Yesterday, I gave a presentation on the future of banking.

This is because I specialise in the future of banking.

When I say that I specialise in the future of banking, most people ask: “is there one?”

An awful lot of people think there is no future in banking but they are wrong.

Of course there is a future in banking … it’s just that no one knows what it is or what it looks like right now.

So here’s my way to clarify it.

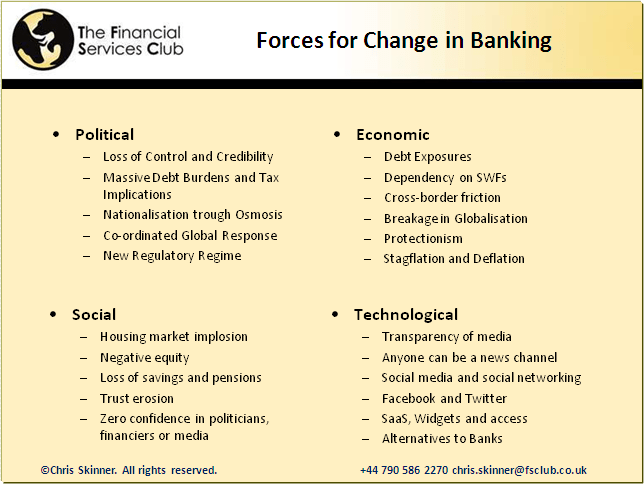

First, use Michael Porter’s forces of change, which we use extensively to model the future in one of the other companies I founded: Shaping Tomorrow. Michael Porter’s forces are based upon the key drivers of impact upon a company, which are Political, Economic, Social and Technological or PEST for short**.

What’s the PEST in banking, apart from regulators and politicians (ed: are these today’s pests)?

Reasonably obvious.

Politically, lawmakers are desperately trying to come up with ways and means to get some stability back into the system to restore confidence, control and credibility.

Economically, the seizure in lending and liquidity is driving down economies worldwide. Apart from major concerns related to protectionism and retrenchment, economists are tryig to figure out whether we are facing normality, stagflation, deflation, or something worse (ed: Reformation, Revolution, Armageddon?).

Society meanwhile has completely lost confidence and trust in bankers and policymakers. Therefore, they are postponing spending, with savings levels rising for the first time in years in many of the ‘borrowing’ economies.

Technology continues to develop at a pace meanwhile, with everything completely transparent. Nothing can be hidden anymore. As a result, new models of access to financial services are arising, such as Zopa, Prosper, Wonga, SmartyPig, the new MTFs and clearing systems for trading, the Barter Network, complementary currencies. All of these are discussed extensively in the discussion series around Banking as a Service.

All in all, the outlook is one where politicians have lost control, the economy is spiralling downwards, society doesn’t trust anyone and technology is allowing them to find out why and get around the system.

What does this mean for the future of the industry?

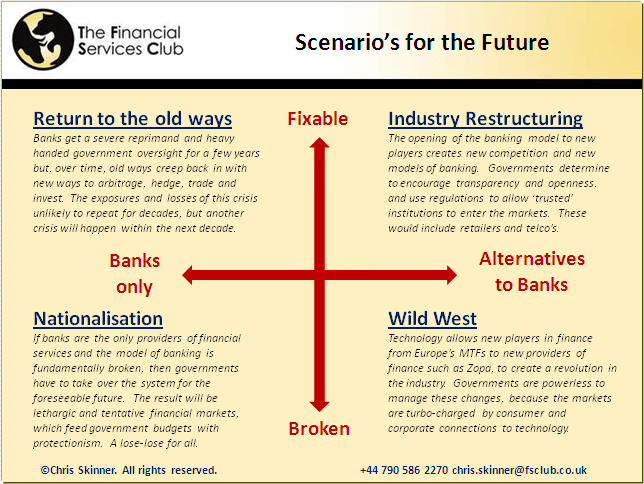

It leads to four scenarios, all of which have a semblance of truth.

The four scenarios are based upon two key axes: the banking model is either fundamentally broken or fixable on one, and banks are the only providers of finance or there are alternatives on the other.

The alternatives to banks are not necessarily non-banks by the way, but could be new banks. In this context, just as MiFID created a whole raft of innovative new ventures in the trading arena – Chi-X, Turquoise, NASDAQ OMX, BATS Europe, Equiduct, Quote MTF, Burgundy, EMCF, EuroCCP – the theory would be that new regulations to cure the banking crisis creates new ventures for finance as an alternative to traditional ones.

Looking at these axes of extremes leads to four scenarios for the future of banking:

Banking is Fixed and Banks are the only Players: this leads to a continuance of the old model of financial servicing with traditional providers still in a position of strength and liquidity is focused upon the traditional key markets and organisations. Result: we survive this crisis but experience another one in five to ten years … hopefully, not as bad as this one.

Banking is Fixed and Alternatives to Banks are Created: the regulators and politicians encourage new regulations and supervisory frameworks that lead to new providers of service, such as the new CCP for OTC Derivatives. These new providers may be an amalgam of existing players and/or new industry consortia, and it drives a flight to safety by encouraging the largest and most secure firms to act cohesively to create confidence. Result: we survive this crisis and the weakest fail, whilst new confidence comes into0 the system through a comprehensive industry restructuring.

Banking is Broken and Alternatives to Banks take over: this is a wild west of new finance where regulators and banks are avoided due to either (a) declining business; (b) being unable to take on board business that’s offered; or (c) not being offered the business in the first place. Result: consumers and corporates are forced to use new models of finance and banks fail as new players take over. This also has the outcome of a financial system that is fragmented and uncontrollable.

Banking is Broken and Banks are the only Players: this is the worst case scenario where banks that don’t want to be nationalised are nationalised by governments that don’t want to nationalise them. Banks become puppets of Minsters of Finance and are seriously debilitated in the face of an onslaught of regulations and red tape. Result: everyone loses and no-one wins.

Right now, the world sits in a hybrid of all four quadrants, with the most likely outcome being an amalgam of all four. I just hope that the dominant scenario is the industry restructuring (top right) though, as the lower two quadrants are scary and the top left is probably unacceptable.

It will be interesting to see the results over the next year or two.

** Some refer to this as PESTLE and include Legal and Environmental forces for change, as well as Political, Economic, Societal and Technological.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...