I was honoured to be invited yesterday to address the European Banking Federation’s (EBF) annual conference in Brussels. There were many dignitaries there, as well as a number of senior Eurocrats, and so felt that my message of Fintech, Blockchain and Real-Time for Free might fall on resistant ears, but quite the opposite.

I was especially impressed by Kaja Kallas, a Member of the European Parliament (MEP) from Estonia. Estonia is one of the leading digital nations of Europe, so much so that the UK Government has partnered with many start-ups in Estonia to learn from their digital leadership. In fact, many of the Baltic and Eastern European countries are showing major innovation developments that we can all learn from.

Kaja made several interesting comments, including the fact the regulators often regulate for what is there today. As a result, they build laws that support the incumbent business model and can often restrict the innovation agenda. Equally, she made the point that if everything is free, then you’re paying for it in some other way. For example, Facebook and Google are not free. They are making money from your data, and sometimes “paying with money is cheaper than paying with data”. Consumers don't understand this, but hey, they will when they get ads that bleed them dry.

Anyways, I couldn’t stay long. Between jumping on a Eurostar train that was delayed due to “migrants on the line” and having to then jump on a flight to Madrid, I purely had time to deliver my keynote and hear the panel on digital disruption (with BBVA, Sopra and Finansradet, v good) before leaving.

In the midst of all this Wim Mijs, CEO of the EBF, launched the EBF’s Digital Banking plan. Europe has a plan! What is it?

Well you can find out all the detail on their website: www.ebfdigitalbanking.eu, but here’s the highlights for those who can’t be bothered.

About the EBF blueprint

The banking sector is much more than an industry and more than an employer. Banks represent strategic partners for Europe’s economy. They channel savings to investments to ensure economic activity and growth and provide essential services in a secure and reliable way for their customers, consumers and corporates alike: deposits, lending, distribution and access to funds, financial advice and payments, among other products and services. Today, they fulfil a vital role in the economy, not to mention that they have always been used as a tool for public policy, and it will still be the case in the future (e.g. transmission channel for monetary policy and access to finance). In this way they play a key part in society and distinguish themselves from the other players.

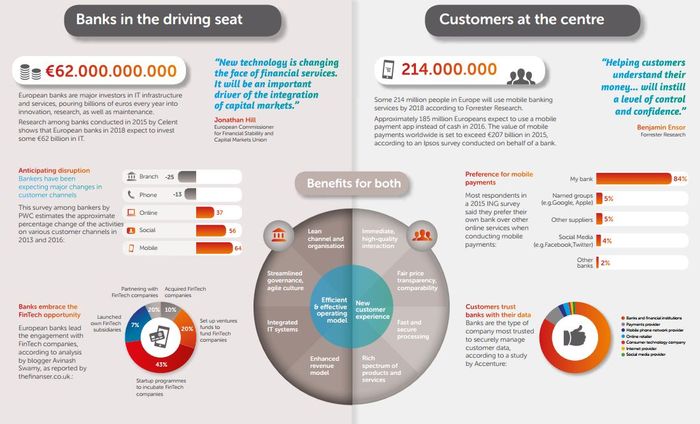

The emergence of new technologies such as cloud-based systems, high-speed wireless network, biometrics or instant payment systems is leading to more efficient banking services, generating many new opportunities for banks and better products and services for their customers. If banks are sometimes perceived as ‘conservative’, they are actually highly innovative actors, constantly embracing change over the years. In this respect, the current digital revolution is simply another significant step in the history of banking.

Digital banking is often understood to be the use of mobile banking or online payments but its meaning is much broader. It encompasses the ability to interact digitally with customers. This is done by integrating digital technologies (e.g. through the use of strategic analytics tools such as big data, social media, innovative payment solutions, mobile technology) and by providing services through digital channels in real time, a seamless experience with appropriate security and authentication systems. Digital banking is, in fact, all about improving the customer experience.

The aim of the EBF Blueprint

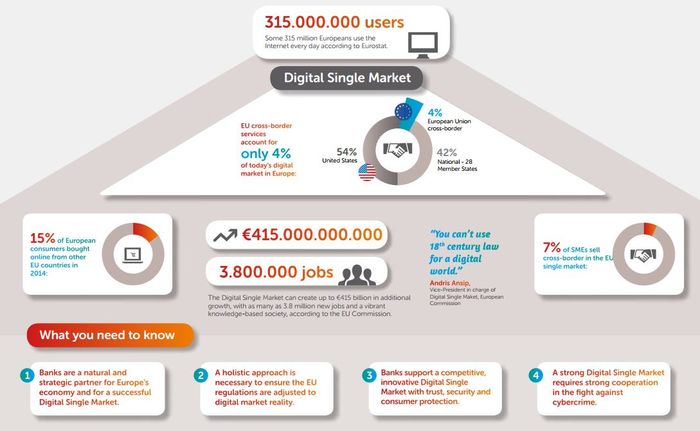

The European Banking Federation’s (EBF) Blueprint on Digital Banking aims at helping to understand more effectively the digital transformation initiated by banks. The EBF Blueprint focuses on the challenges and opportunities in retail banking. It also explains why banks should be considered as strategic players in the Digital Single Market (DSM).

With the aim of encouraging discussion and reflection among banks and EU policy makers, the EBF Blueprint proposes recommendations on which to build a proper framework for a workable DSM. Recommendations, to ensure that the reforms undertaken will lead to the desired effects: restoring trust, creating a competitive and innovative market, and boosting economic growth and employment.

In particular, the EBF blueprint provides indications on the changing environment driven by customer expectations, a description of today’s digital bank representing an innovative customer experience, and a portrayal of the bank of the future. And more importantly, the barriers and opportunities for banks and their customers linked to some fundamental issues: better access to banking products and services, big data, payments (mobile/instant and e-invoicing), cybersecurity, crypto-technologies, e-identification, digital skills (education, competencies, recruitment), and the importance of removing regulatory inconsistencies and ensuring fair competition.

As a next step, the EBF Blueprint will be followed by ‘issue papers’ proposing an in-depth analysis on the strategic topics identified.

You can download the whole report here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...