Standard Chartered paid off the new Sheriff of New York City, Benjamin Lawsky, to the tune of $340 million to get rid of the pest. As Investec's commentator Ian Gordon said yesterday, they “acted with pragmatism and integrity in the face of extreme provocation”.

What really gets me here is the whole USA versus the rest of the world thing.

It was pretty well summed up in the email everyone has been quoting from StanChart's London manager to their New York office: “You fucking Americans. Who are you to tell us, the rest of the world, that we're not going to deal with Iranians?”

Well, those Americans unfortunately control the world's economies because we’re all tied to the dollar.

But what would the world look like if we weren't?

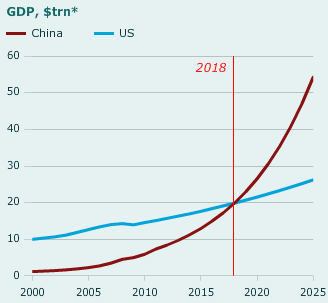

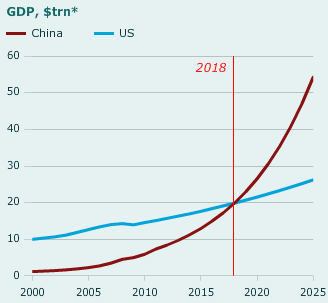

At this year’s Olympic Games, like the world’s economies, America came top of the table and China second. What will happen when it’s the other way around?

It will be one day and in the not too distant future.

According to the BRIC report of 2003, it would be sometime around 2041.

According to the latest reports, it will be within the next decade.

Source: the Economist

Then the world changes for it is only as long as the dollar is the reserve currency of the world that all the banks need to process transactions through the USA. When, rather than if, the USA loses that economic grip, everything will change.

What happens if a basket of currencies is used as the reserve currency in the future?

Or the Renminbi?

The game changes big time.

That is why banks like Standard Chartered and HSBC want to keep China happy, and why banks like Standard Chartered and HSBC are making the Americans so pissed off.

Both banks focus on Asia as their core markets today.

That's where the growth is, and their most powerful influence is China.

China has been an ally of Iran, which is why both banks have tried to walk the fine line between pleasing their Asian and Middle Eastern interests, whilst not falling foul of their American need to keep a processing hub for the world’s reserve currency: the dollar.

It is why Standard Chartered claimed that it was only 300 transactions worth $14 million that flouted US laws as a ‘clerical error’, rather than the 60,000 transactions worth $250 billion that has now been conceded in paying the fine.

It probably was the former rather than the latter, as the US has unilaterally targeted Iran for over two decades whilst the rest of the world has not.

It is America’s singular focus of support for the nation state of Israel that drives this anti-Iranian focus.

That is why China and Russia have not been on the train, and why Europe was slow to jump on too.

But Europe has joined the train, as has the United Nations.

That is why we now find organisations like SWIFT joining the train.

SWIFT first of all changed their messaging systems to ensure that all bank details travelled from the originating institution to its final destination - the cover payments changes as agreed by the Wolfsberg Committee - in 2009, and followed these actions by conceding to a European Parliamentary decision to eject the Iranian banks, including their central bank, from the SWIFT network completely in March this year.

It is through these global decisions that banks such as Standard Chartered and HSBC - plus the rest including ING, Credit Suisse, RBS and US domestic banks such as Citigroup - got caught out.

It’s that sheer complexity of global transactions, changing regulations, legacy systems that constrain change and political stances that distance nations.

Think about it.

You have a transaction from Iran or to Iran.

It originates or completes in, let’s say, Zurich.

The transaction might travel through multiple jurisdictions and, at some point, has to go through the USA for processing to enable a dollar movement. Nearly all cross-border global monetary movements will end up going through the USA at some point because they have to, as it owns the reserve currency of the world: the dollar.

The question then is at what point did US, European and United Nations mandates change, to affect which transactions, based upon what information was held with those transactions - knowingly or unknowingly- as they travelled the world, and which bank did what actions, when.

So simple, ay?

Also, keep in mind that Standard Chartered is processing $190 billion A DAY through its New York office. Therefore, if during a period of TEN YEARS, $250 billion slipped through that may or may not be dodgy, is that such a big surprise?

Sure, the bank should not be breaking a nation's regulations, obviously, but if those regulations are designed politically by one nation at the opposition of another equally important nation, then banks make choices.

That’s why so many banks have been caught out in this money laundering mess, as any global bank is likely to have offended at some point by dealing with one nation against the wishes of another.

That is also why, as per usual, paying a fine and fezzing up means that the bank can draw a line and move on.

That’s what StanChart is trying to do, although there are still other US authorities - the US Treasury, the Federal Reserve, the Justice Department and New York prosecutors – that they have to clear.

In a final, final thought on all of this however, you need to consider the political motivations of US law enforcers in more depth.

I blogged the other day saying that these money laundering moments coming from the USA are purely catching out our banks because, based upon the above, it's easy to do that.

What about catching their own banks however?

It irritates many over here that UK banks have been all over the global headlines as seedy money launderers when US banks, such as Citigroup and Wachovia, have been similarly caught laundering Colombian and Mexican drug money.

Wachovia was fined $110 million in 2010 for “for failing to apply the proper anti-laundering strictures to the transfer of $378.4 billion” in Meixco, whilst Citigroup, JPMorgan and Bank of New York are also caught in the process.

In fact, an economic analysis recently found that only 2.6% of Colombian drug money remains within the country, “while a staggering 97.4% of profits are reaped by criminal syndicates, and laundered by banks, in first-world consuming countries”.

The fact that these issues don’t get the headlines is because US regulators saw fit to not pursue the prosecution of some of their own banks, such as Wachovia, and just fined them a mere $110 million to brush the whole thing under the carpet.

So to the FSA and Bank of England, I suggest you target the US banks for drug money laundering, make a few headlines and $s out of the fines, and get rid of this message that all of our banks are sleazy just because they processed transactions to Iran.

Or is that just being petty?

If you're interested, I expressed a more politically correct version of these views on Bloomberg this morning:

Postnote:

Someone asked me why Standard Chartered is a UK bank when it’s all focused upon Asia, Africa and Middle East. The answer is that it is an Indian-African bank by origin, created 160 years ago as the Chartered Bank in India to support the British Empire’s expansionism. It moved to Hong Kong later, and then merged with Standard Bank of South Africa in the late 1960s. The foundation of the bank is therefore British expanisionism in Asia, Africa and the Middle East, which is why it has its base here but focuses over there.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...