You may or may not know Cornerstone Advisors. If you don’t, you are missing out on major news! They are my favourite bank consulting service in the USA ever since I subscribed to their newsletter Gonzo Banker, years ago. They also have two of my favourite people in the banking world on their staff: Ron Shevlin, the Snark Machine, and Mary Wisniewski, the Fintech Icon.

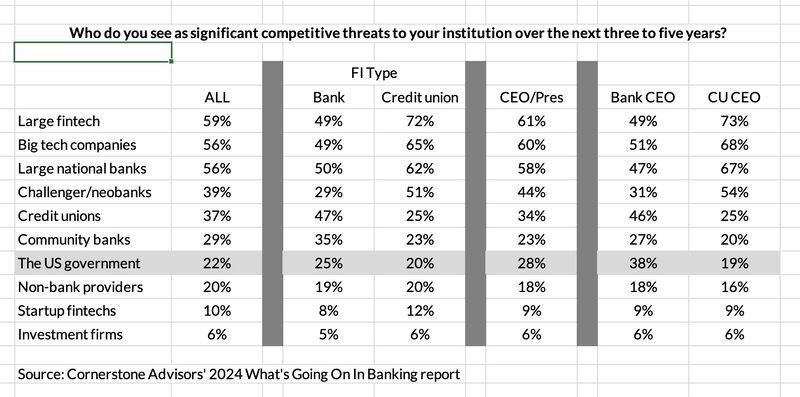

They are always publishing fascinating research articles and I absorb much of their info into my portfolio and presentations. The latest is a report about competition in banking. Ron writes this report after surveying American banks and credit unions, and he notes that big fintech firms like PayPal and Square/Block were the most frequently cited significant threat in 2022 and 2023 but, this year, he introduced a new competitor: the US government.

It’s an interesting report. Here’s part of the introduction:

The crisis of 2023 may be abating, but the banking industry is still in the throes of the “Crisis of the ’20s,” a crisis that will last the entire decade. This crisis touches banks’ products, technologies, people, processes and the political climate.

Here are five elements of the Banking Crisis of the ’20s:

1) Checking accounts ain’t what they used to be. In the first half of 2023, nearly half of the “checking accounts” opened in the United States were opened by digital banks and fintechs.

I put quotes around checking accounts because bankers don’t see offerings from companies like PayPal and Square as checking accounts. Young consumers, however, don’t know the difference between a checking account and the Square Cash App account or PayPal payment account. They all enable consumers to make payments. Square’s and PayPal’s products, however, enable consumers to do a range of activities that would require them to open multiple accounts at banks.

In addition, banks have learned—or are learning—that the checking account isn’t the anchor product (for a broader relationship) they once thought it was. Without reinventing their product set, banks won’t survive the Crisis of the ’20s.

2) Zombie cores. A person’s core has to be in shape, and so does a bank’s. Getting their core systems into shape has become either a nightmare or an impossibility for banks. The bank technology landscape is littered with what Cornerstone Advisors call “zombie cores”—core apps that haven’t been sunsetted but are no longer supported or enhanced by the tech companies that provide them.

Banks have two options throughout the rest of this decade: core replacement or core modernization. Neither option is cheap, and neither option is fast. The good news for banks is that this situation has given rise to a new category of tech firms—let’s call them core integration platforms—promising to make it easier to integrate ancillary systems to existing cores and create a strategy for core replacement.

3) The people shortage. Core integration platforms are a good thing for banks, but the new reality is that banks will still need people to put things together. The (midsize) bank or credit union IT department has evolved from being a builder to a vendor management team and will evolve further in this decade to become an integration team.

Finding these people—and others who bring expertise in technologies like machine learning, conversational AI and generative AI—will be the number one challenge for banks throughout the rest of the decade. The amount of work and positions that will need to be outsourced or partnered for means the typical bank may find that nearly half of the people working “with the bank” don’t work “for the bank”—or even “at the bank.”

4) The creativity imperative. Every management fad has a life cycle, and the innovation fad is on its last legs.

For the past five years or so, banks have obsessed over “innovating.” Other than an ad hoc innovation team led by someone with a lofty chief innovation officer title, few banks have truly created any innovations.

That isn’t to say that they haven’t made a lot of internal changes and improvements, but many of these efforts don’t live up to the innovation label. Banks need to stop playing innovation charades. With the influx of new technologies, the challenge isn’t “innovation” but “creativity”—how can they, at an organizational level, make more creative use of data and technology than their competitors, and how can they help their people become more creative in getting their jobs done.

An unforeseen (by most people) development in 2023 was the industry’s infatuation with generative AI and specifically ChatGPT, which was introduced at the end of November 2022. These technologies will have a huge role to play in helping financial institutions become more creative.

I’m not convinced, however, that most financial services executives really know what generative AI is (and isn’t). We’ll have a lot more to say about generative AI—and AI technologies, in general—later in the report.

5) The political element. For some politicians (you know who they are), banks are the scapegoats for society’s ills. Increased regulations from a bank-unfriendly government works against all the things banks need to do the survive and thrive in the Crisis of the ’20s.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...