Building upon Friday’s discussion of how the system treats the poor, there are interesting movements afoot at the Brookings Institute. If you’re not familiar with Brookings, it is one of America’s oldest Think Tanks and provides independent research into social sciences, particularly economics, governance and foreign policy, for the US Government.

The Institute has a dedicated area of research and reporting on Financial Inclusion and have just produced their 2016 report.

The Financial and Digital Inclusion Project (FDIP) evaluates access to and usage of affordable financial services by underserved people across 26 geographically, politically, and economically diverse countries.

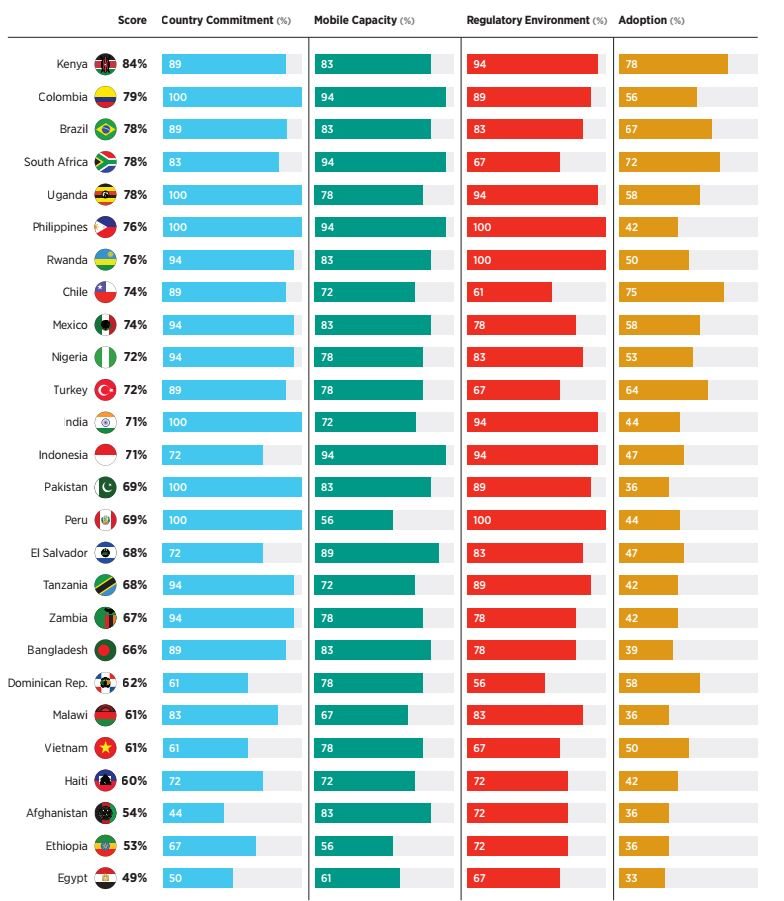

The 2016 report assesses these countries’ financial inclusion ecosystems based on four dimensions of financial inclusion: country commitment, mobile capacity, regulatory environment, and adoption of selected traditional and digital financial services. The 2016 report analyses key changes in the global financial inclusion landscape over the previous year, broadens its scope by adding five new countries to the study, and provides recommendations aimed at advancing financial inclusion among marginalized groups, such as women, migrants, refugees, and youth.

The 2016 report builds upon the first annual FDIP report, published in August 2015.

It’s intriguing, but unsurprising, to see that the leading countries developing financial inclusion are mainly in South America and Sub-Saharan Africa (doubleclick image to enlarge):

The Brookings Institute identifies four priority areas where action is needed to advance inclusive finance:

- an increased focus on establishing (and then achieving) specific, measurable financial inclusion targets;

- promoting more comprehensive data collection and analysis regarding financial access and usage, particularly among traditionally underserved groups such as women;

- advancing regulatory efforts designed to facilitate financial inclusion; and

- enhancing financial capability to promote sustainable financial inclusion.

I would replicate more of the report here, but would instead urge you to download it in its full 164-page glory. It makes fascinating reading.

The only part I am going to replicate here is the commentary on digital identity through mobile network systems, as this is something the UN has picked upon and is the focus of our Financial Services Club meeting on September 20.

Advancing access to digital identification is often crucial for facilitating financial inclusion among women, as women are less likely than men to have the formal identification relevant to account opening processes. Of course, any digital identity program should be developed and implemented with a focus on ensuring adequate privacy for users. In Nigeria, MasterCard and UN Women have partnered on an initiative that aims to provide women with information on the benefits of a formal identification program and to enrol half a million Nigerian women in the program. In Pakistan, the government implemented a biometric ID system to ensure that certain government payments could only be collected by women beneficiaries. Women using the new ID cards “reported having higher status and more bargaining power in their families”.

As a last note, one of the endorsers of ValueWeb is Seth Wheeler, a former Brookings Guest Scholar and, before that, Special Assistant to the US President for Economic Policy at the White House. Brookings know what they're talking about :-)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...