I’ve blogged and presented about this subject many times before, so rather than repeating all that, here’s a summation with a new twist.

Money is meaningless because we no longer deal in money.

When we use the word money, most of us would envisage some brand new shiny, crisp notes coming out of a cash machine, but cash is declining fast.

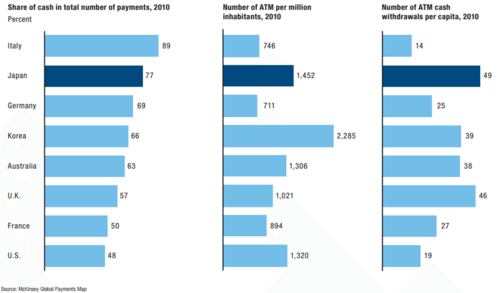

Sure, there’s still a lot around,

Source: McKinsey Payments Report 2012

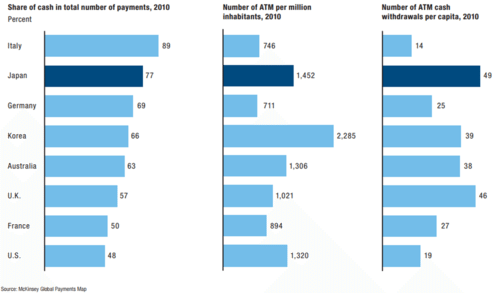

But cash in the economy is decreasing

Source: the Payments Council

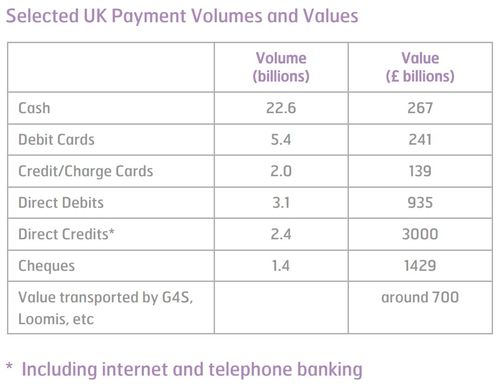

And is primarily used for small value transactions

Source: the Payments Council

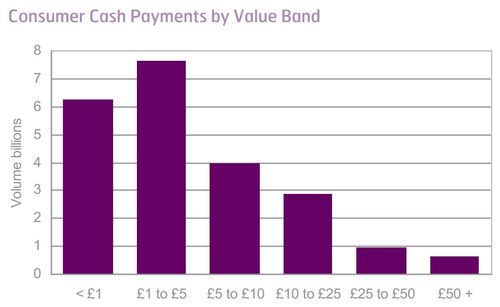

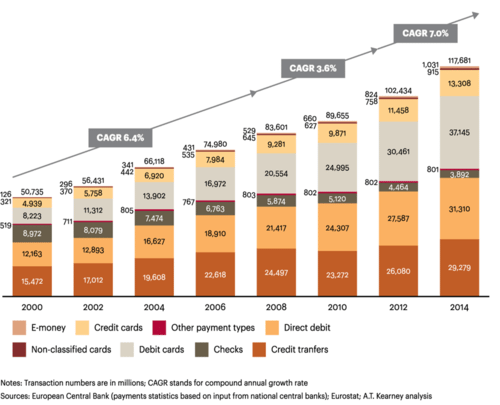

This is because electronic payments are taking off

Source: ATKearney

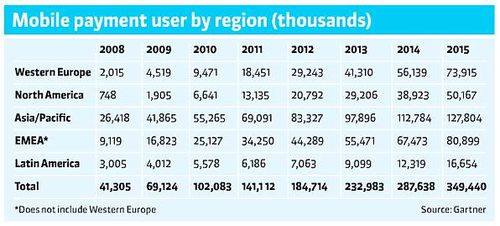

And now contactless and mobile payments are attacking that small value domain.

So cash disappears and is replaced by electronic, digitised transactions.

So money in the form of cash is less meaningful and that

regular old nugget used in many presentations about the gangster Willie Sutton, who was asked: “why do you rob banks”, and he answered: “because that’s where the money is”, is so last century.

Sure, Sutton is right, but he robbed banks physically, taking the cash out at gunpoint rather than by cashpoint.

Today, the gangsters take the money out byte by byte.

Money is meaningless because the data is meaningful.

It’s the data that gangsters need to rob, not the money.

Data is where it’s at.

That’s why the majority of cyberattacks target financial institutions.

According to RSA’s December 2012 Online Fraud Report, 284 brands were targeted in phishing attacks during November 2012, marking a 6% decrease from October. Of the 284 brands attacked 45% endured 5 attacks or less. Banks continue to be the most targeted by phishing, experienced nearly 80% of all attack volumes.

Sophos regularly report details of bank cyberattacks. Here’s the headlines from just the last three months:

- Leading US banks targeted in DDoS attacks

- US senator blames Iran for cyber attacks on banks

- HSBC recovers from DDoS attack, after internet banking services disrupted

- Fake Apple invoices lead to Blackhole exploit kit that drains your bank account

- Unmasked! Alleged mastermind of "Project Blitzkrieg" online attack plot against US banks

- US-wanted "bank hacker" is all smiles as he is arrested at Bangkok airport

- US woman arrested for bank robbery brags on YouTube about robbing a bank

And McAfee Labs researchers recently debated the leading threats for the coming year and show that it’s only going to get worse:

- Mobile worms on victims’ machines that buy malicious apps and steal via tap-and-pay NFC

- Malware that blocks security updates to mobile phones

- Mobile phone ransomware “kits” that allow criminals without programming skills to extort payments

- Covert and persistent attacks deep within and beneath Windows

- Rapid development of ways to attack Windows 8 and HTML5

- Large-scale attacks like Stuxnet that attempt to destroy infrastructure, rather than make money

- A further narrowing of Zeus-like targeted attacks using the Citadel Trojan, making it very difficult for security products to counter

- Malware that renews a connection even after a botnet has been taken down, allowing infections to grow again

- The “snowshoe” spamming of legitimate products from many IP addresses, spreading out the sources and keeping the unwelcome messages flowing

- SMS spam from infected phones. What’s your mother trying to sell you now?

- “Hacking as a Service”: Anonymous sellers and buyers in underground forums exchange malware kits and development services for money

- The decline of online hacktivists Anonymous, to be replaced by more politically committed or extremist groups

- Nation states and armies will be more frequent sources and victims of cyberthreats

So when we talk about our wonderful new internet age, the key is to realise that it’s the data where the money is, not the bank, the branch or the cash machine.

Or that’s my take on it anyway.

And if data is meaningful, then we could start a lengthy chat about Big Data and such like … but that’s far too overhyped for a discussion on the blog today, as I’ve had this debate so many times in the past. See these blog entries if you want more:

- I just met Big Data;

- Banks don’t need big data, just PFM;

- Data is a currency … we just haven’t realised its value yet;

- Data is a currency ... just like salt;

- Money is meaningless, as data is now key;

- The battle over information, and how information warfare is the new game;

- The fact that banks should move from being safekeepers of money to beingsafekeepers of data;

- Why banks should worry about Google, Apple, Facebook, and how these guys do data management better than banks;

- The fact that banks need to radically shake up and wake up to the data challenge; and

- How Amazon would organise itself as a bank, in terms of how bank silos inhibit their competitiveness.

So, for now, I’ll move on to talk about why capitalism is dead.

Oh, that’s tomorrow …

This is part two of a three part series:

- Part One: Mobile is not important;

- Part Two: Money is meaningless; and

- Part Three: Capitalism is Dead

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...