Many interesting, weird and wonderful things drop into my inbox, Facebook newsfeed and twitter status updates.

Take yesterday.

I was sent:

- a copy of the BBA’s Annual Abstract of Banking Statistics,

- lots of notes from my accountant,

- various invites to press shindigs,

- a note from FatBoy Slim, who is an England groupie at the World Cup,

- a disgusting PowerPoint show detailing World Cup supporters of the opposite sex,

- a solution for the issues Apple iPhone4 users are having with signal loss if they hold the phone the wrong way around

- and a note from my conspiracy theorist friend about the weird coincidence that, on 7th July 2005, a company was running a simulation of a terrorist attack in London using the exact situation that became a reality that very morning.

How coincidental was that?

Anyways, talking of simulations, I am also getting lots of emails from bank economists with the title generally being: THINK THE UNTHINKABLE.

The one that really grabbed my attention was from ING, looking at what will happen if the Eurozone collapses.

We’ve had this discussion a few times lately, since Greece and co have been under duress, but no matter how much dialogue there is over this, it never seems to quite go away.

But I’ve not seen a bank analysis of the consequences of a Eurozone breakup before.

Here’s the opening lines:

“Suddenly the unthinkable is thinkable. The possibility that one or more of the members of European Monetary Union (EMU) might leave is no longer being dismissed, even by Eurozone politicians. In this report, we discuss not the probability of this – readers will doubtless have their own views – but rather its potential economic and financial market impact. Complete break-up would have effects that dwarf the post Lehman Brothers collapse.”

Oh dear.

The report is written by Mark Cliffe, Global Head of Financial Markets research, who looks at two scenarios: what happens if Greece leaves the euro and what happens if the Eurozone falls apart.

The first scenario is bad: “While the initial economic damage of a Greek exit is naturally focused on Greece itself, the effects elsewhere are non-trivial. While Greek output falls by 7½% relative to our base case, the remaining Eurozone economies could see their output fall by as much as 1%. Losses on Greek assets spread the pain across Europe and beyond.”

The second is horrible: “the impact of complete break-up is dramatic and traumatic. In the first year, output falls by between 5%and 9% across the various former member states, and asset prices plummet. With their new currencies falling by 50% or more, the peripheral economies such as Spain and Portugal see their inflation rates soar towards double-digits. Meanwhile, Germany and other core countries suffer a deflationary shock. Indeed, with the US dollar surging on safe haven flows to the equivalent of 0.85 EUR/USD, the US also suffers a bout of deflation.”

He concludes that: “without extended preparations for EMU exit, the risk of at least a temporary breakdown in payments systems would be enormous. In our complete EMU break up scenario, the cumulative loss of output in the first two years is close to 10%, dwarfing the loss that followed the collapse after the demise of Lehman Brothers in September 2008.”

Yeuch.

So I do wonder what our banks are doing to protect us from such a disaster by preparing contingency plans for the Eurozone collapse. Believe me, they are creating contingency plans.

Mind you, it’s more cheery than the note I got from the economists at the Royal Bank of Scotland, who “strongly believe that a cliff-edge may be around the corner, for the global banking system (particularly in Europe), and for the global economy (particularly in the US/Europe).”

This one is written by Andrew Roberts, who is “amazed there is not now immense market & media focus on the new letters that will bring forward the end-game and worsen it.”

The 'new letters' to which he refers is the SEC Rule 2a-7 which came into force on 30th June, and demands that US money market funds take a safer position when it comes to their investment policies.

There’s US$2.8 trillion of 2a-7 funds, and this rules demands that they now own 30%, not 5%, of assets in sub 7-day liquid paper. In other words, money that is available for access if liquidity is needed within seven days. This means investing a third of the portfolio in short-term bonds and gold, whilst avoiding longer term investing in things such as ... er, sovereign debt.

“We can all see the logic – the sovereign defaults from EMU have the power to hit EMU banks badly, and the USA does not want to repeat the calamitous ‘breaking the buck’ problem when” they let Lehmans collapse.

Mr. Roberts believes that “the USA is basically pulling up the drawbridge and retreating into its fortress, trying to protect its financial system from coming European banking problems. But the consequence is clear. Banking is about confidence. If you are reliant on markets to fund yourself and that confidence wanes, a total stop can occur immediately/within days. Northern Rock (75% reliant on wholesale markets) was the first example of this in the UK, though not the last. Once we apply 2a-7 to our economic slowdown/deflation themes, this means one thing. If there is a slowdown and sovereign trouble, the problems facing EMU banking have through this rule potentially become a whole lot worse. This worsens – and brings forward – the ‘cliff edge’ potential.”

Jeez, this sounds serious although one of my mates tweeted a response: “surely history tells us RBS haven't the faintest idea what the economy might or might not do?”

Thing is that it’s not the end of it.

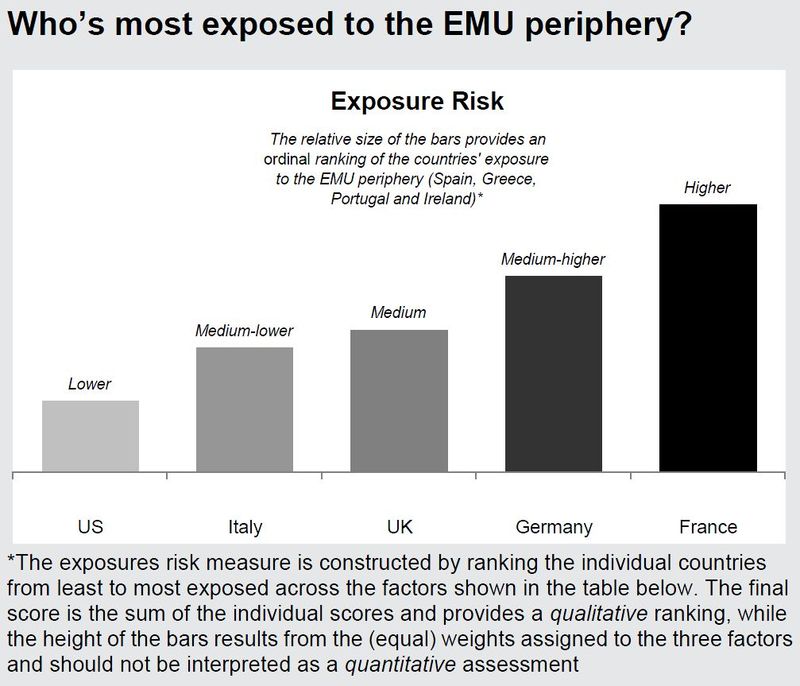

Morgan Stanley, for example, put this chart in their gloomy outlook:

And state that: “euro area banks’ exposure to the EMU periphery could amount to about €140 billion. Germany’s banking sector seems most exposed to Spain, France’s to Greece and Spain’s to Portugal ...

European banks are more wholesale-funded than any other major banking system. According to our equity analysts, European banks have €3.3 trillion of senior wholesale funding – almost half due in 2010-12. We think that providing extra liquidity might help to buy time, though the fundamental problems are unlikely to go away very easily. Bank recapitalisation, further fiscal restraint and structural reforms might help to address the underlying issues.”

Looking at the other economic outlooks, thye’re all talking about the euro, the Eurozone and the probability of a double-dip recession being high.

That blows my tracker fund investments then.

Guess, I'll just have to put all my money on the Netherlands winning the World Cup finals. After all, going Dutch only means spending half of the cost rather than having to take all of it!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...