I was recently presenting in Brazil, and did a fair bit of research and networking about the FinTech scene there. The biggest story is Nubank, parent company Nu, the challenger bank that’s become one of the biggest and brightest in the world. Valued at close to $50 billion when they IPO’d in December 2021, the bank is a tremendous success story.

I loved this Forbes article that describes the background to the business. Started by a Colombian and a Brazilian, NuBank has become one of the most valuable banks in South America in just a few years, but how? When I went to Sao Paolo in the mid-2010s, I couldn’t imagine a FinTech disrupting banking as the regulators, government and banks seemed to work as a collegiate cartel. But then something happened. Knowing that NuBank could not disrupt banking, they attacked bank cards instead.

Here are the key paragraphs from Forbes:

Nubank rolled out its first product: a credit card. Nubank couldn’t start with bank accounts because it faced a high hurdle to getting a bank charter—a Brazilian constitutional provision barring foreign bank ownership. But it didn’t need a banking license to offer credit cards. Plus, Brazilian credit cards had sky-high interest rates, then running 200% to 400% a year, meaning customers would either have to pay off their cards in full each month or pay Nubank a small fortune. While Vélez aimed to make money primarily from interchange fees—the 5% of credit card sales merchants kick back to issuers and the banks—he wasn’t going to be shy about penalizing late payers with interest and fees.

Rather than burn scarce cash on marketing, Nubank used the “velvet rope” strategy common in Silicon Valley—at the start you had to be invited by a friend to apply for its credit card. Faux exclusivity aside, the appeal for Brazilians was obvious: Nubank charged no annual fee and handled applications entirely through its app. Those who qualified were notified within minutes, and the eye-catching purple credit cards arrived as soon as two days later. Plus, everything—from credit-line increase requests to bill paying and fraud reports—could be done through the app.

By contrast, almost all Brazilian banks charged annual fees for even basic credit cards—$20 the lowest. And that was just the start; the banks also charged monthly fees for everything from fraud protection to text-message alerts. In 2019, fees made up nearly 40% of Brazilian banks’ revenue, compared with 15% to 20% for banks in Mexico, Argentina, Peru and Chile, according to a JPMorgan analysis. The big banks are still resisting, but Nubank is putting those fat fees under tremendous pressure.

A great story and articulated brilliantly by Cristina Junqueria, Nubank’s cofounder …

… who is one of only two Brazilian women self-made billionaires.

The story is a great one of exploding the banking system from the outside-in ...

... and the key to the story is that Nubank targeted the soft unberbelly of banking – cards – and proved their capabilities such that, a couple of years later, they got a full banking licence and now offer services in Colombia and Mexico.

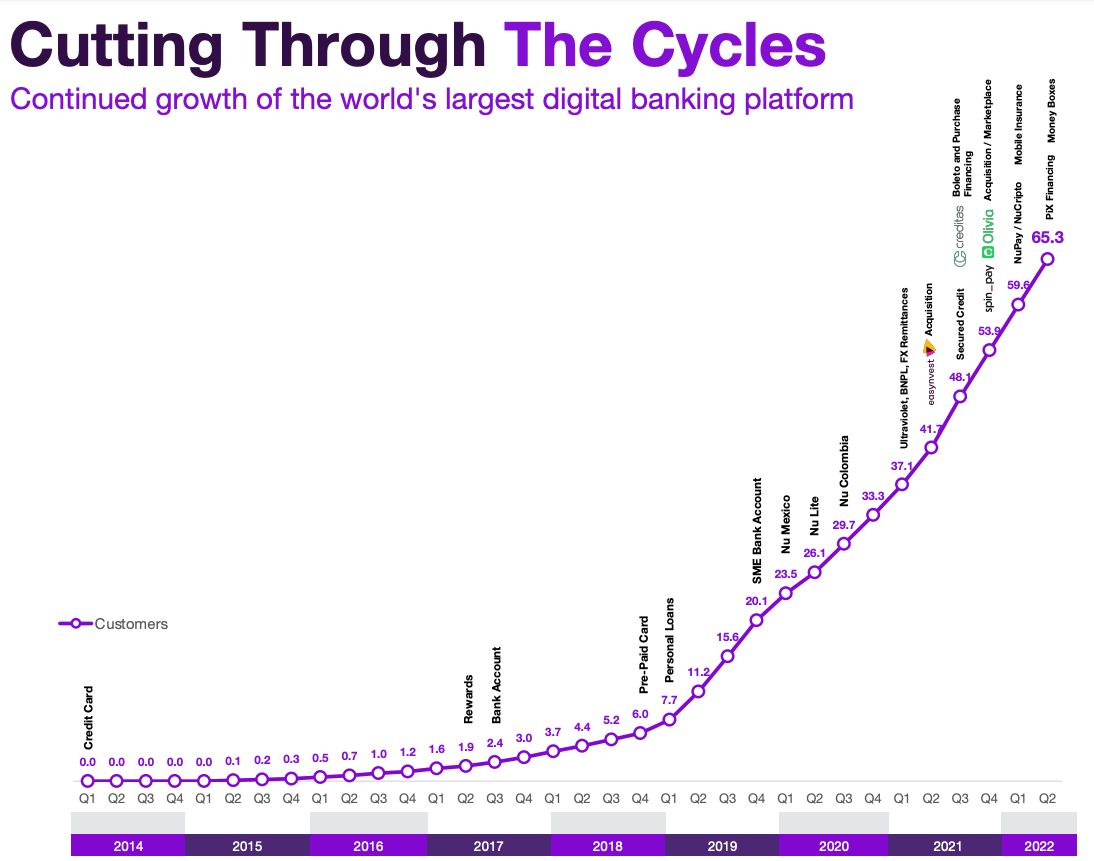

The results are also pretty stunning. In their latest Q2 2022 results, they show growth to over 65 million customers, more than 57 per cent more year-on-year, and are profitable. Here are the key take-aways:

- Customer Base Growth: Brazilian customers increased 51% YoY to 62.3 million, representing now 36% of the country’s adult population, with our SMEs customer base going up 150% YoY, growing to 2.0 million. This likely positions Nu as the fifth largest financial institution in Brazil in terms of numbers of customers. Purchase volume reached $20 billion in Q2´22, expanding 94% YoY FXN, placing Nu as the #4 cards player in Brazil this quarter (in terms of Purchase Volume).

- Engagement and activity rates: Average Revenue per Active Customer (ARPAC) expanded to $7.8, growing by 105% on a FX neutral basis. Activity rate hit a new historical-high mark growing to 80%. Nu has become the primary bank for over 55% of the monthly active customers that have been with Nu for over a year.

- Low-cost operating platform: Monthly Average Cost to Serve Per Active Customer reached $0.8, remaining flat YoY.

- Revenue: total revenue for Q2´22 reached a new record high of $1,2 billion, increasing 230% YoY, as Nu continues effectively upselling and cross-selling its expanding portfolio of financial products.

- Gross Profit: totalled $363.5 million in Q2´22, increasing 109% YoY. The gross profit margin was 31% in Q2´22.

- Multi-Product Platform: during the quarter, the core products - Credit Cards, NuConta and Personal Loans - reached 29 million, 45 million and 4 million active customers, respectively. Insurance, launched last year, has reached over 700,000 active customers, NuInvest has reached over 5 million active customers, and NuCripto reached 1 million customers in July 2022, only 3 weeks after launch.

- Profitability in Brazil: NuBrazil, the Company’s core market, achieved accounting net income in H1´22 of US$13.0 million, a major milestone. Profitability in core has enabled the company to reinvest in adjacent verticals in Brazil, while supporting expansion in Mexico and Colombia.

- International Expansion: Mexico is the company’s second largest market, where Nu’s customer base increased over six-fold YoY to 2.7 million. In Colombia, the company reached 314,000 customers to become the #1 issuer of new credit cards in both countries.

An amazing company with an amazing story, and huge respect to David Velez and Cristina Junqueria for changing the game.

Postscript: Nubank are not the only Brazilian gamechangers in FinTech.

Source: Tellimer

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...