Mint’s blog, a must-read for all bankers if you want to know what consumers top of mind priorities are, sent a post out yesterday titled: “David & Goliath: How Customers are Sticking it to the Big Banks”.

It immediately caught my attention because the Huffington Post in the USA has been promoting the idea of switching banks, as have others such as the Guardian and more.

The Mint blog caught my attention as it quotes extensive research reports, including that of UK website the Money Stop from March 2009, which advises that consumers are “withdrawing billions due to poor returns” on their savings accounts.

In the USA, they cite a Reuter’s survey from May 2009 which finds that “Only 35 percent of customers polled said they are highly committed to their retail banks, down from 37 percent in 2008 and 41 percent in 2007.”

It then moves into analysing the Huffington Post campaign to Move Your Money, which has apparently resulted in millions of dollars moving from large Wall Street Banks to small credit unions. Only running for two weeks, the campaign already has over 26,000 Facebook fans, with daily Web traffic tripling “on the National Association of Federal Credit Unions’ CULookUp.com, a credit union locator site” according to Financial-Planning.com.

The Mint blog entry is worth a read, as is the Huffington Post where “Glenville-based Trustco Bank has seen a surge in business ever since the Move Your Money campaign began calling for consumers to stop lining the pockets of the too-big-to-fail banks and to support their local community banks. Trustco saw 30 new accounts opened in one day, including one worth seven-figures.

Some people challenge this campaign, saying that moving money from a bank that is too big to fail to a small bank that can be allowed to fail is stupid, but it all makes good media news.

The trouble with all of these campaigns and discussions is that it does make good news stories but little changes in reality, as blogged about before.

Do I have any proof?

Actually, yes I do.

The UK Office of Fair Trading has carried out a range of analyses (pdf) on the UK Personal Current Account (PCA) – the equivalent of USA deposit account – situation over the past eighteen months and their last report, October 2009, states the following:

“The £8 billion PCA market is the cornerstone of the UK's retail finance system and an essential service for 90 per cent of adult consumers. However, the OFT's market study concluded that the PCA market was not working well for consumers. The OFT was concerned that a combination of complexity and opacity made it extremely difficult for individual consumers to know how much their account could be costing them compared with others on offer. This, together with perceived difficulties in switching, had led to very low switching rates and thus reduced incentives for banks to compete on price or provide new products and services.”

And calls for more transparency of charges and easier access to switch accounts.

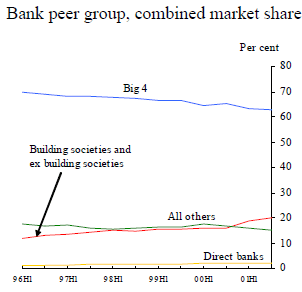

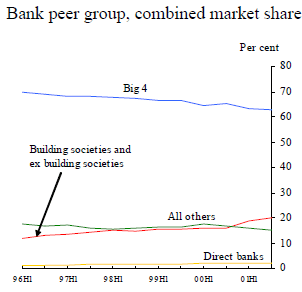

Without a regulatory change, then things will continue to stagnate. For example, here’s the stats for current account market share from 1996-2001 as discovered by FSA across four key groups in the UK:

– Big Four: Lloyds TSB, Barclays, HSBC/Midland, NatWest

– Building societies (present and former)

– ‘Direct’ banks

– Other banks (BoS, RBS, medium & small banks)

So, the share of all current accounts was concentrated in four banks in the last half of the 1990s, with a slight decrease over that time.

Ten years later, RBS owns NatWest and Lloyds has acquired Halifax/BoS. The OFT report (pdf) states:

“The PCA industry is moderately concentrated, with the four established banks representing a combined share of 65 per cent of all current accounts (increasing to 84 per cent with the inclusion of HBOS and Nationwide).”

Take out the Nationwide in other words, and the Big Four banks have actually increased their stranglehold of the UK’s core banking sector significantly over the last decade. That is even with millions of discussions of bank switching and issues with service and charges.

This will not change without regulation, even with all the media promotion to switch accounts, and yet the conclusion of the OFT’s October report – to deal with bank charges – was a case lost in November.

Net:net - banks are not only too big to fail but they’re also too big to mess with, and I suspect that Barack Obama and Arianna Huffington will find this to be the case with taxes and impacting market share.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...