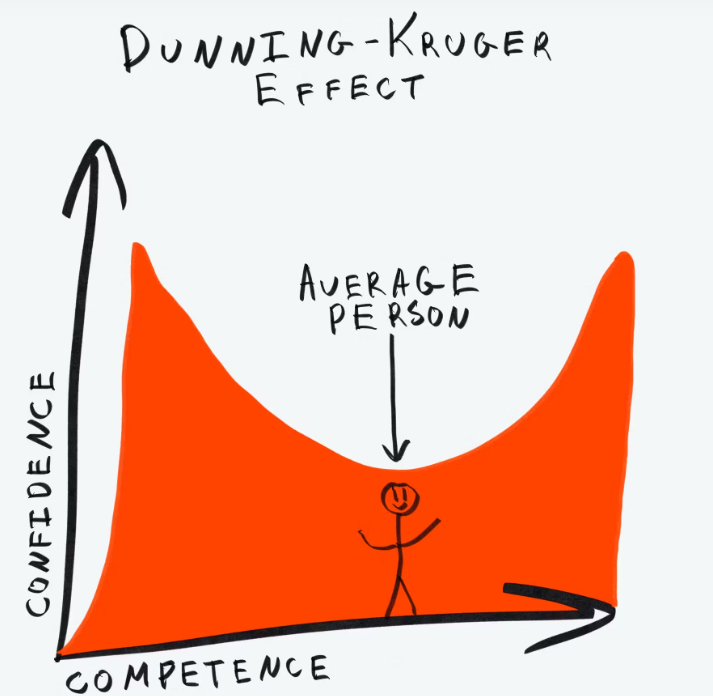

I had never heard of the Dunning-Kruger effect until the other day. Inspired by a bank robbery, Professor David Dunning worked out that people sit at opposite ends of a spectrum of confidence. Some are hugely confident and competent whilst, at the other end of the spectrum, they are hugely confident but completely incompetent.

How could a bank robbery inspire this?

Well, two guys decided to rob banks in Pittsburgh but, rather than making themselves disguised or wear masks, they just covered their faces in lemon juice,. This is because lemon juice is the way you make invisible ink become visible and so, if you wear lemon juice, you become invisible.

It’s an incredible story and here it is in its entirety as told by Wikipedia.

On January 6, 1995, McArthur Wheeler and Clifton Earl Johnson robbed two Greater Pittsburgh banks at gunpoint without attempts to disguise themselves. Instead, they had covered their faces in lemon juice, believing it would make them invisible to security cameras. Johnson was arrested a few days later, while Wheeler was apprehended in April after being identified in surveillance photographs. Both received multi-year jail sentences.

The robberies directly inspired the research of the Dunning–Kruger effect, which describes that people with little ability in a given field can believe they excel in it for some reason (take note Donald Trump).

So, what happened?

On January 6, 1995, McArthur Wheeler and Clifton Earl Johnson robbed two banks in the Greater Pittsburgh area at gunpoint. At 2:47 p.m., at the Swissvale branch of Mellon Bank, one of them stuck up the teller with a semi-automatic handgun while the other waited in line. They left together after obtaining US$5,200 (equivalent to $9,987 in 2022). The other robbery took place at Fidelity Savings Bank in Brighton Heights.

Neither robber wore a mask or otherwise attempted to disguise, and they had instead applied lemon juice to their faces. According to Wheeler, Johnson had told him lemon juice would make one invisible to security cameras, akin to how it functions as invisible ink. Although initially sceptical, Wheeler had tested this method by covering his face with lemon juice and capturing an image of it with a Polaroid camera. As he was missing from the resulting photograph, he trusted the method to be effective. Detectives believed his absence in the image was caused either by a bad film, a maladjusted camera, or Wheeler having unintentionally pointed the camera away from his face.

Johnson was arrested on January 12. A surveillance photograph of Wheeler was broadcast as part of a Pittsburgh Crime Stoppers segment with the 11:00 p.m. news on April 19. Anonymous tips subsequently led to Wheeler's arrest at 12:10 a.m. on April 20, less than an hour after the broadcast. When shown the photographs in which he had been identified, Wheeler was shocked and exclaimed “But I wore the lemon juice. I wore the lemon juice.” Johnson pleaded guilty to the heist at Mellon Bank as well as two unrelated robberies from 1994. He testified against Wheeler and was given a five-year prison sentence on October 27. Judge Gary L. Lancaster sentenced Wheeler to over 24 years in prison, followed by three years of probation, on January 5, 1996, for the Swissvale stickup. Charges for the Brighton Heights case were dropped.

A brief account of the robberies was included in the 1996 edition of The World Almanac. David Dunning, a professor of social psychology at Cornell University, discovered this story and subsequently a longer article about the case in the Pittsburgh Post-Gazette. He came to believe that “If Wheeler was too stupid to be a bank robber, perhaps he was also too stupid to know that he was too stupid to be a bank robber — that is, his stupidity protected him from an awareness of his own stupidity.” With his graduate student Justin Kruger, he organized a research program to determine whether someone's perceived competence could be measured against their actual competence. They authored the 1999 paper “Unskilled and Unaware of It: How Difficulties in Recognizing One's Own Incompetence Lead to Inflated Self-Assessments”, in which they found that “when people are incompetent in the strategies they adopt to achieve success and satisfaction, they suffer a dual burden: Not only do they reach erroneous conclusions and make unfortunate choices, but their incompetence robs them of the ability to realize it. Instead, like Mr. Wheeler, they are left with the mistaken impression that they are doing just fine.” This became known as the Dunning–Kruger effect.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...