We had a good debate this week about the

future for multilateral interchange fees (MIFs) amongst the card companies.

The argument made for change by regulators

appears to boil down to that the card operators and issuers are ripping off customers

by taking percentage fees opaquely.

These fees are applied throughout the process, and the lack of visibility

of charging means that customers don’t know they’re being ripped off.

The solution: more transparency.

Now I can see the argument and solution

rationale, but I fundamentally disagree with it.

The reason I disagree is that customers are

not rational when it comes to money.

They will happily pay fees to ATM

operators, currency exchanges, PayPal and more if it is convenient and supports

instant gratification.

I should know, as I’m one of them.

Do I count the fees and the breakdown of

costs for every transaction?

No.

Do I object when I see the cost of a transaction?

Yes.

Take the example of booking an airline

ticket and you see that there is £4.50 ($6) charge for booking the ticket using

a credit card.

Do we get upset with the airline?

No.

Are we pissed off with the card company and

the bank?

Yes.

Or take the example of my own bank who

recently started itemising cross-border transactions with the charge per transaction.

Do I appreciate the transparency?

No.

Do I object to the fee per transaction?

Of course I do.

In other words, customers would far rather

prefer everything bundled into one charge where the bank fees are hidden,

rather than seeing the fees per transaction itemised explicitly.

That does not sit well with regulators, but

ask the question: why is this?

We happily pay for fees from service

providers, and we don’t mind seeing the explicit charges for our telephone

calls or internet provision, so why are we so resentful about bank or card

company charges for services rendered?

Because there is this mentality that transactions

should be free.

Or there is in certain countries and

economies, particularly the UK where banking has been ‘free’ for the last four

decades.

Mix this mentality of free with the

psychology of money that gets upset with anyone who controls our urges to

spend, and you have a dangerous concoction of anger and resentment.

And that’s why customers don’t want to see

transparency in banking , as they resent every charge made.

So I’m all for more bundling, and adding an

extra 0.01% charge in the process, as it’s better to keep customers happy than

to annoy them with those pesky charges.

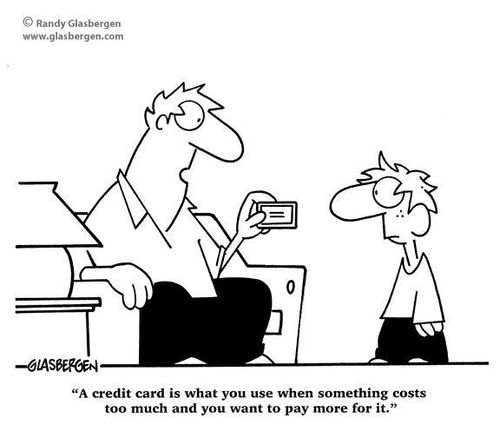

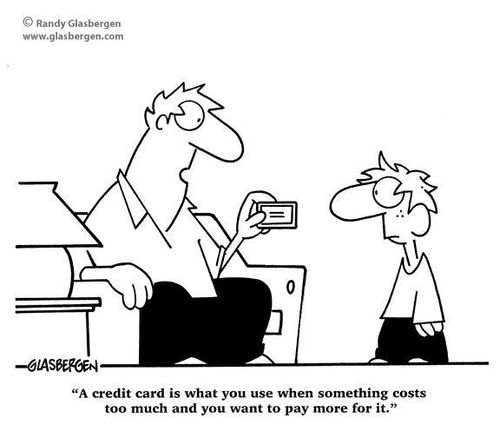

Cartoon found via Facebook page of Peter Aceto, CEO of ING Direct Canada

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...