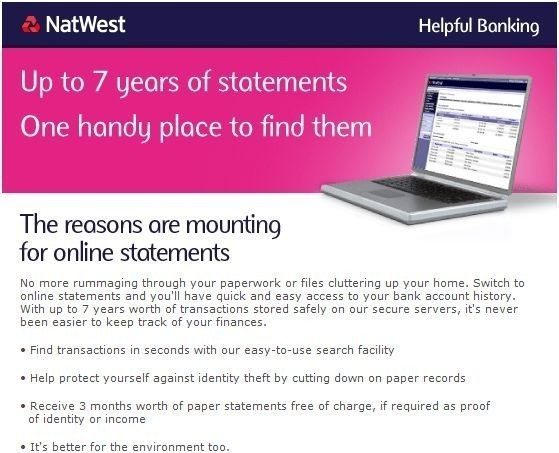

Nice email from NatWest today encouraging consumers to switch to paper-free banking:

No real commentary on this ...

... except that isn't it a bit weird that the benefit is that you're protected against identity theft by having no paper around ...

... and yet you need the paper statements to prove your identity.

Oh yea, and just in case you're not sure about doing this, the bank is offering a prize to one lucky winner to pay their mortgage for a year ... I was going to offer them my structured finance mortgage but they limited the offer to £20,000. Shucks!

The Finanser is sponsored by Vocalink

and Cisco:

For details of sponsorship email us.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...