Recently, Dr. Gail Bradbrook of Extinction Rebellion allowed The Finanser to publish a guest piece, which was generally well received. However, one letter stood out as a rebuttal. Gail determined to reply to this view, and so the dialogue carries on below…

When economics and investments are led by our better selves

Dear Anonymous Banker,

I will address the many points raised in your letter over these coming weeks.

I’m focusing here on the idea that we need more time because we have to protect our economy. We don’t have time; physics and ecology sets the timetable, not the requirements of our economic system. And if our political economy requires protection, whilst it fails to protect us, we need to rethink our economic system. Perhaps our anonymous banker would further consider me an extremist for suggesting that?

When activists insist we question the economic system we are also labelled “anti-capitalist”, which is a trope for “naive, anti-business, anti-markets, anti-progress and uninformed”. The label is used to divide and discredit, at a time when we need to listen to each other, to apply imagination and determination together, to make change. We need a grown-up conversation about economics - no one wants to throw any babies out with the bathwater in the process!

The “free” in free markets used to mean free from monopolistic powers. Now it has come to mean being free to do whatever the hell you can get away with, if you’ve enough money to buy your way out of regulation in secrecy, and the funds to lobby politicians to do your bidding.

How many of us noticed that we gave up on the idea that monopoly power is bad?

Apparently if monopolies provide a better price then all is fine, even though big tech’s monopoly power is a threat to democracy. Each year, government subsidies of around half a trillion dollars artificially lower the price of fossil fuels. If you include the fact that the burning of fossil fuels creates this incredible “economic externality” of destroying our life support systems, the IMF estimates subsidies of almost 7% of global GDP. Does this all add up to functional capitalism? I think not.

As Mrs Thatcher said to the UN in 1989 “We should always remember that free markets are a means to an end. They would defeat their object if, by their output, they did more damage to the quality of life through pollution than the well-being they achieve by the production of goods and services.”

The idea of endless economic growth on a finite planet has long been derided. The latest distraction to making urgent and necessary change is the promotion of so-called “green growth”. This is the idea that we can achieve a sufficient and rapid decoupling of economic growth from greenhouse gas emissions and the use of natural resources.

A review of 835 academic papers concludes: “large rapid absolute reductions of resource use and greenhouse gas emissions cannot be achieved through observed decoupling rates”. The argument is over. Green growth is a fallacy. The authors also state: “We find that in this rapidly growing literature, the vast majority of studies [...] approach the topic from a statistical-econometric point of view, while hardly acknowledging thermodynamic principles on the role of energy and materials for socio-economic activities”. In other words, the analysis isn’t based in the real world of physics!

This isn’t a new problem as most economic studies are based in one school of thinking, namely neo classical. Academics who consider the ecological basis of any economic system as being central, often finding themselves as “heterodox economists” shoved to the side and often moved into a different department.

Helpfully those other well-known political extremists – the global bankers at BIS – said in their Green Swan report of 2020:

“Bringing the economic system back within Earth’s ‘sustainability limits’ therefore involves much more than marginal changes in the pricing and accounting systems, and could entail re-evaluating the notion of endless economic growth itself”.

The European Environment Agency has acknowledged that green growth is "unlikely" and calls for post-growth and degrowth alternatives to be integrated into EU policy.

Whilst growth of specific green sectors of the economy is to be welcomed GDP, as currently measured, will not carry on growing in the long term. Either because we make the necessary changes to our economic system and find alternative measures of progress (such as the genuine progress indicator), or because we destroy the financial markets and the civilisation on which our growth based system relies.

Economics by its nature is a political discipline masquerading as a science. For example, there are at least nine different schools to choose from. Professor Ha Joon Chang of the Faculty of Economics, University of Cambridge says: “Never trust an economist!”. This is especially true when it comes to economists thinking about climate change. There is, according to Professor Kevin Anderson of the Tyndall Centre, a widespread view that an average increase in warming of our planet by 4°C is incompatible with an organised global community, devastating to eco-systems and highly unlikely to be stable … and yet an economist, William Nordhaus, was given the nobel prize in economics for saying that 4°C of warming is optimal!

The economic modelling underpinning Nordhaus and others work, is based on fancy sounding analysis like “integrated assessment models” using estimates of “damage functions”. However natural scientists’ estimates of damage from climate change are 20-30 times higher than estimates from economists, with a huge gulf in understanding of climate tipping points and representations of climate catastrophes.

“Future discounting” is also a term that is used by economists. This is the way in which economic models value future assets compared with their value today. Professor Nicholas Stern said economists had misunderstood the basics of “discounting”:

“It means economists have grossly undervalued the lives of young people and future generations who are most at threat from the devastating impacts of climate change,” he said. “Discounting has been applied in such a way that it is effectively discrimination by date of birth.”

Professor Steve Keen, famous for being one of the few economists who warned the world of the coming financial crisis of 2008, has thoroughly debunked the appallingly bad neoclassical economics of climate change:

“Given the impact that economists have had on public policy towards climate change, and the immediacy of the threat we now face from climate change …, this work could soon be exposed as the most significant and dangerous hoax in the history of science.”

Nevertheless, the Bank of England has re-used these fallacious, broken, economic models to risk-assess the finance system with respect to climate change, whilst choosing to leave out specific scenarios that are believed likely to occur including food shortages and disruptions to power systems and supply networks.

So, what would it look like if financial investments and our economics were led by our better selves?

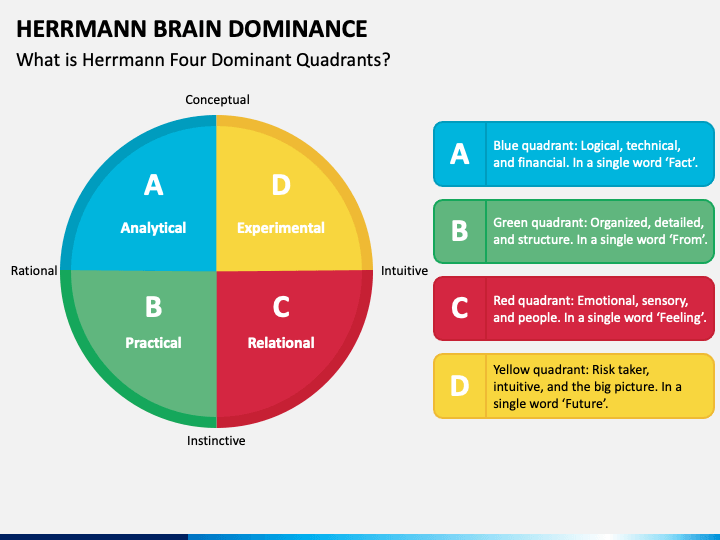

Let me share some interesting science. There’s at least four of you – four different personalities from the four different aspects of your brain!

Source: Herrmann’s Brain Dominance

Our left hemisphere tends to think in detail-oriented ways, reducing life to mechanical parts. Emotionally our left brain is inclined towards immediate self-interest, generated by resentments from our past and anxiety about the future. Left brain thinking has captured our mainstream economic analyses!!

Our right brain might be considered the seat of our better selves. It thinks from the perspective of meaning and purpose, seeing the whole, and is associated with feelings of playfulness and gratitude.

So, two brain hemispheres both thinking and feeling. These four different aspects to ourselves are described engagingly here by Dr. Jill Bolte Taylor. As a young brain scientist, she experienced a stroke that gave her direct experience of her better self - her right brain. Dr Taylor’s “Stroke of Insight” Ted Talk has had over seven million views.

We are collectively entering shit creek, because the higher wisdom of the right brain is consciously suppressed in our western culture and political economy:

“Economics are the method, the object is to change the heart and soul.” (Margaret Thatcher)

Indigenous cultures that have a greater part of their humanity “online”, steward relationships with the world in a holistic and sustainable way. Tackling multiple, intersecting, and accelerating crises involves re-orientating our culture and economic system towards a higher purpose. Our brilliant left brains can manage the details and get shit done, once we have consulted our better selves for the nature of the quest. As described in Dr Iain McGilchrist’s seminal work, we have to set the Emissary back into service of the Master.

Fortunately, there is a vast imaginative, compelling literature about how to do things differently. In the first case, the urgency of the crisis requires levels of economic change undertaken in times of war and pandemics. Thankfully, the Rapid Transition Alliance use a number of positive analogies beyond those of war eras, to show how we have pulled off rapid change in the past and can do it again, if we can summon the will and focus that is needed.

Economies are often blends of different approaches including a mixture of some state run monopolies and social provisions – such as health care systems – alongside free markets, which include cooperative models. So, we don't need to engage in mutually exclusive, either-or thinking here. Rather, we need to think together about what we want our economy to be for, such as for well-being.

To design a well-being economy we might be inspired by the many works of people like:

- Mission Based Economics of Mariana Mazzucato;

- Doughnut economics (Kate Raworth);

- Circular Economics (Ellen McCarthur Foundation);

- Balanced Economics (tax justice movement);

- Regenerative Economics (John Fullerton);

- Bioregional economics (Molly Scott -Cato);

- Tim Jackson’s Prosperity Without Growth; and

- Steve Keen’s The New Economics: a Manifesto.

Many of the ideas above are encapsulated in the concept of “degrowth” - a planned reduction of energy and resource use designed to bring the economy back into balance with the living world in a way that reduces inequality and improves human wellbeing. Degrowth-minded approaches might include providing universal basic services, banning planned obsolescence and single use plastics, introducing the right to repair and carbon rationing. For a thorough explanation enjoy Jason Hickle’s excellent book Less is More. We have an abundance of great ideas, but what we really need is a political will. Good folks of the finance system are key to making a resounding call for change.

And calls for change can be met by more immediate actions through investment choices. A recent paper takes the spectrum of investor intentionality, ranging from conventional investing through to impact investing and proposes to position degrowth investing as the next logical step. Degrowth investors are required to contribute to social and environmental solutions that measurably bring the economy within social and ecological boundaries. Impact investing is still needed in degrowth scenarios, since socially and environmentally impactful growth in some areas is still important.

Humans have faced down existential issues before. We can do it again. We can stop the harm and start repairing the damage we have done, as well as preparing for the consequences of the problems we have stored up. We need economics and investment making to be led by our better selves.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...