I will not spend much more time on this, but was irritated by the CEBS stress tests last week and so one more quick note.

The reason CEBS, the European Commission and European Central Bank gave for not including the scenario of a sovereign default in the stress tests is that they just don’t think it’s going to happen.

“It is not possible”, they said.

“Why”, we asked.

“Because it is just incredibly unlikely and, even if anything did start to fragment in the fissures of finance in Greece or Spain, we have the European Financial Stability Fund (EFSF) to solve it”, they replied.

Now that’s an interesting statement ... because it is also a fuddle.

The EFSF is a €440 billion fund designed to cover any sovereign debt crisis in Europe in the future.

Therefore, the concept of a bank being exposed to huge losses from Greece and Spain is no longer an issue.

That is the logic.

And it’s quite good.

But it’s already been shot to pieces.

Ken Wattret, a market analyst with BNP Paribas, performed a really interesting analysis of the EFSF and issued a note in July that provides a clear Q&A overview. The analysis is available through their website (large pdf, see page 10) and a public version was summarised nicely by Financial News.

Here’s my summary of Ken’s research note:

The EFSF is a limited liability company based in Luxembourg announced in May as a measure to “preserve financial stability in Europe”. Its CEO is Klaus Regling, a former senior German Finance Ministry official who worked on the preparations for EMU and who has also worked at the IMF.

The purpose of the EFSF, according to its terms of reference, is “to collect funds and provide loans in conjunction with the IMF to cover the financing needs of Eurozone member states in difficulty, subject to strict conditionality”.

According to the Framework Agreement, the EFSF will finance the provision of loans via the issuance of “bonds, notes, commercial paper, debt securities or other financing arrangements” which will be backed by unconditional and irrevocable guarantees from those member states which participate.

Only the member states of the Eurozone participate in the scheme, providing guarantees up to a total of €440bn on a pro-rata basis.

If a Eurozone member state seeks assistance from the EFSF, they must initially agree a Memorandum of Understanding (MoU) with the European Commission, in liaison with the IMF and the ECB. This MoU will set out the budgetary and economic policy conditions which the Eurozone member state must comply with in order to receive financial assistance.

The detailed terms and conditions would then be set out in a Loan Facility Agreement which is subject to the agreement of all the guarantors (i.e. those countries in the EFSF).

The EFSF will enter into force when five or more member states, comprising at least two-thirds of the total guarantees, have confirmed that they have concluded the necessary procedures under their national legislation. It will last for almost three years, with the guarantees applying to loans made on or before 30 June 2013.

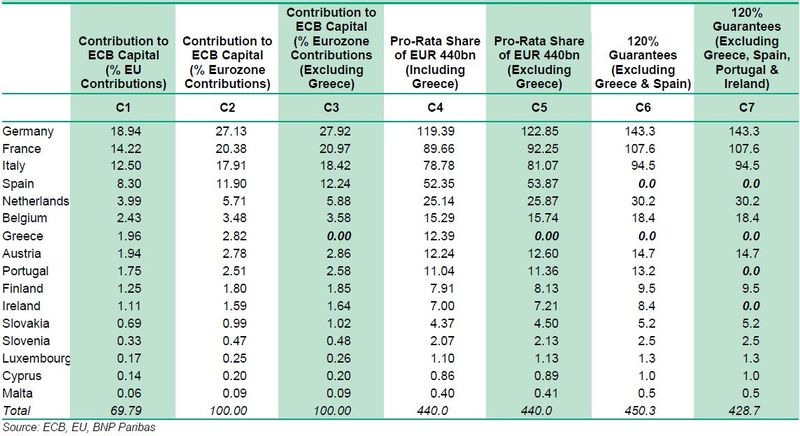

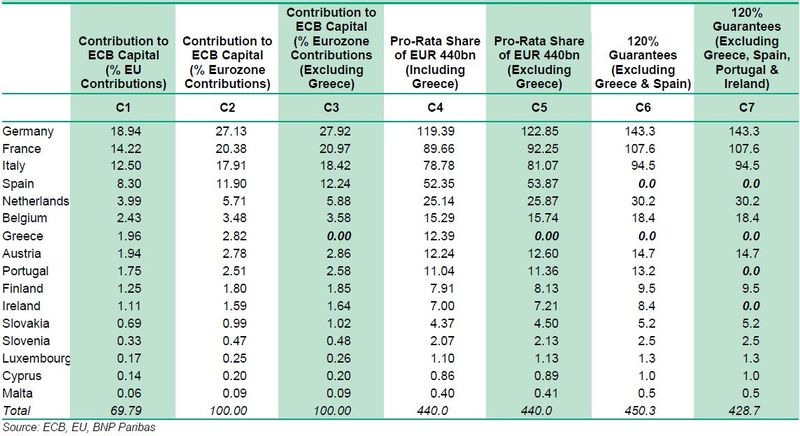

Now then, what Mr. Wattret did next is the most intriguing part. He produced this chart (double click to see larger image):

Column C3 is the one that interests me, for it shows that Germany and France contribute almost half of all of the ECB’s capital for this scheme, whilst the PIIGS – Portugal, Italy, Ireland, Greece and Spain – contribute almost 35% of the scheme, with Italy and Spain representing 30%.

Greece does not contribute anything to the scheme at this time for obvious reasons.

So what the ECB are saying is that the $1 trillion exposure of European banks to the sovereign debt of just Greece and Spain, as discussed yesterday, can be covered by the €440 billion available in an emergency through this scheme.

But let’s take this a step further.

Spain gets into distress and has to leave the scheme.

That removes a further 12% of the scheme’s funding.

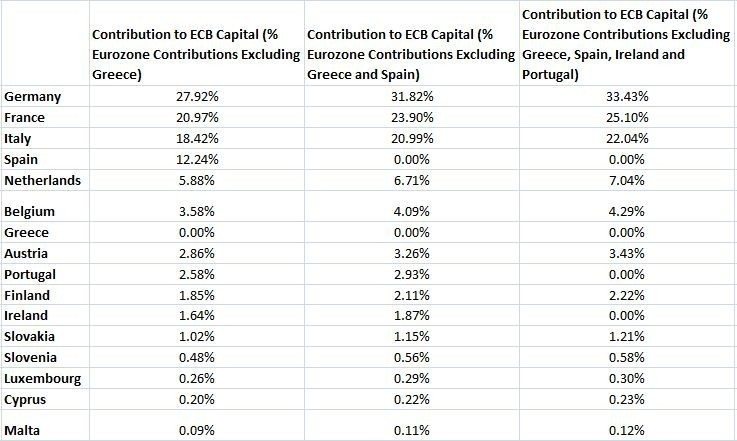

In fact, if Ken had continued his percentages and logic across columns C6 and C7, then the new figures look like this:

In other words, should Spain have issues, the burden on France and Germany increases by a further 7% of the fund – or an additional €7.5 billion to bring their number to a total of €250 billion between them.

This is what prompted me to ask at the end of the CEBS press conference: “so what you’re really saying is that you didn’t use the scenario of a sovereign default because you believe French and German citizens will be happy to bailout Spain like they did with Greece?”

That didn’t go down well but it had to be asked and, no matter how unlikely it is for this to occur, it is the reality of the situation.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...