After discussing Metro Bank yesterday, the other presentation that caught my attention at innotribe Belfast was from Fidor Bank.

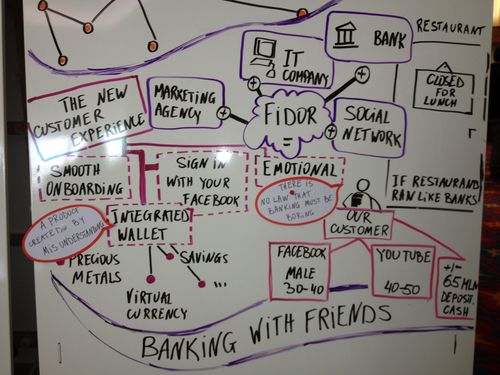

The two presentations are like going from one extreme to another however – Metro with their branch based focus compared with Fidor with their GLoSoMo (Global-Local, Social Mobile) approach.

I interviewed Fidor Bank CEO Matthias Kröner for 45 minutes ...

... and found a lot of new ideas I had not realised were part of this bank’s appraoch.

Prior to this discussion, I had met Matthias but it did not click as to exactly what his bank was doing before.

Now that it did, I can confidently say that Fidor Bank is the most innovative bank concept out there right now.

Why?

Because Fidor Bank is the bank I would create if I were going to launch a bank today.

First, the sign-on to Fidor Bank is through Facebook Connect which, at this time, is one of the only banks that would work this way.

Second, the bank doesn’t just aggregate accounts but, on a single page, I can see all my account holdings from savings and investments through to precious metals and even virtual currencies, such as World of Warcraft Gold.

Third, the bank offers an interest rate on savings that is determined by the number of Likes on their Facebook page. From their website:

“The Fidor Bank is the first bank in the world where you can help shape the interest of FidorPay. The rule is simple: The more Facebook Likes, the higher the interest rate. The minimum interest rate of your FidorPay account is 0.5% pa By 25th of each month, if the bank achieves a certain number of Likes, then a higher interest is paid and calculated, starting in the month at the rate achieved in each case. From 22 000 Likes FidorPay will offer 1.5% interest per annum for the remainder of the year. At the end of 2012, the interest rate resets again to 0.5% pa.”

Clever and this came out of a misunderstanding over lunch where the firm was talking about interest rates (zinsen in German) and one person said: “do you think our customers like our interest rates when they come from Facebook”, which the product manager heard as: “do you think our customers likes set our interest rates when they come from Facebook”, and there you go.

Fourth, Fidor really get social media, as demonstrated, and show that they get this through their marketing efforts.

Since the bank launched, they’ve spent €100,000 on marketing in total. That works out as around €1.33 per customer registration as a cost.

As Matthias said, it costs €7 per click for most banks to just advertise a product on Google and get Google clickthroughs. Fidor is getting customers acquired for just one euro per customer.

Fifth, they offer a variety of capabilities from P2P lending through crowdfunding. They even offer an online betting platform like Betfair, called Brokertainment, a matching service that allows people to offer a punt on anything.

The example Matthias used is the idea that the FTSE100 will increase by at least one basis point between 11:00 and 11:01 on 20th June 2012. I say that I will place €5 on this and someone else can then take that offer. If FTSE goes up, they owe me €5; if it goes down, I owe them … and Fidor Bank will take the payment through any currency format I choose including World of Warcraft.

Sixth, they’re not trying to reinvent things but partner for everything: their P2P lending is fully integrated with Smava, the German equivalent of Zopa; the media firm Bertlesmann are their primary agent for distributing their services in online virtual games; they partner with hyperWALLET to provide global payments capabilities; and more.

Finally, I like Fidor Bank.

For example, they describe themselves as ‘banking with friends’, and believe that “there is no law that says that banking transactions must be boring”.

Much of this is conveyed through Matthias's own humour - yes, he is a funny German (but then he is Bavarian) - so I asked Matthias why they don’t have branches.

“Why would we have branches?” he replied.

“Branches don’t show me how qualified advisors are, whereas we show that in our chat rooms. Branches create a them and us position – servers versus served – whereas you would be unable to tell who were the customers and who are the employees in our bank. Everything we allow you to do online – managing virtual currencies, checking rates, using social connectivity – you cannot do in a normal branch. And branches are only open during certain hours.”

The most amusing response to the question was the one he concluded with: “I used to work in hospitality – the restaurant and hotel business – and if I ran my restaurant like a bank, you would turn up for lunch and we would be closed. That’s because it was the staff lunchtime and they would be eating. We would probably open around 3:00 instead, after our lunch had finished.”

In conclusion, Fidor Bank is the most innovative bank that I’ve seen out there today, and it is a bank (it has a full banking licence in Germany).

You can learn more by looking at an overview of the business today from Matthias:

Or watch the Finovate 2011 video that demonstrates the service.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...