of £125 million through private funding.

Vernon likes the fact that the press call Metro the "Apple of Banking". That's because Metro Bank is different.

"You have to have a different model where the consumer sees the value, through a culture that's pervasive and executed brilliantly every day so that they become fans. Every great business builds fans. That's what Apple does and what we want."

He underscored that you should "think about us as a powerful retail company that happens to be a bank", and underlined this by talking about how they invest.

The banks view is that you should over invest in stores and facilities, as that's building the brand, and that Britain's banks have underinvested in these areas for years.

That's why Metro is focused upon the small things, like the pens. They give away pens. Lots of them. Take away as many pens as you want. Why chain the pen to the counter? Give them away.

Like the vans. All the banks in Britain have vans picking up cash and cheques from branches, and they don't even bother to brand them. Metro Bank's vans are all fully branded, as that's thousands of free eyeball impressions every day.

Like the coin counting machines. You don't need to be a customer to use those machines, and yet these coin counting machines cost about £30,000 each to put into the branch. In traditional banks, you wouldn't do that. You would ask where the return is. How do you justify that?

But Metro Bank justify all of this because of the customers becoming fans and that delivers the shareholder returns.

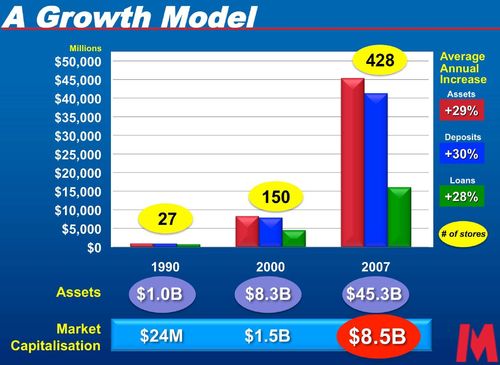

On this note, Vernon shared this slide of the USA experience:

Look at the shareholder returns.

A bank that delivered with a multiple of 28 to 1 on its sale, and a massive value increase in market capitalisation over two decades.

But it's not just investing, it's about hiring and culture.

The culture has to deliver the brand and, other than for a few key jobs, anyone can be trained to deliver retail banking. The key though, is how they deliver it. It's the how that counts, which is why attitude is more important than skills. That's why Metro Bank, during hiring, look for smiles.

"If an applicant doesn't smile during the first interview, they don't get a second interview. After all, if they don't smile then, when are they ever going to smile?"

Everyone owns stock in the company in one form or another and the management demand 100%, not 90% or 99%. 100%.

That's why they physically shop the stores every other day. They don't ask consumers to do the shopping, but actually make 1,000s of visits every month to make sure the stores work.

Equally, the bank wants everyone to be able to make decisions, which is why they have a rule that it takes only one person to make a yes decision, but it requires two people to say no. If you're going to turn away business, you need a second check for that.

Perhaps one of the oddest things for a UK bank is Vernon's passion for dogs.

"Why do dogs rule in our bank? Because if they love my dog, then they love me."

At this point, Vernon introduced us to Duffy*:

Vernon Hill, Metro Bank from the Financial Services Club on Vimeo.

Vernon then focused upon how the bank grew from a billion in assets to $45 billion in two decades, and made it clear that all of this was achieved through organic growth. There were no acquisitions, just pure organic growth.

You get organic growth of this size and nature through fans, and 97% of Metro Bank's existing customers would recommend them to a friend. That figure is 57% for First Direct, 10% for RBS, -19% for Lloyds and -35% for Barclays.

Vernon was shocked by this: "If I was Lloyds or Barclays, I would climb under the table seeing these numbers. I've never seen negative net promoter numbers before in my life. I don't even know how you can get negative net promoter numbers. What are you doing?"

Even worse is general satisfaction figures, with dissatisfied customers typically representing a third to a half of the customer base of most UK banks, rising to 67% for Santander.

As Vernon noted: "These are horrendous numbers and I say to you British bankers: 'KEEP IT UP!'"

That got a big laugh!

At the end, Vernon took many questions from the floor. Here's his response to whether there is any competition in banking:

Vernon Hill, Metro Bank from the Financial Services Club on Vimeo.

After all of this, we had a hearty debate and dinner.

Another fine evening, and one to note for the future to see whether Metro Bank really do shake up the bank business in Britain.

NOTE: the full set of slides and a podcast are available for FSClub members

* All well and good, except that Duffy wasn't meant to be in our highly secure building so, at this point, we had a great debate with the security guards over whether the dog should go or stay. He stayed, I'm pleased to say.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...