Having spent much of the weekend absorbing the European bank stress test results, I’ve got to ask why they bothered.

OK, so it was to get bank share prices up, but the whole thing was just a typical European sham where every country does things in a different way, with the whole thing designed to cover up the real weaknesses in the European banking system.

Bearing in mind that the stress tests were called to shore up confidence in the system due to the concerns in the markets over a sovereign default in Greece or Spain, the fact that the tests left out that particular scenario is ridiculous.

In case you didn’t catch it, the tests looked at a double dip recession and a sovereign debt shock, but purely based upon debt that banks were trading, not debt that banks had in their vaults.

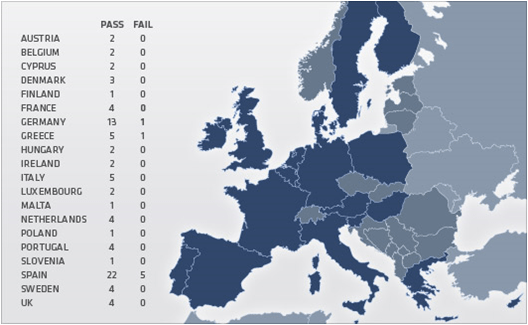

Now I blogged a while back about the fact that Europe’s banks held over $1 trillion in debt to just Greece and Spain (double click picture to enlarge):

With sovereign debt trading on the bank's books worth about a tenth of their total exposure, that means that around $900 billion of potential sovereign debt has been ignored. How this can be ignored is beyond me.

Secondly, the tests ignore any liquidity risk issues, and just looked at market and credit risks. Why?

This crisis started with liquidity risk when interbank lending dried up, and then exploded when sovereign debt became a major concern. The fact that CEBS left out these two clearly important dimensions just seems silly.

But then it is purely a politically motivated exercise to try to stop the haemorrhaging of confidence in the European system.

Now, I actually went to the press briefing on Friday night – a time chosen to ensure that markets could not react immediately to this sham – and saw the baying hounds of the media looking totally incredulous as the headlines were announced.

“We have seven bank failures that, between them, in the most adverse scenario would need €3.5 billion of new capital.”

I’m sorry, but that’s nuts.

When the Americans did their stress tests, half their banks failed and they needed $75 billion of new capital. So how come, in the worst of situations, our banks would only need €3.5 billion and fewer than 10% fail?

Because it’s a fix.

It’s fixed because each country interpreted the stress test conditions for unemployment and house prices and other economic conditions in their own way.

It's fixed because each regulator and central bank applied the test conditions against their bank's balance sheets in dfferent ways.

And it’s fixed by leaving out the sovereign debt exposures and potential defaults on the bank’s books.

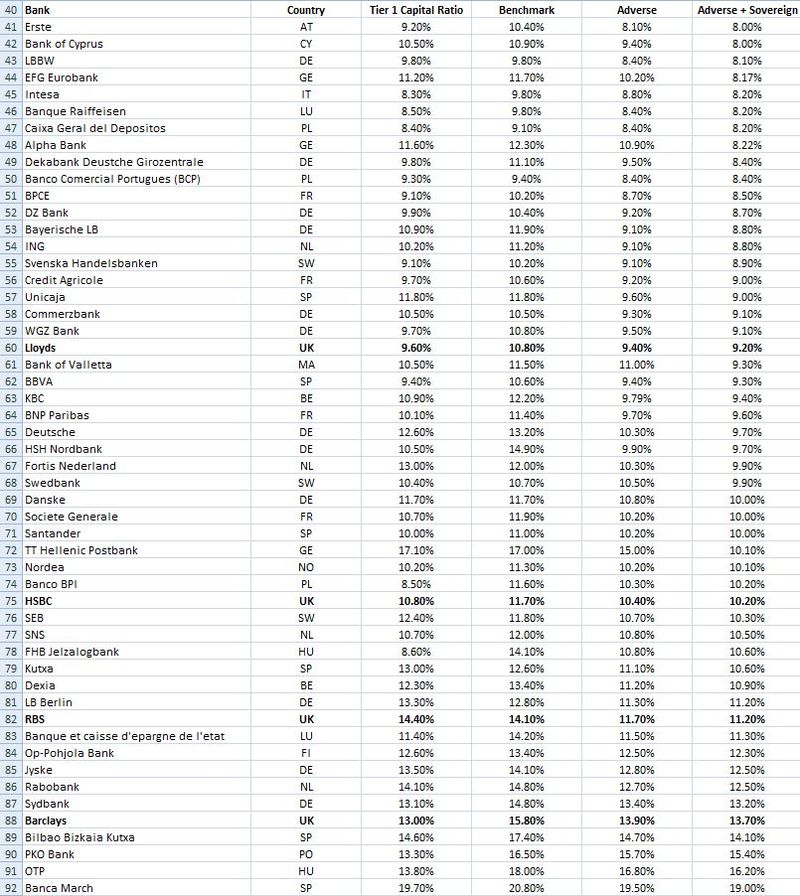

Nevertheless, something useful did come out of it: data.

There's lots of data about the state of the bank's balance sheets released by CEBS that can now be analysed by the markets, rather than the fudge that the regulators applied.

Therefore, with the reservations stated above, I went through the numbers over the weekend and found an interesting result.

First, a little explanation of the numbers.

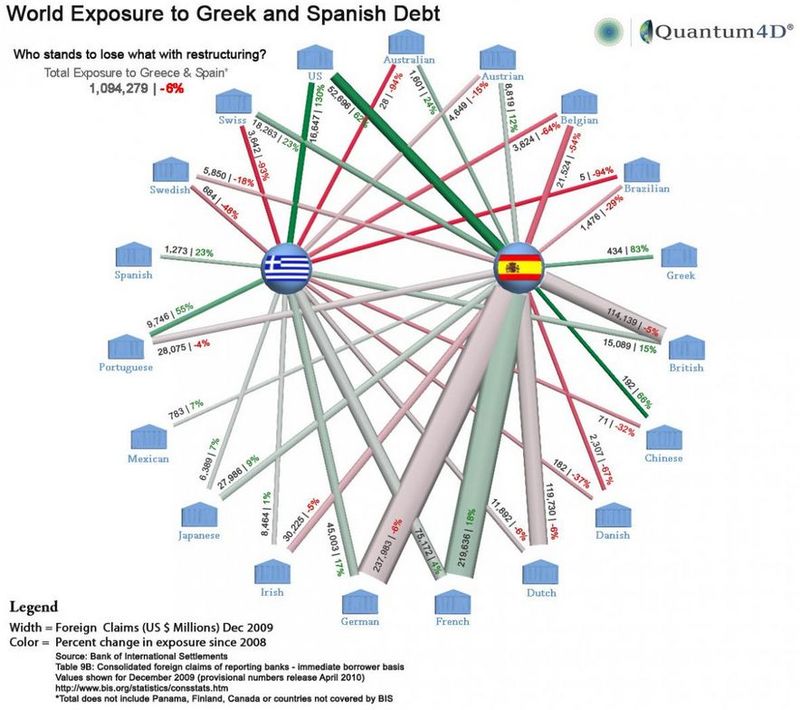

The tests are based upon three scenarios.

Scenario 1 is the benchmark, which is based upon the current ECB forecasts for macroeconomic developments across the European Union.

Scenario 2 is then based upon a double dip recession, which sees no growth in 2010 and a 0.4% downturn in GDP in the European Union in 2011, versus 1% in 2010 and 1.7% forecasted in the benchmark.

Scenario 3 studies the impact of a sovereign debt shock to the European Union on top of this recession, and is geared towards higher debt losses and impairments in the PIGS – Portugal, Ireland, Italy, Greece and Spain – than in other countries.

This does not assume a sovereign default, just corporate debt and sovereign debt on the trading books of the banks. That’s about 10% of the total exposure for the banks, should a country default.

In the CEBS tests, they looked at Tier 1 Capital Ratio – not core capital, just Tier 1 capital – and said that the ratio should not fall under 6%. Under the EU Capital Requirements Directive, as it stands uncorrected since this crisis hit, the lowest level by law is 4%. Meanwhile, the likelihood is that a minimum 8% Tier 1 Capital will be required in the future and, in this context, is a far better ratio to apply.

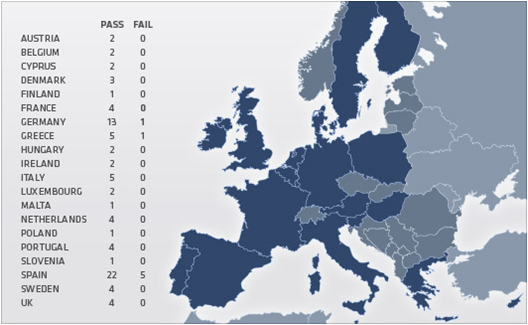

For example, based upon the CEBS view of the world, using the combined worst case of a double dip recession and a sovereign debt shock, they find seven banks would fall under the 6% Tier 1 Capital Ratio level: five in Spain, one in Germany and one in Greece.

Looking at the numbers using an 8% Tier 1 Capital Levels - a level that is rumoured to be required under revised terms for EU bank trading in the future - 39 banks would fail in the worst case scenario: one in Austria, one in Cyprus, five in Germany, three in Greece, two in Ireland, four in Italy, one in Portugal, one in Slovenia and twenty one in Spain.

Figure 1: 8% Tier 1 Capital Measures Failed by 39 Banks (double click image to enlarge)

Figure 2: Banks that Pass the 8% test (double click image to enlarge)

That would have been a far more realistic number to have announced and, based upon the fragmented application and interpretation of the tests by member states, is probably more likely to be the worst case scenario than the seven bank fails CEBS announced last Friday.

NOTE: failure does not means the banks are insolvent just undercapitalised, and so this would have been a much better way for CEBS, the ECB and the European Commission to have achieved some credibility from this exercise.

Skinner Says Stress Test Methods 'Pretty Weak' - Washington Post

Bloomberg appearance, 26th July 2010 from Chris Skinner on Vimeo.

Meanwhile, if you’re interested, here are the CEBS documents related to the stress tests:

- CEBS Press release (pdf)

- Summary report (pdf)

- Q & As (pdf)

- Joint Press Release CEBS, ECB, European Commission (pdf)

- Summary of the 91 bank-by-bank results, by country (pdf 5MB)

And a few of the more interesting tidbits that I picked up when looking at the background to these tests:

“According to a survey by Goldman Sachs, 10 of the 91 banks subjected to the stress tests are expected to fail. The poll of 376 respondents, shows that European banks are expected on average to raise £40.6bn in extra capital following the tests.” Money Marketing

“Hypo Real Estate’s Tier 1 capital ratio was 7.7 percent at the end of March, according to a presentation on its website dated June 2010. The lender said in May that it holds 72.1 billion euros ($93.4 billion) of debt in Greece, Italy and Spain, among the highest held by a bank in Europe, according to data compiled by Bloomberg ... Germany’s Soffin bank-rescue fund had provided Hypo Real Estate with 7.87 billion euros in funds by the end of March. The bank has said it may require a total of 10 billion euros from the fund. The lender said on July 8 that it received approval to establish a so-called bad bank to transfer as much as 210 billion euros of investments consisting of ‘non-strategic assets and risk positions.’ The amount represents more than half of Hypo Real Estate’s total assets at the end of 2009.” Bloomberg

“According to CEBS, the other German lenders tested are Deutsche Bank AG, Commerzbank AG, Deutsche Postbank AG, Landesbank Baden-Wuerttemberg, Bayerische Landesbank, Norddeutsche Landesbank Girozentrale, WestLB AG, HSH Nordbank AG, Landesbank Hessen-Thueringen Girozentrale, Landesbank Berlin AG, DZ Bank AG, WGZ Bank AG and DekaBank Deutsche Girozentrale ... Among the banks on the list above, we note that e.g. Commerzbank has leverage of roughly 150:1 (tangible assets divided by tangible common equity), Landesbank Berlin has leverage of 75:1, WestLB 68:1 and Deutsche Bank 56:1. For the sake of comparison, by the time of its demise, Lehman Brothers is said to have been leveraged about 30:1. How can any of these banks not be de facto insolvent? If they hold any PIIGS bonds at all (and some of them do, in spades – e.g. 468% of Commerzbank's tangible book value was invested in PIIGS bonds as of about six weeks ago), it is a near mathematical certainty that they are.” Pater Tenebrarum

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...