So yesterday I argued that PayPal and their brethren of social monies don’t matter. It was like unleashing the sceptical banker that I know resides deep within me, and it felt good.

Then I got a dose of new reality vision (maybe due to so many comments on yesterday’s piece) and it felt not so good, because PayPal and their brethren really do matter. In fact, they matter a lot more than we think.

Most of their secret lies in the pages of the innovator’s dilemma, which I’ve written about before:

The premise is that a new operator enters your industry offering something that looks irrelevant; before you know it, the irrelevant operators subsumes you and the industry by changing its economic paradigms. The best example is Japanese car operators in the USA in the 1950s who offered cheap new cars. Ford and GM thought they were rust buckets and dismissed them as such. However, Americans could suddenly buy new cars and they did en masse. The second hand car market disappeared and, over the years, the Japanese car manufacturers upscaled and produced cheap luxury cars. After half a century, Ford and GM were on their knees and the Japanese had won.

This central tenet of theory is absolutely critical when we look at PayPal, Facebook credits, Twitpay and more, as these developments will be a dilemma for banks, in the innovator’s dilemma style. The question is: do the bankers see the threat?

First, PayPal and their clan are not thinking about being the cream or froth on the cake. They are, instead, thinking about a new market dedicated to froth and cream that has nothing to do with cakes.

Whilst bankers focus upon cake, PayPal and the new breed of payments processors are focusing upon cream.

They have recognised that customers don’t want boring old stodgy cakes, but flexible sweet products that can go with cakes, meringues, biscuits, crumbles and even drinks: think cappuccino!

So they are creating a whole new market for cream, or rather payments, that has nothing to do with traditional processing but sits alongside it today, and could replace it tomorrow.

This new payments market is focused upon convenience, fun and the socialisation of money, rather than on the payments process or the need to pay. This is why it is so different – it’s the virtualisation of exchanging credits – and so yes, it is frictionless, flexible and free. More than this, it’s different.

Second, just like the car industry of the 1950s, it’s also insignificant as a dilemma right now. As mentioned before, PayPal are processing peanuts - $72 billion of transactions – compared to banks that process $4 trillion per day ... but give it time and you have to inevitably ask:

When do we take this market seriously?

When it gets to a trillion dollars a year?

A trillion a month?

A trillion a day?

You see, PayPal are moving and extending reach into higher ticket items and into core merchant services.

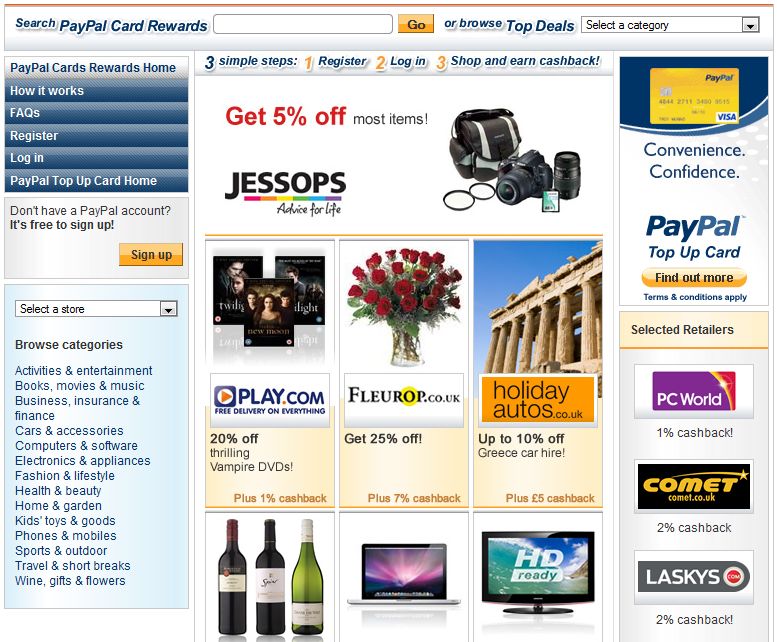

And what happens if and when PayPal offer a cashback program? Oh yes, they already do.

So what would happen if PayPal started offering real incentives, as in undercutting banks if you use a PayPal account as your core payments account, rather than paying via card or withdrawing into a bank account?

They could easily do this, as PayPal don’t allow negative balances, and are rumoured to hold over a billion dollars in deposits on accounts at any time.

That’s a significant figure to play with as a float.

Third, and most important, who owns the last mile?

This is the most critical question, and was raised in yesterday’s comments.

After all, if your main interface to monetary movements becomes PayPal or Facebook, so much so that you forget that a bank or bank account exists behind that brand, then does anything behind it matter?

So here’s the long-term play.

PayPal becomes your primary interface to money.

After a while, using their banking licence, PayPal gains direct access to the electricity generators of monetary movement – the clearing, settlement and payments infrastructures of the world.

They move upscale from being peanuts processing for consumers to displacing acquiring and issuing banks from the payments process through an ever expanding range of services:

- PayPal for Merchant Services

- PayPal for Working Capital

- PayPal for Supply Chain Finance

- PayPal for Trade Finance

- PayPal for Trading

- PayPal for NYSE

- PayPal for the London Stock Exchange

PayPal for ANYTHING!

BTW, it's not just PayPal at this point of time, but any firm that wants to operate in the cream and froth market.

At this point, you’ve realised the innovator’s dilemma.

What started as insignificant small beans payments that appears to be froth or cream on your cake, has suddenly become core business services and major margin erosion as the new entrants upscale and redefine the model.

The payments businesses erode and are substituted by new markets services.

To be clear, if you remember that PayPal currently generates around $800 million in revenue per quarter, or $3 billion a year, then compare this with today's other big boys. The world’s largest global transaction processors, such as Citibank, typically generate around $10 billion in revenues and $3 billion+ in profits.

So today, Citibank’s transaction services is three times bigger than PayPal.

In 2002, PayPal’s annual revenues were around $200 million.

In 2005, they broke a billion.

Today, they’ve reached three billion.

They’re growing at an average of over 25% per annum.

And they can keep growing as they expand services and upscale.

What will inexorably happen is that the core of the payments world – the infrastructures, settlement systems and clearing houses - will remain. These do not need to be substituted, as it's just cables and pipework. But like the electricity and water companies, it's the owner of the interaction and therefore, the customer, that is key and will change. The owner of the 'last mile' as we refer to them.

And that’s where our creamy new players are making their froth.

You see they enjoy being the cream on the cake because they are defining two separate markets – exchanging virtual credits in a digital world versus making a payment.

In conclusion, PayPal and their brethren matter because they are redefining payments and may be insignificant today ... but tomorrow?

Meanwhile, bankers can cry: ‘Let them eat cake’ ... trouble is, what happens when no-one wants cake anymore?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...