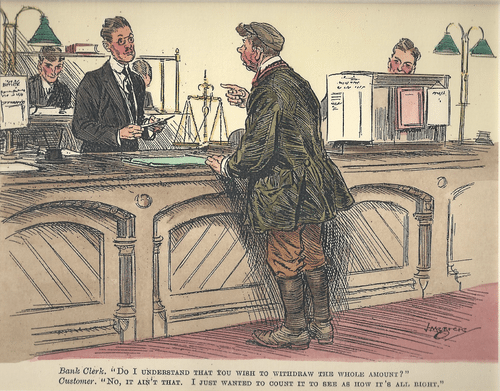

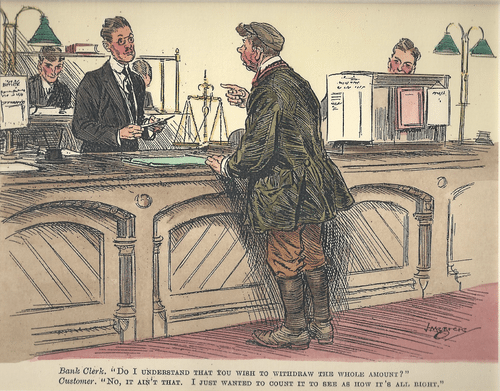

I found this on a market stall the other day. It's from Punch Magazine, 1921.

Times don't change.

This is why you need a bank branch.

The is part three of a five-part series:

- Part One: One banker knows his industry is trashed, and here's his plan

- Part Two: Do banks need branches?

- Part Three: Why you really need a bank branch

- Part Four: Building a customer advisory bank

- Part Five: A truly social bank advisor is key

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...