I spotted a lengthy, but very insightful post, on LinkedIn the other day by Ben Robinson, Chief Strategy and Marketing Officer for Temenos. I don’t usually highlight such pieces, but felt this worth replicating here, and Ben kindly agreed. Enjoy …

Four banking business models for the digital age

Digitization of the banking industry is making new banking business models possible. But, it is the combination of regulation and technology that is making new business models a necessity.

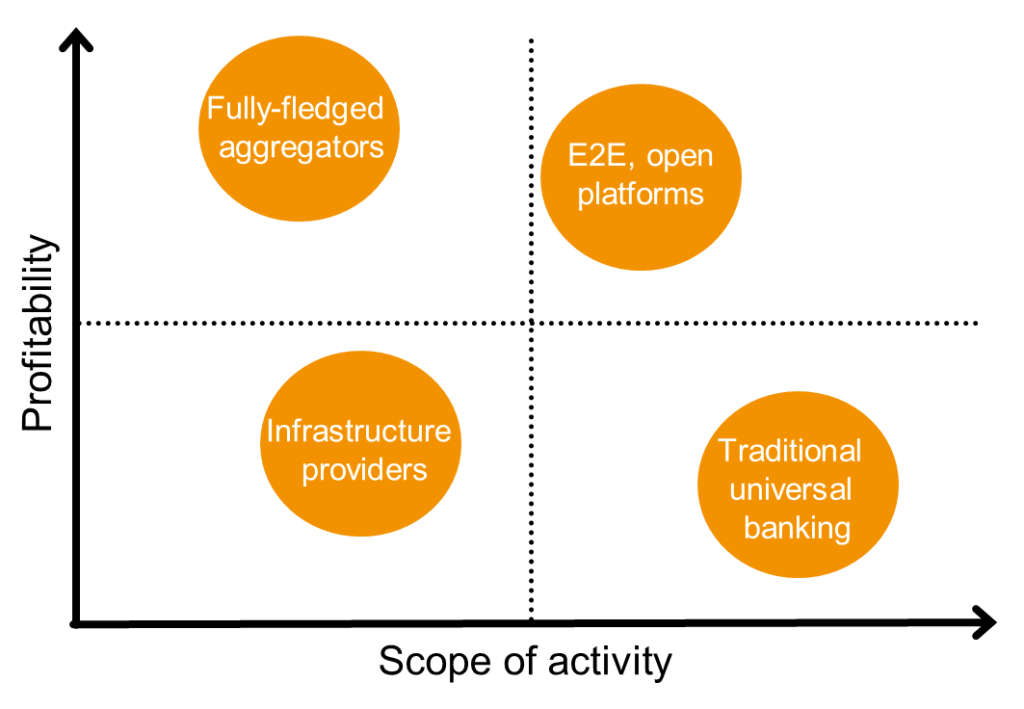

There are 4 strategic options open to banks, shown below. These vary in terms of the scope of banks’ own activities as well as in terms of profitability. The traditional universal banking model and the infrastructure provider model are both asset intensive and low margin, which makes them unattractive. In addition, the universal banking model, in that it requires the bank to manufacture and distribute all of its products, is probably unsustainable. The aggregator model, top left, offers the possibility for very high profitability with low asset intensity, but will be difficult to defend. Thus, it is the vertically integrated but open platform model which offers the best route to sustainably high margins.

From a producer to a creator economy

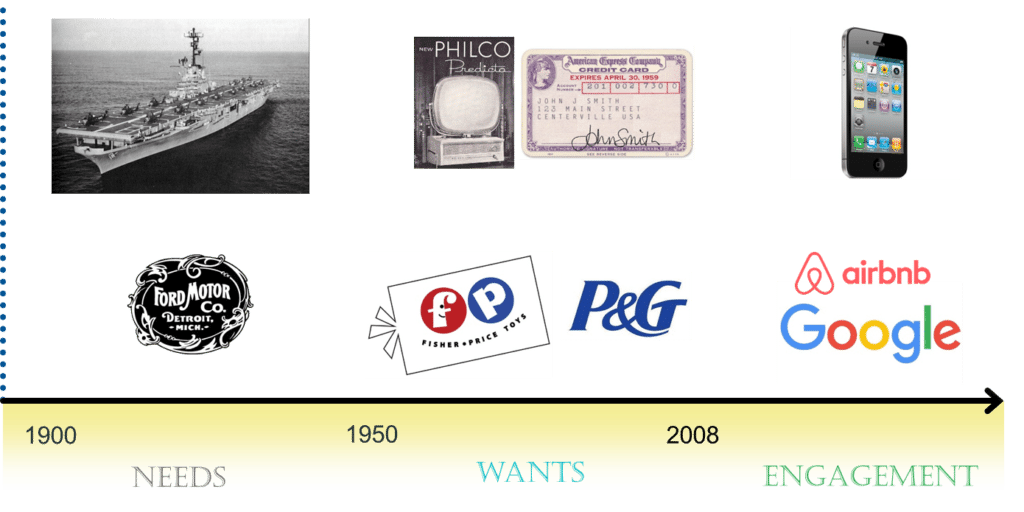

If you have a spare 90 mins, you should definitely check out this presentation from Paul Saffo which gives an interesting take on the economic history of the last 120 years. Paul argues that the first part of the 20th century was the “Producer Economy”, where economic efforts were employed in systemizing production, organising people and capital in the most efficient way possible to overcome scarcity. The most iconic image of this age is the Ford Model T, available in any colour as long as it was black. But, the peak of the producer economy came with the Second World War when the US economy was able to produce 8 aircraft carriers per month and a new plane every 15 mins.

Post the Second World War, the “Producer Economy” gave way to the “Consumer Economy”, where scarcity moved from production to desire and where it was necessary to foster the latter through advertising and credit. The peak of the consumer economy came with the financial crash of 2008 when the economy couldn’t be leveraged up anymore.

Today, Saffo argues, we are in the “Creator Economy” where the scarcity is consumer engagement (a “poverty of attention”) and the means to overcome it is to offer services through platforms, where the consumer becomes at once a producer and consumer. Making the consumer a creator produces network effects, where the consumer’s input makes the product better - like Facebook where more users means more content and interactions attracting more users - and leads to a positive feedback loop of increasing customer numbers and increasing engagement. The only way to stop the increasing returns to scale and tendency to monopoly in the creator economy is to create better platforms, as MySpace, Yahoo and other companies stand testament. Which is why, incidentally, Europe needs to get busy developing platform companies rather than trying to legislate against the ones that exist.

Banking in the context of the creator economy

How well does this model of economic history explain the evolution of banking over the same period?

Well, the first observation is that it is only really a model of the developed world, not the developing world. In the developing world, there is still a scarcity of banking provision as evidenced by the 2bn adults who don’t have access to banking. However,digitization is also helping to solve the problem of financial exclusion, by lowering the cost of banking and making it accessible anywhere and anytime (increasing the supply of banking to a point where the price meets demand).

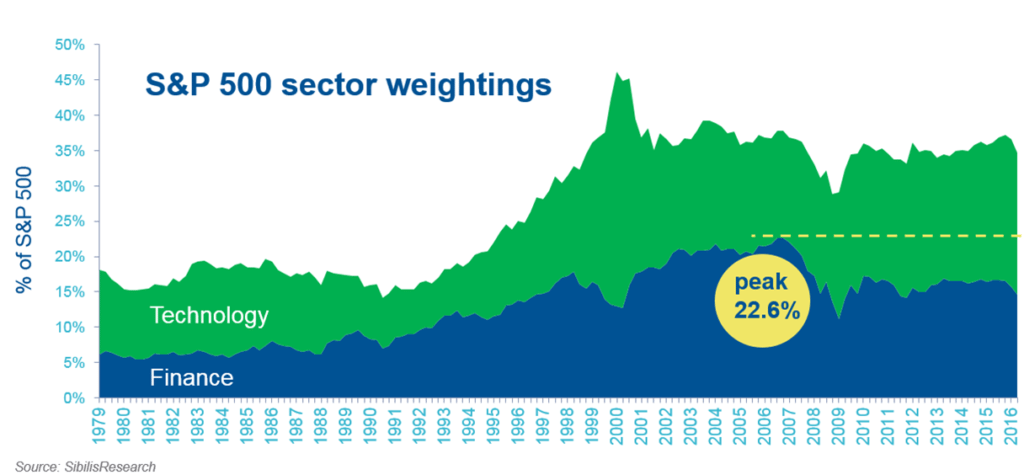

But, as regards the developed world, Saffo’s history reflects very well the changing role of banking. Given the pivotal role of banking in underpinning growth in the “Consumer Economy” – underwriting the sustained rise in demand for consumer goods and, then, for housing (which successive rounds of de-regulation were happy to fuel) - it explains why banking became so oversized relative to historical norms and relative to other sectors of the economy. For example, in 1945, the year the Second World War concluded, financial services made up 2.1% of US GDP. In 2007, the year before the financial crash, financial services constituted 7.6% of the US economy. Similarly, in 1979 (the first year for which data is available), financial stocks represented 6.1% of S&P500 compared to 22% in 2007.

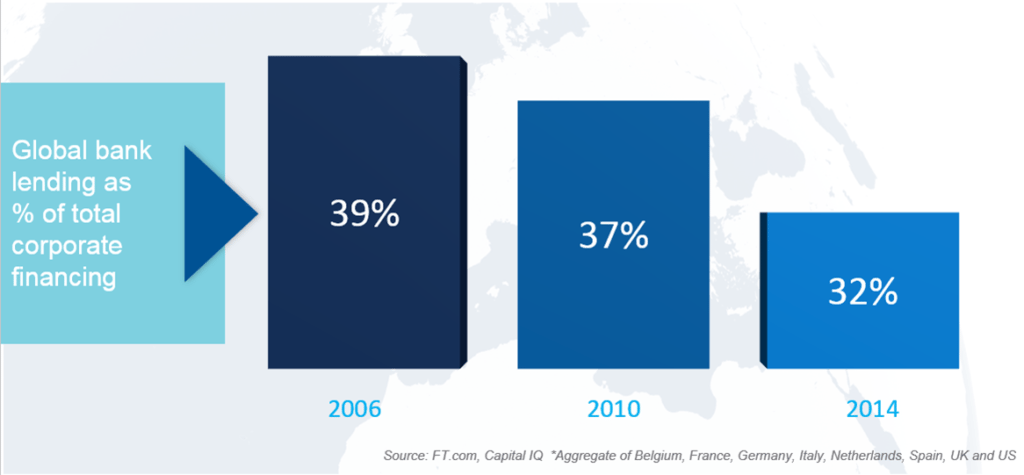

Seen in this context, it seems obvious that what we are seeing in terms of banks scaling back their activities and reporting lower profits is not solely the cumulative result of new regulation, changing competition and cyclical factors such as lower interest rates. Structurally, in the Creator Economy, we do not need such a large banking sector. And, in fact, banks have historically not provided many of the types of finance we need today, such as venture capital to start-up businesses, another reason why traditional bank lending is shrinking relative to alternative sources of business financing.

Not only is banking going to be a relatively smaller industry in the creator economy, but it’s going to have to evolve a lot to stay relevant.

The technology driven change

Banking is subject to the same technology-driven change as other industries and which make a creator economy possible. The internet has provided a platform for distributing goods and services that is global and cross-industry and which can be divorced from manufacturing, opening up banking to outside competition, especially from internet platforms. Advancements in data science and AI make it possible to give faster and constantly-improving levels of online customer experience across much larger customer numbers, meaning companies with the best algorithms – and especially the most data – can dominate. And mobile has grown internet usage while simultaneously increasing the amount of time we spend online, making this the pre-eminent channel for customer engagement and extending the rewards to the platforms that succeed.

A new regulatory regime

But, as a heavily-regulated industry, regulation also plays a very important part in determining banking business models. It is the combination of new technologies and new regulation that is making new business models a necessity rather than just a possibility.

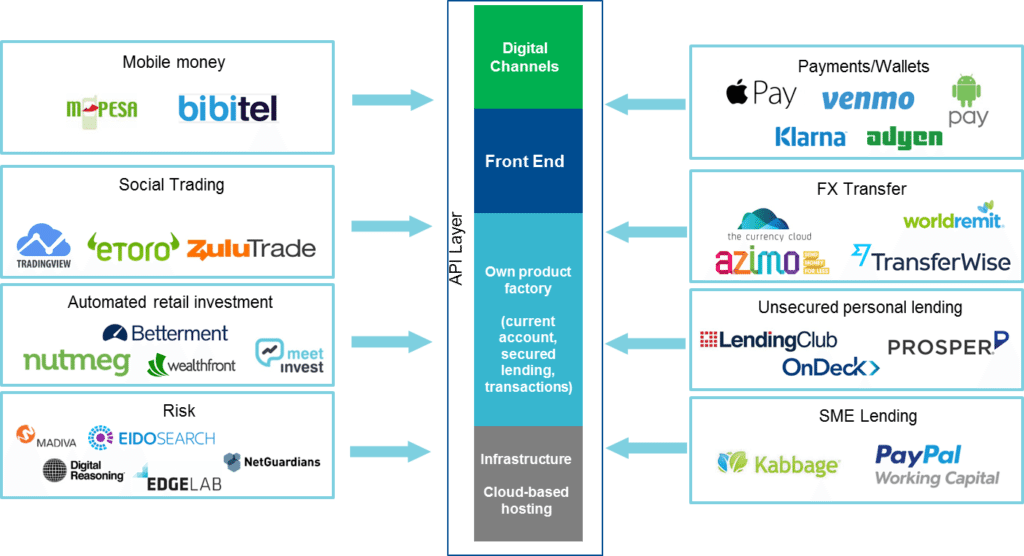

The open banking initiatives such as PSD 2 in Europe, which obliges banks to share customer data with third party providers where a customer requests it, are intensifying the battle for distribution which technology changes had already initiated. From 2018, aggregators can get access to customers’ transactional data via APIs. This will put them in a position to give ex ante recommendations based on customers’ spending behaviour which before would only have been possible by acquiring that data through some other means, such as offering a payments platform (like Apple Pay).

On the other end of the scale, system safer directives such as Basel III, by forcing banks to set aside larger capital buffers against risk weighted assets, have the effect of making regulated banking activities more expensive (and so likely to be provided increasingly by large-scale domestic commodities – see below) and pushing riskier activities outside of the banking industry. In many areas of banking, regulatory arbitrage is likely a bigger advantage to newcomers than faster adoption of new technology .

Other new rules, such as the transparency directives like MiFID II, are also likely to have impacts on business models at once encouraging consolidation among fund providers while opening up a bigger opportunity for automated investment services.

New strategic imperatives

Against this background of changing regulation and changing technology, banks must appraise the ongoing viability of their business model. In effect, we believe that all banks will be forced to adopt one flavour of the following four business models.

Do nothing

The first option is the ‘do nothing’ option. While this may be tempting, in common with so many industries undergoing change, this option is the most dangerous.

Most banks operate a full-service model today. That is, they provide retail or corporate customers with a current account and a range of own-labelled products and services on top, such as mortgages and credit cards.

The problem with this model is that there is a proliferating number of providers at every point in the value chain offering individual products at a lower price point, with less friction and better customer service. Trying to compete with these providers is impossible because of legacy software, but also because it would unpick a web of cross-subsidies where profitable products prop up unprofitable ones.

Rather than wait for this unsteady edifice to come crumbling down, banks should rationalise their products offering, concentrating on areas where they command competitive advantage or areas that are highly strategic (see later).

Become an infrastructure provider

Another option is to become a service provider to other banks or fintech companies, as banks such as Bancorp and Solaris have opted to do.

The value proposition of such a model is to eliminate the need for others to engage in heavily regulated activities and take on the associated compliance burden, or – for a new entrant – even to have to apply for a banking licence at all. As noted earlier, regulation is pushing up the cost of doing regulated business and of compliance in general.

Such a model could be lucrative if the provider is able to achieve significant economies of scale, spreading the fixed compliance costs across a much larger volume of business. And such businesses will be run in the cloud to take advantage of the scale economies of shared infrastructure.

However, since the services provided are commodities and there is no room for network effects (where more users of the services makes the services better), this will not be a high margin business. What is more, since regulation is making cross-border activities more expensive, these infrastructure providers are likely to be domestic champions. How many providers can operate this model will depend on minimum efficient level of scale and whether there are limits to scale economies.

Aggregator

A more profitable model to operate would be one of aggregating financial services.

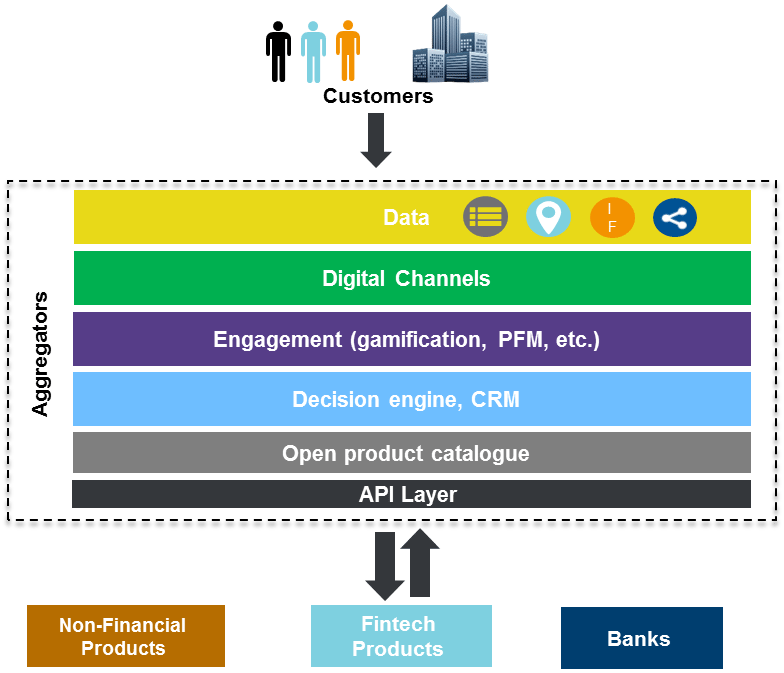

In such a model, a bank would turn itself into a distributor of financial services products. That is, a bank would not manufacture financial products and services but instead source them from an ecosystem of partners. In this way, the bank does not have to incur the costs of manufacturing products or compliance and can also provide customers with access to a broader range of products than if the bank tried to produce everything itself.

In order to make this model successful, the bank needs to become a virtual advisor, using customers’ data to help them make better financial and operational decisions – effectively providing a customer with the right advice and/or other service at the right time and across the right channel for the customer to act smarter. The bank monetizes this service, inter alia, by taking a small fee on all of the products and services the customer uses.

For a long time, the challenge to operating such a model was not technology – mobile has already opened up the channel to do so – but data. Without access to customers’ transactional data, it was difficult to provide truly value-added advice: for example, helping customers to set savings goals is much less useful if you can’t also help them to make savings. But PSD 2 is changing that by allowing third parties access to banks’ transactional data records. Now, internet platforms can add transactional data to the stores of contextual data they hold to be in a position to give very timely and relevant advice. Price comparison sites will be able not just to help you find the best deal, but tell you when you are eligible for such deals.

PSD 2 has effectively made banks online addressable in the same way that smartphones with GPS made the taxi market addressable to Uber or every home having a DSL line made AirBnB possible.

The aggregator model is definitely a model for the creator economy. A bank gains customer engagement by working with customers, helping them to better understand their financial affairs and the options open to them, but ultimately empowering them to make those decisions –making them a co-creator.

As a model for the creator economy, the aggregator model can be extremely lucrative. Operating such a model, a bank can generate massive economies of scale by potentially servicing millions of customers from the same software platform. But also, as a platform, there is the potential to generate network effects that could lead to increasing returns to scale. Firstly, there are the two-sided network effects whereby larger customer numbers leads to a larger number of ecosystem partners which then, by offering the widest choice, attracts more customers and so. But, there are also the data network effects, whereby the bank learns more about how best to serve customers the more data it captures meaning it gives better and better services, attracting more data and so on. If the bank also opens up its platform for customer interactions with each other – with peers giving advice to each other, for example – then there are also interaction network effects enjoyed by the social network platforms.

The challenge with banks opting for the aggregator model is that it is difficult to argue that others couldn’t do it better.

Thin, open platform

A better strategic move would be to pursue a model that enables banks to both capture network effects and capitalize on their existing competitive advantages.

Banks competitive advantages are still numerous: trust (not as much as pre-crisis, butstill more than many potential competitors), large customer bases, lots of data, strong execution capabilities across the value chain, access to cheap deposit funding and plenty of capital.

Moving to an aggregation-only model would mean leaving many of these advantages behind.

So, a better model would be a vertically integrated but open platform. It would be vertically integrated to take advantage of banks’ execution capabilities and by extension their ability to offer superior levels of customer fulfilment (a key reason why Amazon is becoming more vertically integrated). However, it would be vertically integrated but thin with banks only offering a small number of own-labelled products where these are strategically important like current accounts (for data, cheap deposits) and payments (data) or where banks have a competitive advantage (like secured lending). And the platform would be open to allow banks to offer products and services from third-party providers, as in the aggregator model, but as a vertically integrated regulated bank could be delivered faster and with less friction.

As we wrote recently, the theory that the internet giants are asset-light distribution platforms is wrong. Many started out as such, but few stay that way. What most tech companies find is that to maximise their success, to generate greater network effects and to prevent losing out to new platforms, they need to acquire many assets and, in many cases, become more vertically integrated.

PSD 2 has kicked off the platform race. Banks need to open up their distribution channels, to become aggregators, to have any chance of competing effectively. But, their best bet is to combine open distribution with the provision of a few strategic services sitting on top of a vertically integrated infrastructure. This seems the best way for banks to thrive in the creator economy.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...