I know that the theme of mobile banking is appearing a lot at the moment, but it is hot, hot, hot!

A bit like Africa, and this is the story of a great success in Africa.

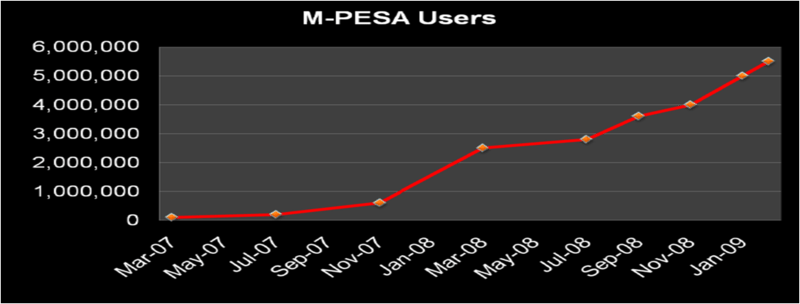

And no, it’s not M-PESA, although that one’s a goodie too.

This one’s ABSA Bank in South Africa.

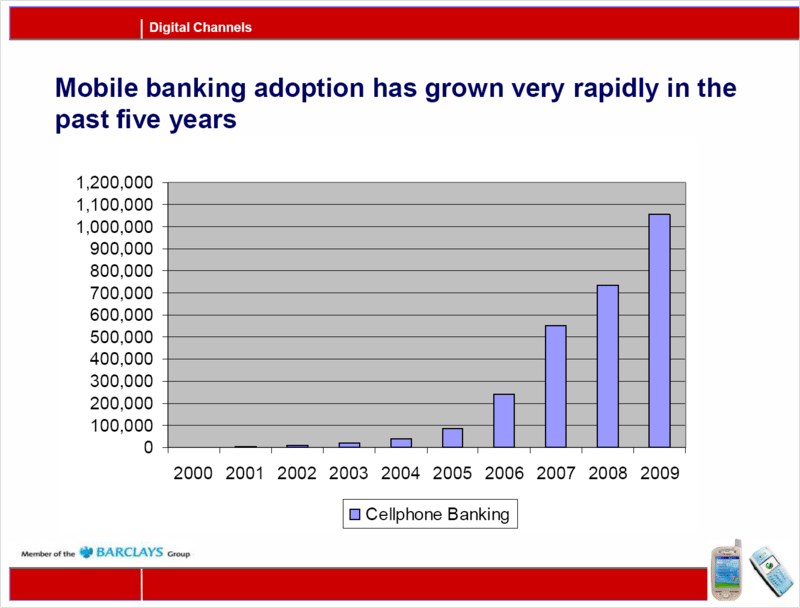

ABSA launched mobile payment services back in 2000 and saw a gradual growth in usage, with a near enough doubling of users year-on-year to reach over one million customers today.

Over half of these customers use mobile banking for balance checking, but buying prepaid airtime and looking at mini-statements are also very popular. The service not only offers simple SMS payment services, but goes a step further by tapping into the functionality of USSD.

USSD allows more functionally rich processes and services to a standard GSM telephone and therefore balance checks and beyond, and is the method by which ABSA Bank has built an affinity for the mobile handset as a financial tool.

Not only is it used for customers to make simple transactions therefore, but the service also offers alerts as an early warning system for fraud. This means that for every payment on debit or credit card, customers can set alerts to their telephone to reduce fraudulent activity. You can also parameterise those alerts, based upon size of transaction or location.

Here’s Christo Vrey, Managing Executive, Digital Channels for ABSA Bank discussing the service:

Christo was speaking at the Financial Services Club’s European Banking Forum ** and makes it clear that

(a) moving the channel from a simple transaction to a useful service for anti-fraud management, customers will pay for the additional services; and

(b) moving the channel from a simple transactional system to a mobile financial channel increases the opportunity to grow market.

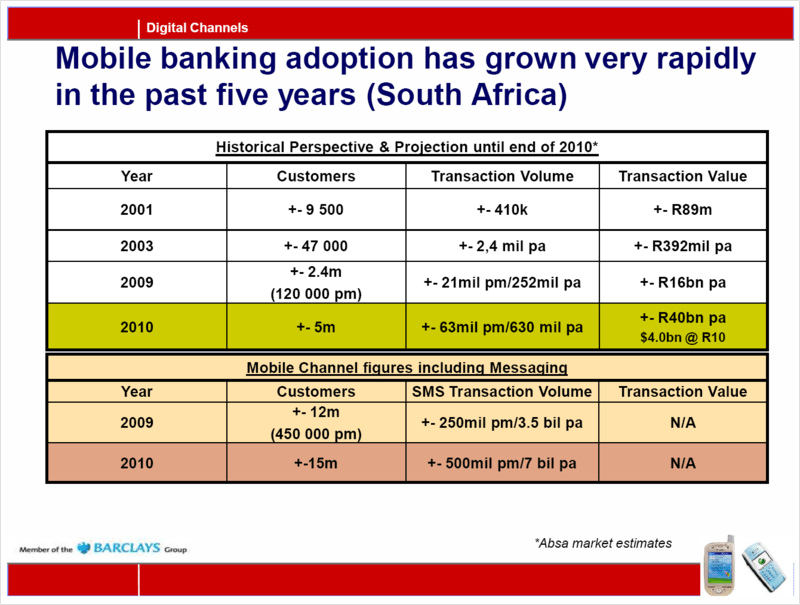

This is made clear in the chart below:

What this shows is that they had forecast the market size to be about 5 million people based upon simple SMS payments but, by adding SMS alerts and USSD the market size triples.

The reason for this is the bank extends the range and breadth of mobile services, to leverage this as a channel rather than as an ancillary. For example, the bank makes it mandatory to use the mobile as a kind of Xiring terminal, where every online payment is authorised through a one time password (OTP) via an SMS text message.

All sorts of other information is provided through the mobile including notice of payment to beneficiaries, account activity notifications relating to ATM withdrawals and debit order payments, and more. In other words, the bank has tried to create an affinity for customers with their mobile bank as their primary transaction and verification tool.

One of the biggest pieces of their service is a demonstration however.

A demonstration?

Sure.

How many people use an ATM if no-one shows them how?

How many people use self-service internet, if no-one shows them how?

And how many people use mobile channels, if no-one shows them how?

Now you may think this is not important, but the most important aspect of ABSA’s experience is that customers swarmed to the service after they rolled out a sales force (double click picture to see larger image):

This sales force demonstrated the service to customers as they went to ATMs across South Africa, and were easily identifiable as they were wearing the bank’s bright red livery.

The fact that people took the time to explain the service explains the blip you see in ABSA’s customers between 2007 and 2009. It also shows the reason for the interest in this service, in that you are looking at a country where geography is a barrier to payments. Getting money from A to B has been traditionally tough, with bus drivers and taxi’s being the only way to normally move money around in an insecure and unreliable way.

In fact, you can combine the story of ABSA, which is really getting into the banked population, with the story of M-PESA which is driving into the unbanked population, and the stories provide a common theme.

First, geography is a key factor. The fact that Africa lacked the infrastructure for some of the payments and other processes we are used to, means that the wireless banking capabilities of mobile make it a key.

And the second factor speaks for itself: mobility. The fact that mobile communications are now in play, overcomes the need for physical movements of the days of old. And the days of old to which I refer are less than five years ago.

For example, I was lucky enough to hear Olga Morawczynksi of CGAP talk about M-PESA last week, at the excellent Digital Money Forum.

Olga made her doctorate study around how M-PESA worked and why, and I don’t have time to report everything she said, so would refer you to previous blogs about M-PESA for background:

Workers' Remittances - a huge opportunity

Is your bank ready to be an MVBO?

Mobile payment provider 'infuriates' banks

Olga made it clear that the reason for the rapid take-up of M-PESA is twofold.

First, men naturally migrate to Nairobi for work, leaving wives and family in rural villages who need money to buy essentials such as wheat, maize and more.

Many of those in the rural communities depend upon these remittances for anything from half to all of their income.

The fact the migrant worker can now instantaneously get the money home without having to leave the City for days, or pay someone a large commission to move funds, is the reason why it works with the typical user making six M-PESA transactions per month in a mixture of remittances and savings.

The second reason was the political unrest in Kenya during the recent elections, which meant saving with a 'trusted' provider such as M-PESA, who are run by a South African, became more trusted than saving with a Kenyan Bank, especially as some of those banks went bust (sounds familiar?).

By January 2009, M-PESA had 5.5 million users out of Safaricom’s 13 million subscribers representing a third of Kenya’s 36 million population.

Those M-PESA users are making 160,000 person-to-person payments every day through a network of M-PESA agents, each of whom process around 90 transactions a day earning US$5 in commissions. US$5 a day in Kenya is a good rate of earnings when the average casual labourer only makes $1 a day.

All in all, the rapid take-up of a new technology, accessible to all through mobile GSM communications in a mixture of SMS and USSD is proving to be a massive success in several African communities.

It will be nice when we can get it here!

p.s. thanks to Aden Davies for pointing out a great article in ReadWriteWeb related to the themes above. Johnny Walker also noted that I missed Wizzit. I've been aware of this one and so this article was not meant to be exhaustive, but Wizzit is important as it is an example of another great banking mobile service in South Africa.

* all videos and presentations are available to FSClub online members

** the European Banking Forum is a conference run jointly between the Financial Services Club and VIB Events

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...