So at one of my meetings last week, someone tells me to checkout The Disruption House. What’s that, I ask? Go take a look, they say. So I did, and it’s fascinating.

The Disruption House is an advisory firm that includes SWIFT Innotribe friend Haydn Shaughnessy. The firm has produced a report as to why banks fail to grasp innovation. The report is the conclusion of a study of over 150 financial institutions, focusing on their commercial and wholesale arms, along with a few retail financial services companies and technology firms that now provide financial services. They focused in on 65 for detailed study and interviewed 20 in order to uncover information about their innovation capability.

Some of the key findings are:

1. Innovation capability. Banks, particularly systemically important banks, have a low innovation capability when compared with companies overall (lagging by 10-15% in a comparison with a generic all companies index), but, more importantly, the top 10 global systemically important banks (G-SIBs) lag the index of all companies as measured by key capability indicators by 23% and lag other banks by 10%.

2. Improvements in 2015. Banks have improved their innovation capabilities over the course of 2015 though arguably not significantly so. In particular BNPP and Barclays have risen in the rankings and now make an appearance in the top 25. CitiGroup move into the top 10 at number 8 (up from 11 in our 2014 review), just above BBVA. Those dropping out of the top 25 include Banco Santander and Société Générale, while RBS has made an entrance into the top 50.

3. Strategy. Banks have a strong strategic position. The average score for strategic innovation capability for a bank was 20.6, marginally above that of a combined group (at 20.4) that included banks and new entrants such as Alibaba and Tencent of China. This score implies that the capacity for banks to make strong strategic moves in the market is high but is not being deployed. The main reason for this is leadership.

4. Leadership problems. Banks specifically lag the innovation index of all companies on leadership, based on our 2014 survey of innovative companies,1 The gap in leadership capability between the most capable and 10th most capable G-SIB is over 75%, with leadership being particularly weak on the key issues surrounding adaptability and so ware-centric decisions.

5. Too much orientation towards product innovation. While banks appear to be working hard to develop innovation capabilities these are still targeted at product innovation more than process innovation, and are biased towards blue sky projects in blockchain (which has at least a 10 year development horizon but which every major bank now has an involvement in) and fintech startups that are going to be difficult to integrate into bank process innovation. These two focal points are not likely to help ROE in the short term.

6. Process model innovation. At present banks, in general, are not deploying the tools that would help them organise, structure and accelerate change nor drawing on their long experience in platforms. Many are suffering from gaps in intergenerational leadership dialogue, IT-business dialogue and a lack of coherence between strategy and innovation initiatives. These are all process issues calling for process model innovation.

7. The narrative of change and thought leadership. We found that leaders within banks have been extremely slow to develop a vision of what the banking industry might look like in ten or twenty years hence. There is little real thought leadership leadership in the sense of the vision of the future and a narrative to support people on the journey to a new industry.

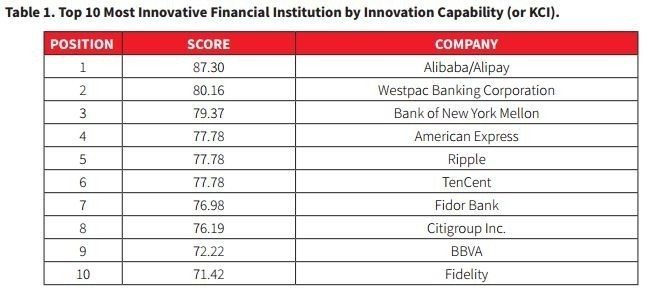

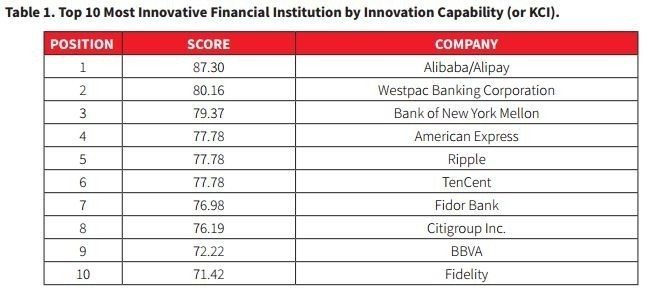

At the end of the report, the guys also list the Top 10 financial institutions ranked by their innovation capability. You might be surprised by the list:

You can download the full report here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...