So, we are finally seeing a new retail bank launched in Britain for the first time in, oh, living memory?

Yes, it’s Metro Bank time.

Opening in about two months time, Metro Bank plans to grow from a couple of London branches to a couple of hundred by the end of the decade.

In the spirit of full disclosure, I should state that the founders of Metro Bank are old buddies of mine. Their Chairman is Anthony Thomson, who has spent much of his life successfully engaged in marketing financial services* and Vice-Chairman is Vernon Hill, who created the massively successful Commerce Bank in America.

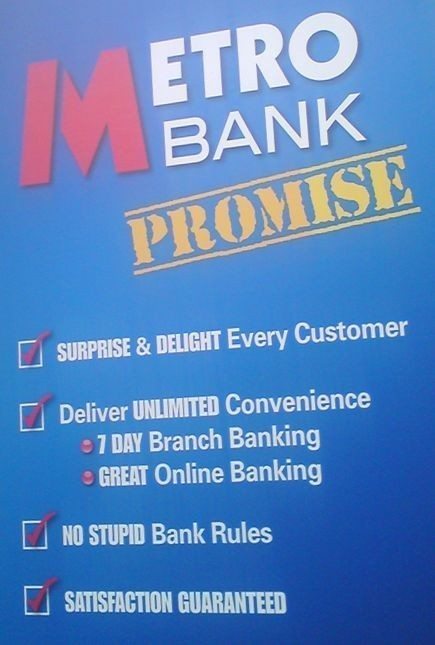

What’s different about these two guys and their banking ideas is that they want to make banking fun. They want you to love your bank. They won’t settle for the mere tolerance of a bank’s service; instead, they want you to really rave about the bank.

This is why dogs will be welcome in branches – branches have doggy water bowels and biscuits at hand to entertain man’s best friend – and why the bank intends to put an end to the traditional British bank’s ways of ‘stupid rules’.

The origins of Metro Bank go back to 1973 when Vernon Hill, an American entrepreneur, created Commerce Bank. Commerce Bank started with one branch, nine employees and $1.5 million in capital and was sold in 2008 for $8.5 billion to Canada’s TD (Toronto-Dominion) Bank, having blossomed into a 470 branch powerhouse.

The secret of Commerce Bank’s success was based upon Mr. Hill’s focus upon creating a bank based upon retailing, further to his previous experience as a manager of a Burger King store. This is why the bank is colourful, with coin changing machines that greet you as you step through the doors – something other banks think is expensive and unnecessary – along with in-branch facilities to open accounts and issue cheque books, including credit and debit cards, within fifteen minutes. Placing card issuing machines in branches is another thing other banks view as expensive and unnecessary.

But the ‘expensive and unnecessary’ is what made Commerce Bank’s approach different and why they view these things as necessary for good service. It is the reason why Metro Bank will follow a similar approach. For example, the bank will not only have coin changers and in-branch card issuing machines, but also plans to be open throughout the weekend. That means more than just Saturday morning, like other banks, but all day Saturday and Sunday too. Their hours are longer – eight till eight every day except Sunday, which is 11 till 4 – and only close for Christmas Day, New Year’s Day and Good Friday.

The bank has also promised to answer every customer call before the third ring in person. Not some outsourced call centre, but a bank run and customer focussed centre.

What is even more intriguing about the bank’s business model is that their core systems in the back office are run on a cloud computing, banking-as-a-service basis. This is particularly unusual as most banks believe in buying in a major installation of hardware and developing their own software systems, for control and security purposes. The idea of using a system – Temenos in this case – and running customer accounts on a pay-as-you-use basis is pretty much unheard of, but Metro claim this has saved them around £20 million in start up costs.

The bottom-line with Metro Bank is that they are a new bank, running a model in a completely different way, to buck the system. And, for those traditional bankers who think this all sound like some fad, glitzy, marketing spin stuff, it does work.

For example, not only did Commerce Bank become a sizeable force in the USA from its origins of one branch to a $50 billion in assets bank by 2008, but it also returned a whipping 23% average growth in share price to its shareholders. If you’d invested $10,000 in Commerce Bank way back in 1973, your stock would have been worth $108,000 by 1991 and $4.7 million by the time of its sale to TD.

The only question mark about the bank has been its management, as assembling a team of financiers that the FSA would sign-off on for a banking licence in the UK has been a major challenge. Now, with an executive team that comprises extensive senior experience from institutions such as Royal Bank of Scotland, Halifax Bank of Scotland, Anglo Irish Bank, Barclaycard, Bank of America and the Nationwide Building Society, they have their licence and are all systems go to emerge from their initial two branches in London to become a 200-branch bank by 2020.

Some ambition, but with Anthony in the lead and Vernon supporting, one that is likely to be achieved.

* Anthony co-founded City Financial Marketing in 1987, which became Europe’s largest financial marketing consulting and communications group before being sold to Publicis in 1997. After this, he created the highly successful Financial Services Forum, the largest membership group I know that is dedicated to the financial services marketing

community.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...