Whilst debating whether new fintech startups would eat the banker's lunch yesterday, I stumbled across a really interesting read by Philippe Gelis, co-founder and CEO of FX firm Kantox. It was so good that I asked Philippe if I could put it on the blog and he kindly agreed. Read and enjoy ...

Why Fintech Banks Will Rule The World, by Philippe Gelis

Last week, I had the opportunity to present Kantox and my vision of Fintech in front of around 150 bank executives from Northern Europe. After my pitch, we had a Q&A round, and one more time I had proof that bankers are not expecting at all what will happen in the next 10 years.

The financial industry is one of the last large industries that have not been already really disrupted. Nevertheless, it seems that bankers do not have much of a different approach to the people who ran the press, hospitality and airline industries some years ago.

Every industry will be “uberized”, but it seems that most bankers still think it will be different in their case, probably because they consider that the heavy regulation will protect them and limit the growth of Fintech at some point. Bankers simply do not understand that tech companies are agile enough to take advantage of any piece of regulation.

They also still believe that customers still trust banks, while since the 2008 financial crisis and due to the never-ending financial scandals (Libor-gate, the FX fixing scandal, etc.) customers (both individuals and businesses) have a huge appetite for alternative finance. Banks are not seen any more as partners, but rather as pure providers only looking after their own interests and short-term profits.

It is a first step for banks to open incubators or to create VC funds to invest in start-ups, some of them Fintech, but it is definitely not enough. Most banks look to fund fintech start-ups that create products to be added on top of banks products, that will make the user experience better, but they almost never invest in products that directly compete with them, that cannibalize them.

Let me explain why I think bankers are completely wrong.

We are now experimenting with the first wave of fintech, which sees companies competing with banks on specific products:

- Loans and credit

- Payments

- Foreign exchange and remittance

- Wealth management

- and many more

Lending Club is far and away the global flagship fintech company. The success of its IPO has been a game changer for the entire fintech sector.

So, banks are getting pressured by newcomers but –and the “but” is really important– these disrupters are relying on old-school banks for banking services and banking infrastructure (bank accounts, payments, compliance, brokerage, etc.). In other words, they are re-inventing the user experience, the user interface or the business model but not “the whole thing” (to steal a quote from Marc Andreessen). And by relying on banks to do business, fintech companies are clients and so generate revenue for the bank. Let’s say it is a co-petition (co-operative competition) model in which fintech stays at the mercy of banks, they disrupt banks on one side but they bring them business on the other side. In the end, banks still win.

It is important to note that many fintech businesses have evolved from pure “P2P models” to “marketplace models” where the liquidity can come from peers or from financial institutions.

Lending Club is known for getting up to 80% of its liquidity from financial institutions and not from peers. Here we have a clear example of banks considering it to be more efficient and therefore more profitable for them to lend money through Lending Club than through their outdated branches. Anyway, the challenge is more in having deep liquidity than in locating the liquidity.

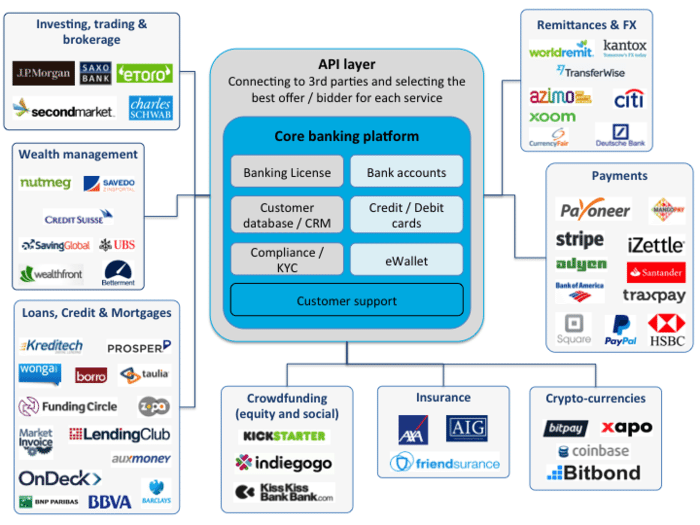

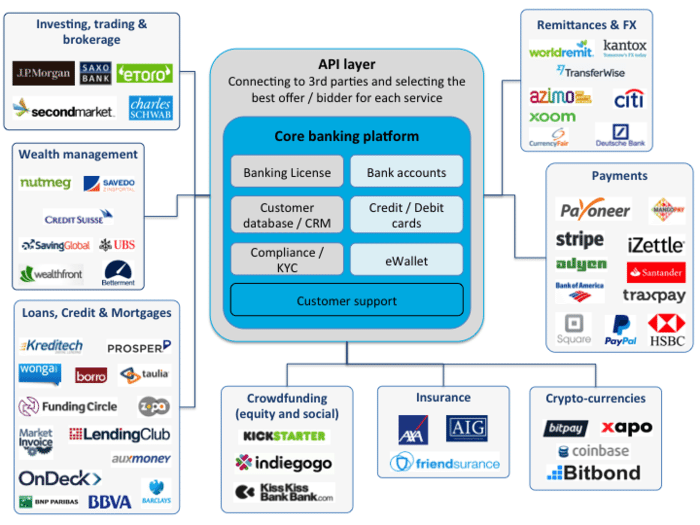

The second wave of fintech, to come in two to five years’ time, will be “marketplace banking” (or “fintech banks”). This will be a type of bank based on five simple elements:

- A core banking platform built from scratch.

- An API layer to connect to third parties.

- A compliance/KYC infrastructure and processes.

- A banking license, to be independent from other banks and the ability to hold client funds without restrictions.

- A customer base/CRM, meaning that the fintech bank will have the customers, and a customer support team.

The products directly offered by the fintech bank will be limited to “funds holding”, comprised of:

- Bank accounts (multi-currency).

- Credit and debit cards (multi-currency).

- eWallet (multi-currency).

All other services (investing, trading & brokerage; wealth management; loans, credit & mortgages; crowdfunding (equity and social); insurance; crypto-currencies; payments; remittances & FX; this list is not exhaustive) will be provided by third parties through the API, including old-school banks, financial institutions and fintech companies.

Imagine that you are a client of this “marketplace bank” and that you need a loan. You do not really care if the loan is provided to you by Lending Club or Bank of America, what you look for is a quick and frictionless process to get your loan, and the lowest interest rate possible.

So, through the API, the “marketplace bank” will consult all its third parties and offer you the loan that best suits you.

We can imagine both a process in which conditions offered by third parties are non-negotiable but we can also imagine a competitive bidding process to get the best offer for each client at any point in time.

I have been asked several times about this business model and I think it is a no-brainer. It is a simple mix between an access fee to the “marketplace bank” and a revenue sharing model with the third parties providing additional services.

Here we have a completely different approach regarding the relationship with incumbents. Fintech banks, thanks to their banking licence, will not rely any more on any bank to be and stay in business, and so will not be at the mercy of incumbents. What is even more powerful, through the marketplace, incumbents will become “clients” of fintech banks, so the system will be completely reversed.

We will see banks pay a commission to Fintech banks to serve their customers!

The beauty of “marketplace banking” is that it competes directly with banks on core banking services without the need to build all the products.

Now the question is, what is really needed to launch a “marketplace bank”?

Technology/API/Compliance/KYC: building the technology is a complex part but many people have the skills to do so. So it is definitely not the main barrier.

Banking license: in Europe, the budget to get a banking license is estimated at approximately €20 million, though it could cost less or more, depending on the country. But it is not only about money.

To be in business you need strong and experienced board members, without them regulators will probably not give you the green light. So this means that you need to be able to convince investors and board members to trust you based on a Powerpoint presentation and to bet big on you. I think that we need the first wave of fintech to be successful, with some exits and big returns, to have people betting a lot of money on “marketplace banking”.

As an entrepreneur you need to have demonstrated that you are able to execute and scale a fintech business to lead that kind of new venture.

Customer base/CRM: here is the most complex part. How do you attract a critical mass of customers based on a simple offering (accounts + cards + eWallet) that relies on third parties for additional services? You cannot only rely on marketing and having a cool brand to attract hundreds of thousands of new customers if you have nothing really different to offer.

You also need some kind of focus: will you target individuals or businesses? Lower end or high net worth individuals? Small, medium or large businesses? Will you focus on one single country or several ones?

As always, it is all about customers and revenues, so you need a clear sales and marketing plan to quickly scale the customer base. I have some ideas how to do it but I will keep it for another post.

I have been asked several times if the first “marketplace bank” will be launched by an old-school bank (an incumbent) or a fintech startup? I definitely think the latter. It is too disruptive and the risk of cannibalization is too high to see a bank assuming the risk.

Anyway, most bankers are not already worried enough by fintech to react to its coming second wave. I remember a pool during a fintech panel where almost 90% of people answered that a fintech bank was improbable and, if it happens, it would be build by an incumbent. This creates a fantastic “window” for us fintech entrepreneurs, to build it, and once it’s done, it will be too late for them to react.

Fintech banks are inevitable!

This is just a blueprint. To pull it off requires a lot of hard work. But given that the elements are all already available, it's not a question of if but when the first pure fintech banks appear. They will be lean, flexible, and unhindered with legacy systems and a bad reputation due to never-ending scandals.

They will eat the lunch of the current bank dinosaurs and could well eventually rule the banking world.

About Philippe Gelis

Philippe Gelis is co-founder and CEO of the foreign exchange marketplace, Kantox. Philippe has led Kantox's growth to serve over 1,500 corporate clients from over 15 countries, carrying out over $1 billion in total trades. Kantox was founded in 2011 with the goal of bringing transparency, efficiency and fairness to the FX market for SMEs and mid-cap companies. Philippe is a regular columnist and commentator in the financial press, and has appeared in Forbes, the Financial Times and Business Insider, among many other publications.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...