The converse of KYC and AML is identity management.

If we had effective identity management where everyone could

be identified as a unique person with certainty and securely, we would not have

the issue of AML and KYC given to the banking system.

The issue with identity is that no-one wants to own the

problem.

Governments give us passports and driving licences; banks

give us accounts based upon these identifiers PLUS utility bills; and these are

the two key identifiers in our lives.

But they are not sufficient, as both can be easily

compromised.

Passports can be copied and bank accounts can be hacked.

It’s not as easy as it used to be – it used to be just a clever

forger who could copy your identifiers, but chips and biometrics are changing

the passport game – but it is still relatively simple to compromise identities,

particularly when people are so loose with their information online.

For example, there are many people who were early adopters

of Facebook.

They friended everyone and felt the more friends they had,

the more important they were.

They post all their personal information online – their

location, relationships, email addresses, birth date and more.

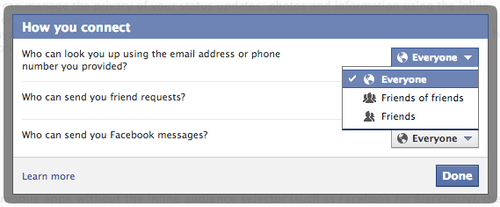

This information can be made private – look at Facebook’s

latest privacy settings.

It used to be that you could only set privacy at the overall

account level to visible or invisible.

Then it became privacy at all levels, and delineated into

friends, friends of friends or everyone.

Even so, it still does not mean that users have

retrospectively gone back and changed their privacy settings.

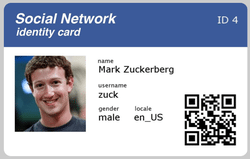

Nor does it mean that Facebook’s evolution has not already compromised

some people’s privacy, including Mark Zuckerberg’s:

This is not the first time his privacy has been compromised. In fact, it seems to happy pretty regularly, although he is obviously a target.

Neverthelesss, it’s pretty worrying when such a leaky

service that compromises people’s identity secrets is now being touted as the

next identity management system.

This is not the way things should be, but it is the way

things might be and could be.

We have multiple identities and identity owners – governments

and financial institutions – which should be working together, but don’t work together effectively

to manage them.

Sometimes we think that the solution would be to have a

single identity management system all governments and

financiers use.

The only trouble with that is that it might get compromised

and then what would you do.

If you have multiple identities and one gets compromised, you

can change it and move on whilst using your other identities.

If you only ever had one and that was compromised, then you

have an issue as you cannot recreate your single identity so simply.

Or so I’m told, although I don’t accept that assertion.

There should be a way to create a simple identity system,

and yet I’ve now seen so many companies created in the technology space to

offer identity management with none of them succeeding, that maybe this will

never happen.

Whilst this is the case, the latest of the firm’s to tackle

this issue – miicard – have made a lovely little video to illustrate the issue.

Enjoy …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...