I’ve covered in-depth views on FinTech in Africa, the Middle East (or is that West Asia?), Asia, Latin America and more, but feel that I skipped over India where the only in-depth views I’ve shared has been about PayTM. So, this time, it’s India’s turn.

According to Ernst & Young – or is it just EY these days? – the Indian FinTech market is expected to reach $1 trillion in assets under management (AUM) and $200 billion in revenue by 2030.

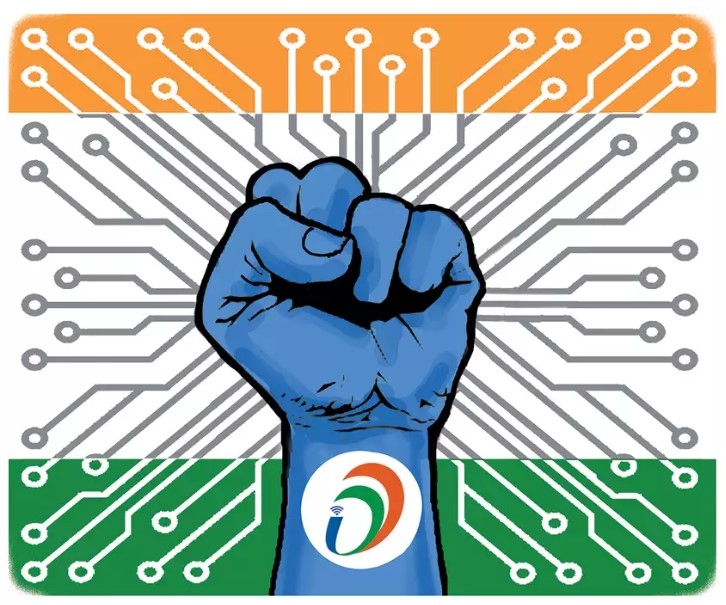

The growth of Indian FinTech is underpinned by a bunch of nurturing initiatives undertaken by the government and concerned regulators, a buoyed funding environment and strengthening VC ecosystem, undeniably massive demographic opportunities, high FinTech adoption, and access to technology and talent for the entrepreneurs building for the new India.

During 2021, the Indian FinTech market saw an investment of $8 billion, producing over 15 FinTech unicorns during the year. There are more than 6,636 fintech startups in India where the industry has a market size of $50 billion in 2021, and estimated to reach $150 billion by 2025. India’s fintech industry is expected to grow at a CAGR of 20% to reach a transaction value of $138 billion in 2023.

This is enabled by the India Stack, the government-backed initiative to create digital identities (Aadhar) and payments (Unified Payments Interface, UPI). I’ve covered those before, and see a really fertile country for innovative FinTech growth.

For example, UPI is a key force behind the FinTech revolution in India. UPI has over 338 banks registered and recorded more than 6.28 billion transactions in July 2022 worth 10.62 lakh crore (around USD$150 billion).

Having said that, the regulator and government represented by the Reserve Bank of India (RBI) have recently cracked down on many start-ups for their foreign investors and loose behaviours. Techcrunch points out:

The Reserve Bank of India has informed dozens of fintech startups that it is barring the practice of loading non-bank prepaid payment instruments (PPIs) — prepaid cards, for instance — using credit lines, in a move that has prompted panic among many fintech startups and caused some to compare the decision to China’s crackdown on financial services firm last year.

Several startups including Slice, Jupiter, Uni and KreditBee have long used the PPI licenses to issue cards and then equip them with credit lines. Fintechs typically partner with banks to issue cards and then tie up with non-banking financial institutions or use their own NBFC unit to offer credit lines to consumers.

The central bank’s notice, which doesn’t identify any startup by name, is widely thought to be impacting just about everyone including buy now, pay later firms that also use a similar mechanic to offer loans to customers. Amazon Pay, Paytm Postpaid and Ola Money are cautious, too, because many believe that they might be impacted as well.

Note that Techcrunch mention Amazon, but over-looked Google. Both Amazon and Google have invested big time in the Indian start-up and payments system.

Amazon Pay India’s operating revenue grew 16.6% to Rs 2,000 crore (USD$500 million) in 2022 from Rs 1,716 crore ($430 million) in 2021. They are also investing in domestic FinTech firms like Smallcase.

Google Pay is also one of the leading payment systems in India – although about half the size of PayTM’s volumes – and is also investing in start-ups like Progcap, which provides corporate-led financing solutions for small and mid-size businesses (SMBs).

Just to build on this a little bit, if you look at the stats of the UPI transaction volumes for November, then PayTM leads (see Digital Human for an interview with their founder, Vijay Shekhar Sharma), closely followed by Amazon, Google and PhonePe.

But it’s not just payments where India’s FinTechs are making a difference. They are also making a difference in access to banking services, savings, investments and lending. As Bain’s report on Indian FinTech cites, they are leading in areas such as Lending, WealthTech, InsurTech, Neobanking and infrastructure. More importantly, there is a very specific focus on bridging the urban to rural divide to ensure financial inclusion for India’s unbanked, underbanked, and digitally uneducated populations.

All in all, India – like China – represents the real revolution technology brings to financial services. I said this twenty years ago about India and China in what, looking back, were pretty visionary columns, and I still say it today. The Southern Hemisphere, the South Americas, Africa, Asia and, specifically China with Alipay, PingAn and Tencent and India with PayTM, Amazon and Google are leading the future structures of our world.

Meantime, other notable Indian FinTech start-ups include:

Arthan Finance ARTH (India): Arthan Finance is a new age LendingTech that endeavours to transform Small Businesses through AI & Deep Learning based customized "Fit to Purpose" financial products.

BankSathi (India): BankSathi is a new edge digital advisory platform that enables financial advisers to develop their digital presence and begin selling financial goods online.

Bimaplan (India): Bimaplan’s embedded insurance platform enables partners to seamlessly provide multiple insurance policies at the click of a button to their customers and deliver an enriched customer experience.

Biz2X India (India): Biz2X is helping banks run their lending operations at scale with enhanced loan management, servicing, risk analytics and a configurable customer journey.

CASHe (India): CASHe is a credit-enabled financial technology platform that offers a wide range of consumer lending products and services including personal loans, BNPL, Credit Line, payments and transfer facilities to salaried millennials using its proprietary credit rating algorithm.

Cashfree Payments (India): Cashfree Payments enables businesses in India with payment collections, vendor payouts, wage payouts, instant loan disbursements, e-commerce refunds, insurance claims processing, expense reimbursements, loyalty, and rewards payments.

CredAble (India): CredAble is India's largest working capital tech platform, catering to the working capital requirements of India Inc. that includes large, mid, emerging corporates, MSMEs, and financial institutions.

Decentro (India): Decentro is a full-stack API banking platform where one can select desired modules, integrate in the sandbox, and launch their product within a couple of weeks.

Financepeer (India): Financepeer specializes in education fee financing that enables educational institutes to manage their funds efficiently by paying student’s entire year's fees up front while the parents get the option to pay back in easy EMIs.

Fintso (India): Fintso is a full-stack wealthtech platform focused on giving access to retail investors, especially the NeXT Billion, by enabling Independent Financial Product Providers (IFPPs) with access to financial products, digital execution, and robo-advisory support.

Finverv (India): Finverv is a SaaS-enabled platform that helps companies embed credit in their ecosystem through a simple plug-and-play design, and in turn, diversifies the credit portfolio of lending institutions.

GroMo (India): GroMo offers a single app to their partners so that they can recommend the right financial products to customers. GroMo is empowering lakhs of micro-entrepreneurs, helping them make a good income by referring financial products in their network.

InsuranceDekho (India): InsuranceDekho is an online platform that lets customers compare insurance quotes from top-rated insurance companies and purchase the insurance policy that best suits their needs.

KYC Hub (India): KYC Hub offers an integrated platform to automate anti money laundering compliance and customer due diligence with AI and data insights. Their AML transaction solution offers PEP and sanctions screening, blacklist screening, and customer profiling features.

Multipl (India): Multipl offers a unique “Save Now, Pay Later” app through which users can save up for their upcoming expenses. They get returns from the market and from leading brands to accomplish goals debt free and at the lowest cost.

New Street Technologies (India): New Street Technologies’ flagship product MiFiX (Multi-interface Financial eXchange) for the BFSI sector is a pioneering blockchain based ecosystem that connects banks, NBFCs and other FIs seamlessly with their customers, business correspondents, and other stakeholders to manage a range of services including origination, KYC, Credit Bureau Referencing, underwriting, documentation, account opening, disbursements, collections, reconciliation, reporting, billing & settlement.

Progcap (India): Progcap is revolutionising the way financial access is delivered to underserved segments of the Indian retail economy. It uses technology and its unique delivery model to underwrite credit and provide under-banked semi-urban and rural retailers access to flexible, collateral free working capital.

Revfin (India): Revfin is a digital lending platform to make loans convenient and accessible to financially excluded individuals. Its lending platform combines traditional underwriting methods with innovative techniques like biometrics, psychometrics and gamification.

Rupifi (India): Rupifi powers B2B transactions for SMEs. It is India’s first Embedded Finance company which operates in the B2B Payments space through its B2B BNPL product.

product.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...