So the morning was interesting, beginning with another #innotribe session.

As I walked into the room, it all seemed a little bit strange, as the whole space had been rearranged into a large café.

This included beer mats on the tables and Edith Piaf singing je ne regrete rien through the speaker system.

Weird, but kindof nice, as it meant was could step out of our suited and booted SIBOS positions and think outside the SIBOX to discuss new economies.

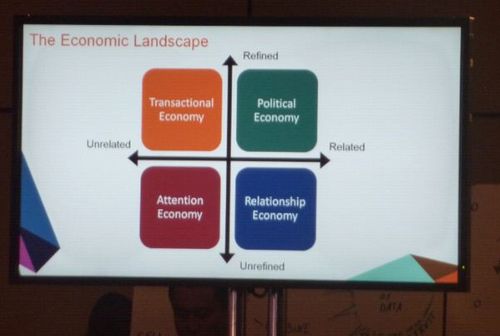

The new economy discussion focused upon ideas related to two dimensions of how we look at the world.

According to Greg Rader, we relate and refine to work out what has economic value.

We relate more closely to family and friends than to colleague and associates, and we refine information through filters from the unrefined twittersphere to the highly refined televisual news headlines or blogs we read.

Each of these affects how we see economic value from transactional economies that are refined but distant; to relationship economies that are unrefined but close.

I must admit that, as I saw this slide, I thought to myself that banks are transactional and therefore have no relationship. In fact, banks aspire for relationships but are sitting diametrically at opposites with such closeness.

In other words, transactions are cold, objective and secure, but relationships are warm, emotional and random.

How can banks marry the two together?

Well some, such as my twitter mate Gordon Rae, using the Theory of the Firm.

However, this was not the point of the session, as the point was more to do with how economies are evolving and adapting and that these four quadrants are not separated and distinguishable quadrants anymore, but are melding and morphing together as our work-life balance changes.

No longer are we in work mode and life mode.

No longer are friends and family separated from colleagues and associates.

Today, our worlds’ are colliding where business people are connected to our families via facebook, and our families are connected with our business world through twitter.

Worlds are colliding and therefore so are economies.

It prompted me to ask whether banks should therefore consider being safe vaults of social value as well as economic value.

It got a little bit of a derisory response until Craig Burton, Founder and Principal of Burtonian, probably made the most insightful comment of the day and the session: “Baking your business model into an API is an economic imperative”.

Putting everything into an Application Programming Interface (API) is how Facebook, Paypal and others are working today and, if they didn’t, they would be dead.

This is Craig’s contention for banking.

In other words, banks should throw their functionality out there for anyone with the gumption to plug and play with and integrate into their apps, websites, mobiles ... anything.

It's the functionality that is key, and by letting API capabilities allowing anyone to leverage that functionality is going to be the real way for banks to increase their economic value in any economy.

He went on, some might say bravely, to say: "The way SWIFT does it today is a workaround using messaging and PKIs. It's 10 year old technology."

You may or may not agree but, either way, ‘nuff said.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...