I still remember fondly the BAI Show of 2008 where there were several key highlihgts. One of the biggest was the one-to-one interview with Arkadi Kuhlmann, Chairman, President and Chief Executive Officer of ING Direct USA.

At the time, Arkadi had just produced his book: “The Orange Code: How ING Direct Succeeded by Being a Rebel with a Cause”, a very good read, which told the story of ING Direct USA, from a startup predicted to fail to one of the largest US banks in the course of a decade.

Today, ING Direct USA is the largest direct bank in America with 2,275 employees and 7.7 million customers across its savings accounts, checking accounts, mortgages and brokerage services. ING Direct USA had US$8.3 billion (€57 billion) in funds and US$40 billion (€29 billion) in own originated mortgages, as of 31st March.

So it’s sad but not surprising to see ING Group sell ING Direct USA yesterday to Capital One Bank.

Sad, because it’s a bank that is so very different. After all, how many bank leaders would have made this sort of statement:

“I don’t like and don’t want rich Americans. I don’t want all their bitching and moaning. They come in and say, ‘I’m willing to give you a million dollars, what are you going to do for me?’ and I say, ‘Nothing’. There’s no hierarchy here. It’s a democracy and we’re all level.”

Not surprising because ING ran aground in the financial crisis, as have so many, so they need the cash from the sale of assets that are easy to sell, such as their standalone, rampantly successful American business. Oh, and also because they were told to sell it by the European Commission.

As Jan Hommen, CEO of ING Group states: “In addition, the transaction today shows ING is taking decisive steps in the restructuring of ING Group and underlines our commitment to meet the requirements of the EC in a prudent yet decisive manner.”

Hmmm … sounds a bit like Stephen Hester of RBS or Antonio Horta-Osario of Lloyds. They don’t say it, but they’re all thinking: “We will sell these assets, but we don’t like it and think the Eurocrats are just being mean and spiteful.”

Shame.

However, the Eurocrats might respond: “You got yourselves into this mess and forced us to get you out of it, so we’ll do whatever we can to make you stable for the future.”

And, in reading the fine print, it is clear that the sale will have a substantial positive impact on ING Bank’s Core Tier 1 Capital Ratio. According to the sale detail, Tier 1 Capital will improve by 99 basis points, based on the ING Core Tier 1 Ratio of 10.01% per 31 March 2011.

The sale has also produced some interesting insights.

First, the headlines:

- Total proceeds of US$9 billion (€6.3 billion) in a combination of cash and shares

- ING to receive US$6.2 billion in cash and US$2.8 billion in the form of 55.9 million shares of Capital One

- Transaction expected to result in capital release at closing of US$4.1 billion

- ING to have 9.9% stake in Capital One after closing

But here’s the really interesting bit of the sale.

The Investor Presentation of the acquisition that Capital One placed on their Investor Relations space yesterday.

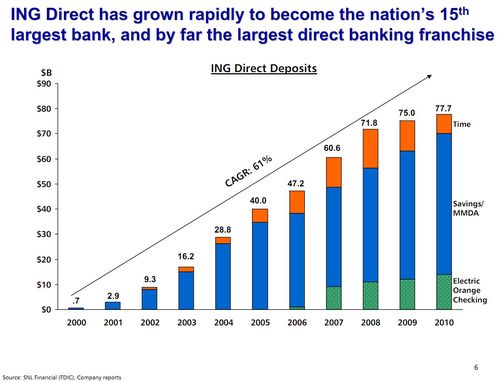

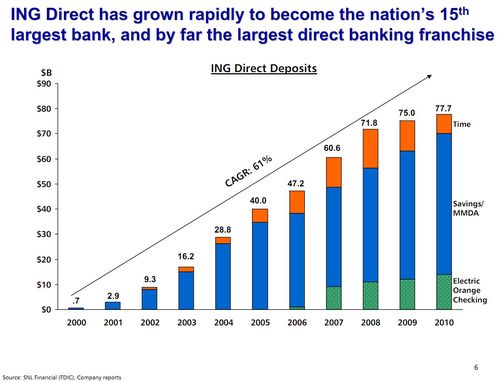

I said that ING Direct USA was “rampantly successful” for example.

How successful?

I think this slide says it all (doubleclick image to see larger version):

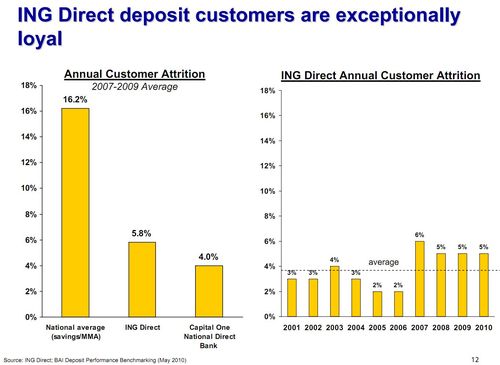

Another slide that intrigued me was the one that outlined customer attrition rates …

Capital One’s presentation states that ING Direct USA’s customers are incredibly loyal but one in twenty leave every year! But then, it’s better than the national average where almost one in five leave each year.

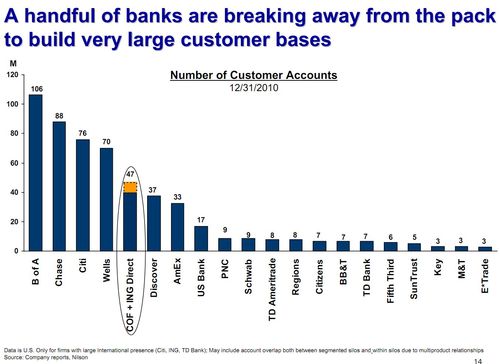

Then there’s this slide, which gives a great overview of the state of American bank competition:

The USA, like the UK, has the Big Five banks and then the rest.

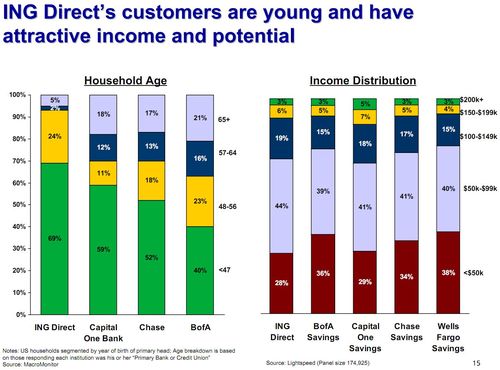

There’s then a great slide about demographics …

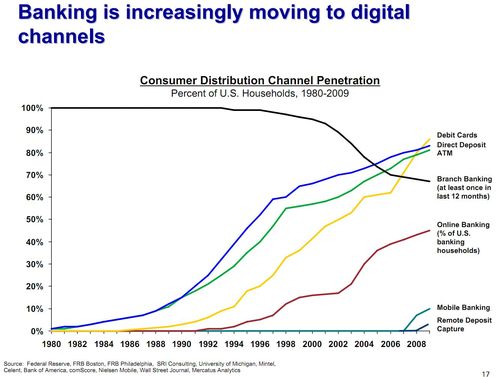

So, direct banks attract young, rich people whilst branch-based banks are more popular with old, poor people. That’s good news for the future as my favourite slide has to be this one ….

… which clearly shows the branch-based model is withering on the vine.

Trouble is that people still want branches, as that creates trust in an institution if you can eyeball them, which is why bank branch numbers are still growing. For example, the Market Rates Insight website reports in January that:

“Banks branches are expanding across the United States, even in areas that showed little or no population growth. It seems that banks are continuing to add local branches across the board in a disproportionate rate to changes in population … in Rhode Island, the population growth was less than 1%, yet the number of branches grew by 15% and in New York State, despite a population growth of only 3%, the number of branches increased by 19% in the last decade.

“In the 10 highest population growth states – Nevada, Arizona, Utah, Georgia, Idaho, Texas, Colorado, North Carolina, Florida and South Carolina – the number of bank branches increased at the same rate or higher than the population growth since the 2000 census. For example, Nevada’s population increased 32% over the last 10 years, but the number of bank branches increased by 45%.”

Interesting logic.

HT to Ron Shevlin

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...