I mentioned that BRE Bank is dropping their branding

later this year and replacing it with mBank, the brand they launched last

decade to support their online activities.

What is this all

about?

Here’s an analysis.

BRE Bank launched in

the 1980s as a division of Commerzbank, and is Poland’s fourth largest bank.

In 2000, with the

rise of the internet, BRE Bank launched mBank, a pure-play online bank. As an internet-only bank, it has risen

rapidly to become Poland’s biggest online bank and its third largest retail

bank. Thanks to its success, mBank expanded

into neighbouring markets in the Czech Republic and Slovakia in 2007.

In 2012, the bank

realised that there were significant changes taking place in the banking

markets due to the use of mobile social media, and decided to redesign the bank

from scratch based upon four key tenets:

- Real-time

marketing; - Personal

Financial Management; - Mobile

banking; and - Social

media.

This was not a

lightly made decision, as it involved a $31 million investment and a complete redesign

of the bank, which launched just before our last Financial Services Club meeting

in Warsaw earlier this month.

In fact, it is not a

lightweight decision at all, as it has resulted in the bank dumping its

original name and brand, BRE Bank, and replacing the whole thing with the mBank

focus and brand, with a new logo and refreshed look and feel.

This all took just

fourteen months to happen with the transactional service built from

scratch by a team of 200 bank staff in collaboration with partners including Accenture,

Artegence and Meniga whilst the website, mBank.pl,

is the main communication vehicle of the new brand and this was designed and

developed by Artegence and Intercon Systems.

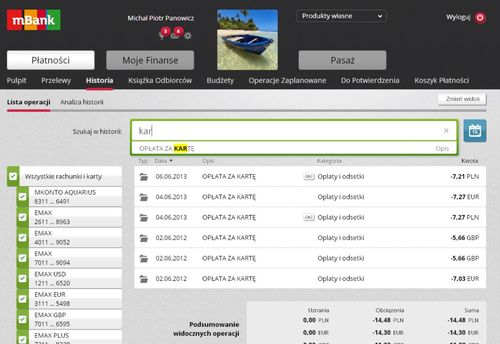

The new service offers over 200 new functions and

improvements. In addition to design,

these include a smart transaction

search engine which makes a search through your transaction history as

easy as using google on the internet, with results displayed in real time:

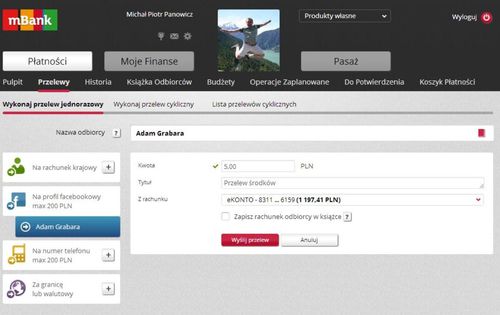

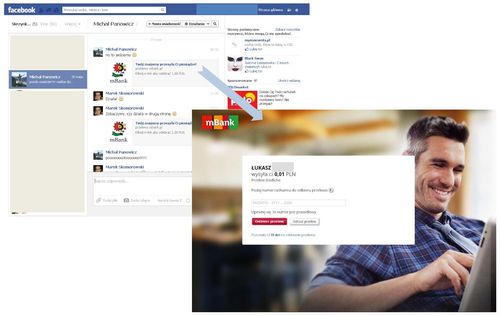

Money transfers via

SMS and Facebook, where customers need not remember or ask for account

numbers and can use phone numbers or social network connections instead:

Facebook transfers appear on the landing page for the users

of the social media services, and are just messages sent with cash attached:

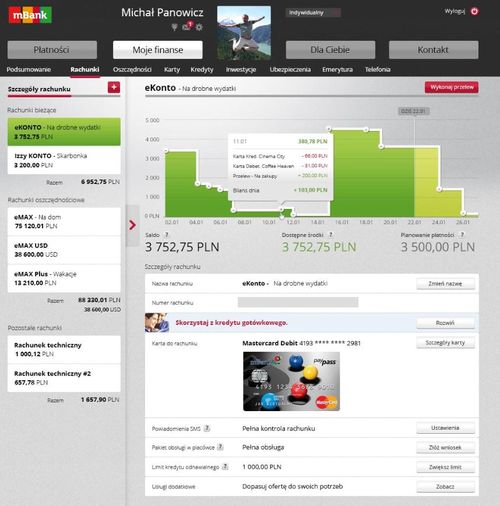

Personal finance

management (PFM), facilitating management of budgets where the system clearly

explains when money was spent and what for, and presents a forecast of overall

spending by the end of the month:

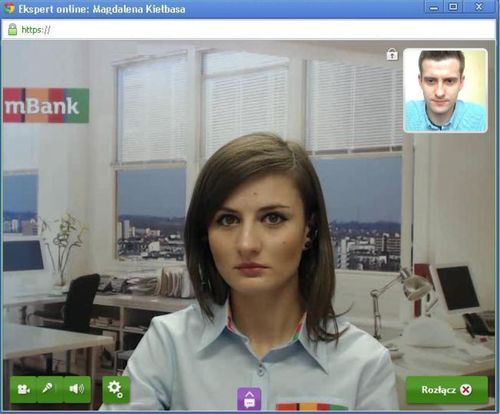

An on-line expert available

24/7 via a video or voice connection and chat:

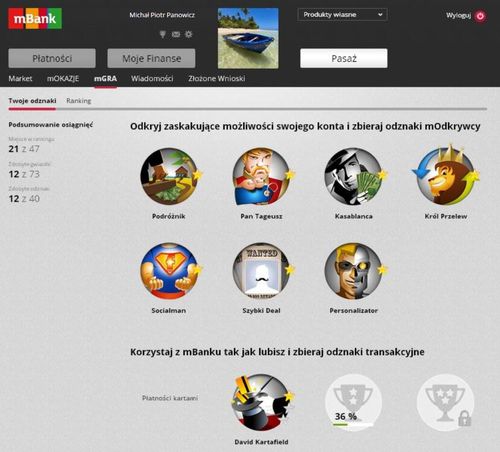

And gamification in

the bank’s transactional service to encourage smart spending and saving:

It’s already won awards (Finovate Europe Best in Show)

and a lot of press coverage.

No wonder, as it’s the first bank invented mobile social

solution I’ve seen that even comes close to delivering the new retail reality.

Related banks are Moven, Fidor and Simple, but these are new

startups rather than bank invented, and so well done to Michal Panowicz and his

team for creating one of the world’s first mobile social banks within a bank.

Here's the full slide deck from the launch with more links for those interested:

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...