Just to mop up the final discussions at the White House #FinTech summit, there was a fourth panel on financial inclusion. This panel comprised, from left to right:

Gayle Smith, Administrator, USAID; Jo Ann Barefoot, Senior Fellow, Mossovar-Rahmani Center for Business & Government, Harvard Kennedy School; Greta Bull, CEO, CGAP (Consultative Group to Assist the Poor); Ryan Falvey, Managing Director, Financial Solutions Lab, Center for Financial Services Innovation; Franz Paasche, VP, Corporate Affairs and Communications, PayPal; and Vikas Raj, Director of Investments, Accion Ventures Lab

This was also an interesting panel with Franz from PayPal noting that “the best way to shut down corruption is to digitalise cash”. This is so true. Vikas built on this by recognising that mobile services like Easypaisa in Pakistan and M-Paisa in Afghanistan move money straight from government accounts to the account of the target user. This is a very powerful driver as the user is in control and the middleman which, in several economies is a corruptive influence, is avoided or ignored. That is a key. As Greta noted making “customers feel empowered and in control is a key, which is what drove M-Pesa” in Kenya.

The panel went on to talk about blockchain for identity. Combine blockchain digital identities, based upon a mobile biometric fingerprint or eyeball, with a mobile wallet that has interoperability and standards, and you have a transformational moment. You can see this in Tanzania, where operators are building the rule book, and you can then see a near-term future arising out of Africa where a cheap mobile identity scheme takes over the world (as blogged about the other week).

This cheap and easy digital identity program is actually being pioneered by India where Aadhaar, the digital identity card rolled out by the Indian government to almost a billion people so far, has laid the bedrock for a mobile financial inclusion program that is truly transformational. Aadhaar has taken years to rollout – it’s not finished yet – but is the basis for the Universal Payments Interface (UPI) which allows any Indian to pay any other Indian via a mobile, cheaply and easily. The Unified Payments Interface (UPI) was launched in early April, and lets users use their mobile as a way to authenticate identity, essentially turning the phone into a debit card that can be used anywhere.

A few other discussions highlighted how government also has to compete with tech developments. For example, after the healthcare.gov disaster, US government has hired more techies and rock star developers from Silicon Valley than banks. Around 300 techies joined USDS after the Healthcare.gov disaster and the CFPB (Consumer Financial Protection Bureau) is one of the most technically advanced government departments, according to many.

In a separate discussion, Anjan Mukherjee, Counsellor to the Secretary of the US Department of Treasury, talked about cybersecurity and outlined that there are four pillars to the US government approach to cyber security

First, there is the Financial Services Information Sharing and Analysis Centre, which networks 7,000 banks and non-banks to share knowledge of their cyber defences. Second there is the NIST framework, which allows standardisation for cybersecurity to take place. Then there are lots of simulations of cyberattacks, run by various agencies and, finally, the Treasury proactively targets to shut down threats.

This work is important because a cyberattack on the financial system can have a ripple effect across the whole economy. That is why the G7 has a cyber working group, co-chaired by The Treasury and Bank of England, to develop a common cyber security framework of best practices that will be universally applicable to banks, financial institutions, FinTech and tech providers and more.

Roy L. Austin Junior, Deputy Assistant to the President for Urban Affairs, Justice and Opportunity, talked about civil rights and big data. This was intriguing as he mentioned the data about hate crimes in America. Roy noted that the department gets race crime data from 2014. It's out of date when they get it. It’s also probably not accurate. For example, in 2014, the data stated that there were 759 hate crimes in California. How many in Alabama? 9. In Mississippi? 1.

That doesn’t sound quite right, but that's the only data set the Department for Urban Affairs, Justice and Opportunity has to deal with. In an impassioned speech, Roy make clear that this has to change and that Big Data can make that change.

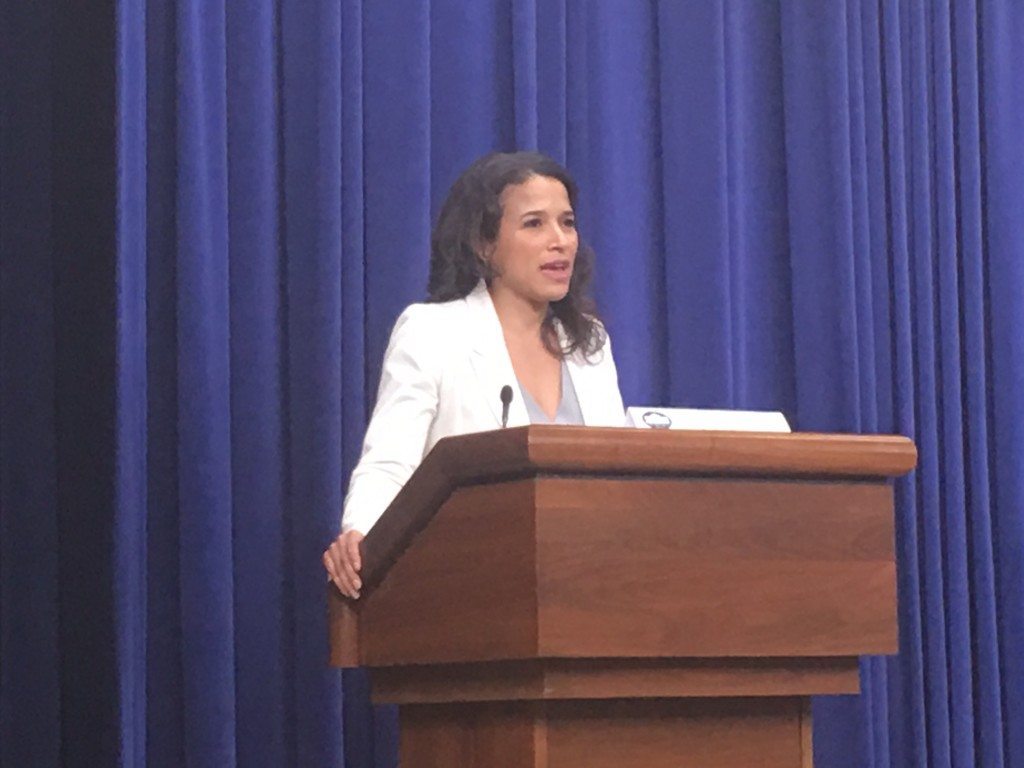

So there you go. A comprehensive update of the White House FinTech Summit, which I felt privileged to attend. The whole day was organised by the one and only Adrienne A. Harris, Special Assistant to the President for Economic Policy at the National Economic Council, and a good friend.

Adrienne also summarised the day in her blog, which I’ve copied here. Here’s to the next time. Cheers Adrienne.

Technology is changing the way consumers relate to their finances, and the way institutions function in our financial system

Imagine a world in which your phone can help you make financial decisions, from small things like choosing which loyalty programs give you the most bang for your buck, to big things like comparing mortgages. Or one in which an app can make the lag time between earning money and actually receiving the money you earned virtually disappear so you don’t end up visiting a predatory payday lender. Imagine a time when, as a small business owner, you can accept payments online from all over the world in minutes. Or when you can send money to relatives back home instantly and automatically.

Technology has always been an integral part of financial services – from ATMs to securities trading platforms. But increasingly, technology isn’t just changing the financial services industry, it’s changing the way consumers and business owners relate to their finances, and the way institutions function in our financial system.

Today at the White House, we convened stakeholders from across the financial technology (fintech) ecosystem, including traditional financial services institutions, fintech start-ups, investors, thought leaders, and policy makers, to discuss how fintech can help advance critical economic policy priorities. From consumers’ financial health to growing and managing small businesses; from cybersecurity to helping developing nations prosper; and from big data to blockchain – we spent the day identifying those areas where partnership across industries and between the public and private sectors can help advance our financial well-being and economic prosperity.

Here are a few highlights from today’s event.

FinTech and the Government’s Role in Fostering an Environment for Innovation

The afternoon began with Secretary of Commerce Penny Pritzker moderating a panel focused on what government can do to help ensure that innovators – whether from large institutions or start-ups – have the capacity, resources, and room to create products, services, and businesses that ultimately advance our nation’s economic competitiveness. Similar to the Secretary’s conversations during her recent Open for Innovation event in New York, today’s panel highlighted how financial firms and start-ups are partnering with one another to create and scale innovation, as well as the important role of government in ensuring that these partnerships can reach their full potential.

FinTech and SMEs

The Small Business Administration and Treasury Department continued the afternoon’s conversation with a discussion about the intersection of fintech and small and medium business enterprises (SMEs). Small business is a vital part of the American economy, responsible for creating nearly two-thirds of net new jobs in the U.S. each year and employing more than half of all Americans. Despite their importance, however, small businesses historically enjoy less access to capital and other resources that can help entrepreneurs manage operations and grow their businesses. Building on Treasury’s recent report on marketplace lending, the panel discussed how innovations in financial services can help entrepreneurs to benefit from marketplace lending, payments processing systems that assist with accounting and inventory management, or fraud protection and cybersecurity products that help protect the business and its customers.

Big Data and Civil Rights

Last month, the White House published a follow-up Big Data report on the intersection of big data and civil rights. As outlined in the report, financial data can help prevent fraud, assist consumers with managing their financial lives, and prompt access to credit for underserved populations. But these opportunities also come with risks for consumers, including risks to privacy and civil rights. During today’s Summit, Roy Austin, Deputy Assistant to the President for Urban Affairs, Justice, and Opportunity, spoke about the report’s recommendations and how fintech can use big data to advance both civil rights and opportunity.

FinTech and Financial Health

Jason Furman, Chair of the Council of Economic Advisors (CEA), moderated a panel on the intersection of fintech, financial inclusion, and financial health. This panel touched on the importance of access to basic financial services, and explored how new financial tools and services can help consumers make smart decisions about their finances, and ultimately improve their financial lives and overall well-being. As the number of financial products and services increase, and as our financial lives become more complicated, it’s imperative that consumers can find and use the tools they need to achieve their objectives. Whether you’re a recent graduate thinking about the best way to pay down your student debt while saving for the future, a young professional preparing to buy your first home, or a retiree wondering how to draw down the money you’ve worked hard to save, financial health is an issue that impacts all of us, regardless of demographics. You can learn more about this important topic in the issue brief CEA published today.

FinTech and Development

Finally, US Agency for International Development Administrator Gayle Smith capped off the day with a conversation about how fintech is becoming an increasingly potent enabler of development goals, in particular in countries overseas where innovations such as mobile phone-based payment systems are making vulnerable communities more resilient, allowing governments to operate more transparently, and underpinning new business models so that households living beyond the electricity grids in East Africa can access clean energy for the first time and Indian villages can develop sustainable water systems. To ensure these fintech innovations drive systemic improvements and support broad-based economic growth, the panel identified the need for the public and private sectors to align around a common vision and work together to lay the foundations for modern, inclusive economies.

These are just a few of the highlights from today’s discussion. We look forward to continuing our engagement with stakeholders about how best to harness fintech to improve financial well-being and promote economic prosperity.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...