This week has been fascinating with lots of discussions

about branch versus no branch and financial advisor versus product seller.

I was going to leave it at that, but feel one final blog post worthy of discussion

and this is about the role of social media.

We all talk about Facebook and Twitter in the abstract whilst, for most banking

people, it's an alien world that is firewalled away from them.

This is brought home to me regularly when I ask how many

people use twitter. In most banking audiences,

it’s one or two.

By way of illustration, I

presented at two conferences this week.

One was for bankers with four people on stage, and I was the only one

with a twitter account. The other was

for innovators and every presenter had a twitter account.

I’m not saying this proves anything, but it is fairly consistent

that, for most bank employees - Gen Y or

otherwise - using Facebook at work is seen as 'wasting time'.

Complete baloney of course, unless they are just conversing with their

girlfriends about make-up or boyfriends about soccer, but there's the rub:

banks don’t want to be in the social media space.

That may change.

For example, American Express (AMEX) has heavily invested in social

engagement as a channel.

This is because AMEX realise that for every person on

Facebook who likes their page or updates, 235 people will see their news.

With an average ten thousand or more people viewing

their news at any time of the day, that’s over two million people engaged with AMEX 24*7.

So why have the banks missed this engagement channel?

Because it’s viewed as flakey and new, and because it’s

viewed as purely for PR and marketing purposes.

That’s the mistake as social media can be used as a

customer advisory channel.

And this is where it gets interesting, as we talk about the customer advisory

bank.

A bank that truly engages with advising customers via Facebook and Twitter would be different.

This would be a bank that wants to be part of the social community, not just

using these capabilities as PR or marketing mechanisms.

And that really is the difference.

The best way to illustrate this approach is using someone

like myself, who really believes in social media as an outreach tool.

You are purely reading this because you know me through

social media: the blog.

Blogging, facebooking, linking in, twittering and more are all ways to really

socially engage a community via remote channels.

If only viewed as a marketing or PR stunt then I could part-time it, but this

is not the case. Instead, this is a core community of interest, which is

networked as much through remote channels as through direct channels.

Hence both have equal priority and, in some ways, remote channels get higher

focus as they have far greater activity.

So people trust a remote presence.

And that's where banks are missing an opportunity,

If a bank viewed social channels as of equal importance as their call centre

and branch, then they could really engage customers as a remote trusted

advisor.

Imagine if you will, the bank that picked up on your everyday financial needs

as you text, tweet or status update.

"Oh I wish I could go to the scissor sisters concert tonight", you place

on Facebook.

And your bank says, "you can afford a ticket, and I've found one for

you".

Wow.

Or you tweet "thinking about buying this used Aston Martin", and your

bank sends you a direct (private) message saying: "are you mad, you're already $20,000 overdrawn".

Shucks.

Now I know a whole bunch of you are going to say, "this is awful - it's

big brother bank in reality”, and the answer is that this has to be based upon

permissions based marketing.

But if the customer has accepted that their bank can

share their personal updates for ‘concierge services’, then sure, the bank can

proactively and contextually advise me.

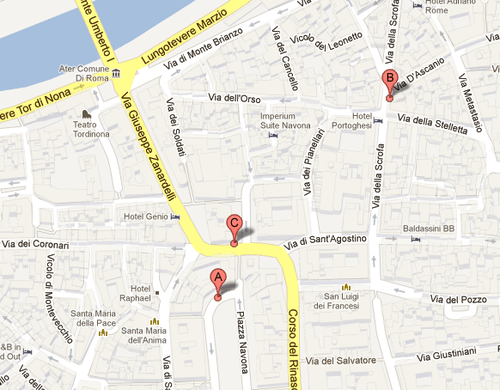

“Just arriving in Rome”, you foursquare.

“Best exchange rate is €1:25 and the nearest branches are

here ...”

... responds my bank.

Love it.

This is really getting my bank to advise me on my

spending and saving - its called PFM – and now I have a truly engaged,

permissions inclusive bank relationship, socially enabled through remote

channels.

Fantastic.

And so, if you really want to see how social media can move from social

marketing to social advisor, then banks that leverage these remote social

channels for social relationships will be the ones that really excel.

Now the only question is: where are they???

The is part five of a five-part series:

- Part One: One banker knows his industry is trashed, and here's his plan

- Part Two: Do banks need branches?

- Part Three: Why you really need a bank branch

- Part Four: Building a customer advisory bank

- Part Five: A truly social bank advisor is key

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...