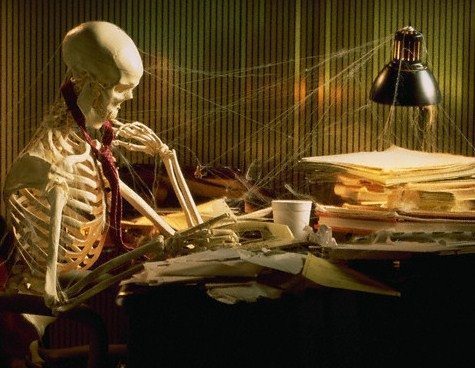

I talked about the legacy problem yesterday and, in reality, the problem isn't just the legacy system. It's the legacy people and legacy customer.

The legacy people are the ones who sit in the organisation and resist change. They know where their cheese is and they don't want it to move. This appears to be the mentality with ANZ as the real resistance to changing core systems is more the fear of the risk of doing this, than the actuality of doing it.

Legacy people are also those who sit and look at new technology and wonder how to apply it to existing processes. For example, the bank that has built a great virtual branch for Oculus Rift. Yes, you can augment my reality but if, in reality, I never visit a bank branch why would I want to do so in virtual reality?

These legacy barriers to change and legacy thinkers are the reasons for creating faster horses, rather than inventing new forms of transport.

Go and ask the legacy customer what they want, for example, and the answers would vary but would most likely include lower fees, better interest rates and made to feel special. Ok, that's what all the challenger banks are focused upon, but the customer doesn't think outside the box. They think inside. This is why you have banks that have delivered innovative apps, easy payments and fee-free accounts, but the customer is still using Internet banking (as they don't trust mobile apps), cheques (as they're easier than that PayPal thingy) and passbooks (well, it worked in the past and I like to see my balance).

It may sound ridiculous but show me one mainstream bank that has got rid of anything from the past. If they had branches, they still have them (maybe a few less); if they try to get rid of cheques, the outcry is so huge that they still issue cheque books; and if they try to stop customers using a particular service, such as shutting a branch, the press make out that the bank is like Lord Voldemort from Harry Potter. Banks get no glory for innovating, if it means that they tell their customers they can't do something anymore.

The result is that we have the legacy bank with legacy people looking after legacy customers. So here is a reason that can be given for not changing legacy core systems, and is likely to be the one that ANZ are using.

Does the fact we have a 40-year old core mean that we are losing customers, cannot compete effectively or exposing us to cyber security issues?

No.

So why change them?

If the customer doesn't care, has no issue and it's not causing any problems in processing and operations, why should they be changed?

Where's the compelling reason?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...