During one part of my recent conference activity, I asked the banks in the audience how they organised their innovation strategies. All of them have one, is the good news. All of them have different nuances of how they structure for innovation however. The most common structure appears to be to have innovation under the remit of the Chief Operating Officer (COO). The COO then places a Chief Innovation Officer, or Chief Digital Officer dependent upon terminology, in each line of business. The CDOs will then have innovation hubs, accelerators and incubators spread around the geographies, with at least one in USA, one in Europe and one in Asia (what about LatAm?). In fact, it seems clear that you have to cover at least Silicon Valley and London, but many cite New York, Tel Aviv and Singapore as priority too.

Anyways, innovation has been a theme of this blog pretty much since I started writing it. Back in 2008, I made the point that banks find it hard to innovate and weren’t committed to it. Then the crisis hit, and innovation went off the agenda. I think the difference today, thanks to FinTech and regulatory change, is that innovation is clearly back on the agenda and is committed to this time. However, that commitment falls into two camps: those who are watching and keeping their finger on the pulse of innovation; and those actually creating change and seeking business transformation.

All of the banks in the room had a commitment to innovation and a clear focus upon nurturing start-ups, partnering with them and reinventing their businesses. Very few appear to have internalised the innovation process by linking it directly into the Leadership teams’ agenda for transforming the bank to its digital future. Some want to sit on the side-lines and wait until they have to move; one or two want to carpa diem and be the champion of change.

It is the endemic culture of finance to fast follow, which is why most fall into the former camp. Fast following allows banks to keep up with change without risk. Watch, monitor, see if anyone is doing this well, note if customers like it and are willing to switch to it … if that happens, then hey, let’s copy it and do it.

That’s the fast follow industry in operation. If ABC Bank do it, then we must do it. It has been something that has been a pragmatic way to deal with change historically, and it is still pervasive today. However, being second can cede power. There would be no PayPal or AliPay if banks had created a frictionless payment system for the internet (see iDEAL in the Netherlands). There would be no Apple Pay, Samsung Pay or Android Pay if banks had taken a lead in offering mobile wallets (yes, there is Chase Pay). Equally, there would be no Square, Stripe or Klarna if banks focused upon easy checkout (but note that banks do invest in these things).

These developments demonstrate the reason why banks do not need to be on first footing, as little is destroying or disrupting their system. There are things that add to their system, which is what PayPal, Apple Pay and Square are doing, but none of these developments are replacing their system. Where there is an opportunity for replacement – such as when you see peer-to-peer lending, robo-advising or digital currencies – then the banks’ innovation labs kick into fifth gear and investigate heavily to find out whether they are a serious threat and, if they are, then make sure the bank follows it.

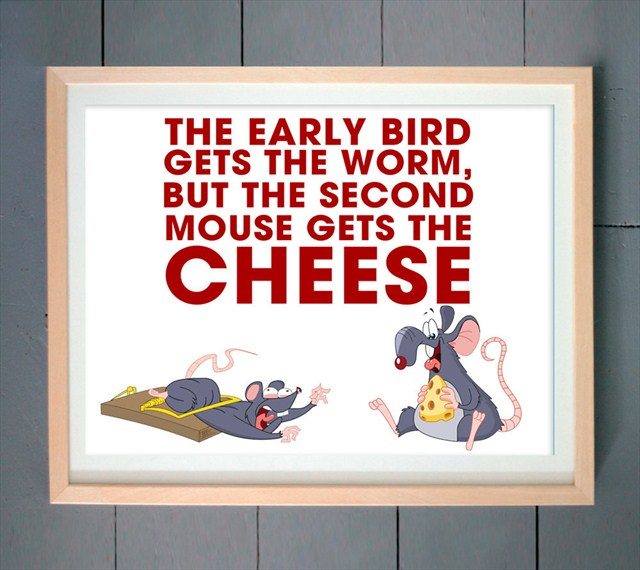

Fast follow is lower risk than first footing. Hence the reason why banks prefer to be a second mouse rather than early bird.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...