There are wide differences of opinion between different banks of the role of a branch these days.

Is a branch a branch, a store, a transactional centre, a sales centre,

a retail lobby, an automated machine or all of these things or none of

them?

On the one hand, I see HSBC saying that branches are uneconomic; on the

other hand, Santander has decided to rebrand all their UK branches and want more. Meanwhile, there are new banks opening branches, such as Tesco and Metro Bank, and old banks closing branches by the dozen.

Who is right and who is wrong?

Are branches alive and kicking, dead and gone, or in terminal decline?

Answer: depends where you sit.

A branch is useful for banks that see them as a key channel and as an asset for human interfacing.

Now that sounds like a dreadful techno-nerd phraseology but then, truth be known, I’m a dreadful techno-nerd person.

I hate branches.

Can’t stand the things.

Only ever go in there for paying in cheques, and how long will they last for gawd sake (2018 in Britain).

If that’s the only reason for going into a branch, then close them down.

But not everyone goes to branches for cheques.

Many want branches around as a place to go to ensure the bank can be trusted and to talk to someone. To human interface.

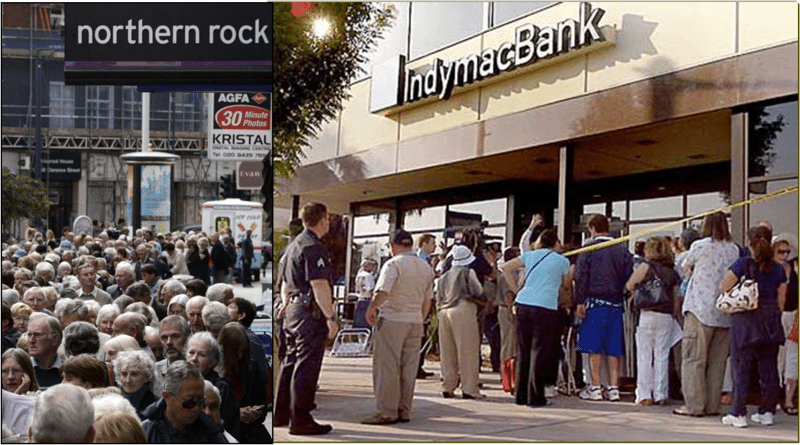

And, after the many issues of the past year with banks closing, the ability to queue and get your money out of it physically seems somehow reassuring.

Ah, but if trust is your only reason for having branches, then close them down.

After all, trust in banks has collapsed in the last year and if you only keep your branches open so that people can queue when you collapse and get their money out, then that's a pretty rum state of affairs.

Equally, some people trust a one man bank more than some big banks, so this is not the key either.

But then, that one man does have a branch so maybe there is something in that?

You see, it is all about the human connection isn’t it?

The ability to transact and interact with a human.

But, yet again, you don’t need branches for that either do you?

You can interact with humans on telephones, via keyboard and, soon, via remote video.

So what is the real point of a branch?

It’s …

… errrr …

… it’s to …

… to errrr …

… it’s to sell, isn’t it?

The future bank will have big sales centres replacing existing branches, and then lots of automated satellite stations for transaction services.

No.

Rubbish.

You can sell via the internet and telephone too. After all, if you needed branches then no-one would bank with call-centre only banks such as First Direct.

And yes, First Direct does have ATMs via HSBC but HSBC branches do not cater to First Direct customers or vice versa.

So, what is the real point of a branch?

It’s a channel.

And, if you are a bank that sees the human channel with physical connectivity as being important, as Santander obviously do, then you need branches.

If you are a bank that sees remote connectivity and services with limited human interaction in a physical space, as HSBC see the world, then you do not need branches ... just automated transaction centres.

And customers will self-select their preferred bank to service them based upon their view of the bank's competence at managing these channels and the channels they offer that suit the customer's lifestyle.

So, if I’m a customer who wants a bank with branches and humans, then I will choose between Santander and the few other banks on Main Street left to service me that way.

Meantime, if I’m a customer who never wants to see a branch again in their lifetime – and there are some of us who feel that way! – then give me First Direct, Smile, PayPal, Zopa and SmartyPig any day.

This is the reason why Metro Bank and Tesco are getting into UK bank branches … because they recognise that the incumbent players have no idea as to whether to be committed or de-committed to their branch strategies and operations.

And while the incumbents dither and prevaricate, they are just losing on both ends of the scale.

Their customers are dissatisfied with their shoddy, under-invested branch operations, and their competitors are seeing huge opportunities to recreate the branch experience to gain traction with those customers who want a branch experience.

No wonder banking is such fun when the business models are being reconstructed in real-time and the decision makers haven’t noticed or reacted.

Meanwhile, if you are committed to branch as a channel, it would do you no harm to look over the Financial Brand's Future of Branches presentation.

This post also relates strongly to the Multichannel Myth, whereby a bank should focus on single channel excellence, and a huge debate 18 months ago about branches.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...