There’s a strong dialogue about why new services such as PayPal and Square take off so fast, and the answer is a combination of usability and accessibility.

If something is easy and it works, then it can gain critical mass fast.

That’s true of Facebook, Twitter and other social media.

The more intuitive, accessible, easy and social it is, the more viral it becomes and hence gains mass market fast.

That’s true of Zynga’s games and Youtube’s videos.

And it’s true of mobile payments, which is the secret sauce that Barclays believe they have discovered with Pingit.

I attended the launch of Barclays’ Pingit for Corporates last week, and it proved interesting.

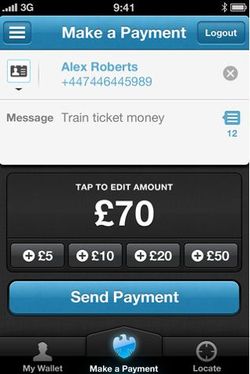

First, for those who aren’t familiar with Pingit, it’s like a PayPal for mobile and offers simple P2P mobile payments whether you are a Barclays customer or not.

Developed internally by Barclays through a private cloud service, it was launched in February and the ad campaign started in April:

What proved interesting in the launch is the speed of use of Pingit.

From day one in February, folks were downloading the app fast – 120,000 in the first five days, over 400,000 by mid-April and 500,000 by May 9th.

Barclays claimed the number had reached over 700,000 as of May 16th, 80% of which is on iPhones apparently, even though it’s also available on Android.

I’m sure the ads help, and Barclays claim that their social media is helping.

Here’s a screenshot of the Facebook page …

… that led me to their viral video …

… although it’s not that viral with only 1500 views.

What really helped is that Apple highlighted Pingit as a showcase app, due to its fast download numbers rising, and that #Pingit was the second highest trending topic on twitter the day after launch.

Barclays then said that they were surprised at the uptick in usage volumes, and how the average transaction had been anticipated around the £25 mark but was so far averaging around £75 per transaction.

That surprised me too.

The demographics prove interesting:

- 29% of users are 18-25 years old;

- 37% are 26-35;

- 26% are 35-50; and

- 7% are over 50.

Now they’re pushing for merchants to offer Pingit via simple QR codes and Corporate Identifiers.

The idea of the Corporate ID is that firms can buy Pingit accounts such that customers just put in “Tesco” or “Waterstones” and the payment is made without needing to know the company’s account numbers or other details.

That’s pretty cool.

Even better is that you can embed all the data you need in a QR code.

So, as you walk past an ad for a charity campaign, hold your phone over the QR code and make an immediate donation.

Or, even better for the utility firms, send out a bill to a customer with a QR code embedded that includes all the payment details and the payment amount.

All the customer needs to do then is hold their phone over the code, check the payment amount is correct and Pingit.

For the corporate, there’s also the added advantage that not only do they get all the customer data back they need – account number, payment details etc – but it is now enriched with the customer’s mobile telephone number for further verification and potential marketing.

Fast, simple and easy … and innovative.

I hadn’t seen such stuff before and certainly not from a UK bank.

The final points really rammed home why this is important.

For a corporate, the idea of a real-time refund is phenomenal.

Imagine an angry customer calls.

“You’ve just taken a direct debit from my account for £175 when it should have been £100, what are you going to do about it you &$%@!”

And the call centre representative replies: “well sir, here’s your £75 back with an extra £25 to say sorry”.

Ping!

And there it is, on your phone, there and then.

A real-tme faster payment refund via mobile.

Lovely-jubbly.

If you need any more convincing, the Barclays teams threw out a couple of research numbers which show that, by 2015:

- One in three people on Planet Earth will own a smartphone (Parks Associates); and

- Payments by mobile will be worth $670 billion (Juniper)

So what?

There are lies, darned lies and statistics.

All I know is that when you have a simple P2P mechanism for mobile payments fit for smartphones that corporates can leverage, then something’s changed.

And it has.

The negative bit

Downside #1

As a non-Barclays customer you have to go through a very complex account verification process that involves not only a PayPal like penny drop into your current account with a reference number that you need to enter; but this is followed by a letter to your house via snail mail with another verification number.

OK, OK, I know it’s all secure KYC stuff, but it’s a pain in the arse and will put a lot of people off.

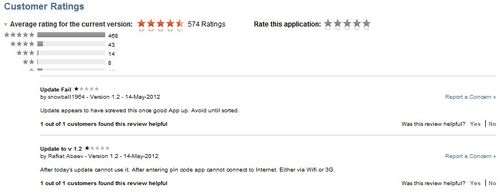

Downside #2

The app is not robust yet, and the latest update froze a lot of people’s phones which is getting negative vibes on the app store.

Teething troubles I know, but it’s not going to help the cause.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...