I've been studying developments in the Middle East lately, and particularly the countries of the Gulf Cooperation Council (GCC). The GCC has been running since 1981 and comprises six core states of the Persia Gulf Region: the UAE, Saudi Arabia, Kuwait, Bahrain, Oman and Qatar.

The GCC is a bit like the EU, which formally established in 1957, in that its aims are to:

- create similar regulations in areas such as the economy, finance, trade, customs, tourism, legislation, and administration;

- foster scientific and technical progress in key areas of industry, mining, agriculture, water and animal resources;

- establish scientific research centres;

- set up joint ventures;

- unify the military presence for the Peninsula Shield

- encourage cooperation of the private sector;

- strengthen ties between the peoples of the GCC; and

- create a common currency by 2010.

Ah, there’s the key one at the end there. A common currency.

I’ve been visiting the region regularly for about ten years now, and this currency has always been on the agenda. Now, after a decade, it’s still on the agenda, and that’s about it.

That’s surprising as the GCC is very closely harmonised already; unlike the EU where there has been a massively fragmented region of economies, cultures, languages and monetary policies.

So you would think it would be easy.

In particular, the GCC countries are all closely pegged to the US dollar and, apart from the UAE’s wild child Dubai, pretty stable economies.

So what’s holding it back?

Politics.

It is a political issue about harmonising currencies that is the gating factor to a GCC currency or an Arabic currency. On this later point, assuming the GCC succeed, there is a plan for a single currency for the 18 member countries of the Council of Arab Economic Unity. These include the six GCC states, plus Yemen, Egypt, Iraq, Lebanon, Libya, Sudan, Syria and a number of other countries.

What are the political issues?

Firstly, what to call the currency.

If you call it the riyal then it means that Saudi, Oman and Qatar wins, as the dirham is the currency of the UAE whilst the dinar is used in Kuwait and Bahrain.

This is why the region voted to call it the ‘khaleeji’, which means ‘of the Gulf’, although no-one refers to the khaleeji, they just talk about the ‘currency union’.

So there is no official currency name as yet.

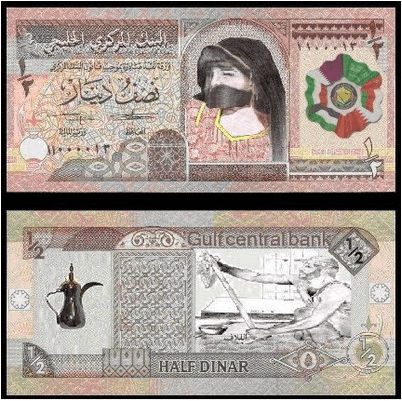

I did discover some currency designs:

But these are fake as none of the bankers I met had seen these designs, and the fact its called dinar gets thrown out of court straight away ... as does the fact that half is in English rather than Arabic.

In fact, the only thing folks liked about these notes is the six flag logo, so that might stay.

Even if the region gets a currency name that all nations can agree upon, where will they headquarter the Gulf Central Bank?

As soon as it was chosen to be in Riyadh, the UAE walked out. Meanwhile, Oman had said it wouldn’t join the currency and Kuwait has issues due to being linked to a basket of currencies, rather than just the dollar.

Nevertheless, five nations have agreed to create a Gulf Monetary Council and move towards union by 2015 rather than 2010. GCC Secretary-General Abdulrahman Al-Attiyah has stated that the first meeting of the joint monetary council will take place at the end of this month, and that is considered to be an important milestone towards the monetary union.

Some say 2010 was just the start date towards union anyway.

All in all, like the EU efforts, the GCC has a long road ahead. At least they have the oil resources to motor along it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...