I blogged about Santander last week and embedded the survey results on service, which actually warrant a blog entry in their own right, so here it is.

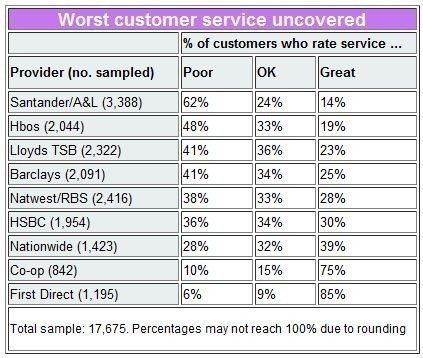

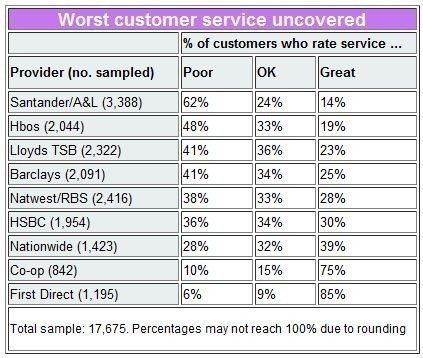

Now I love customer surveys of views on banks, but they are published too far and few between and often with poor density, so it was an unexpected delight to see that Money Savings Expert had performed a survey of over 17,000 UK consumers.

The results were published last week and here they are:

Yet again, First Direct on top and, yet again, Santander at the bottom.

Why do I say yet again?

Which? Magazine survey of 15,000 consumers in January 2009:

Smile and First Direct generated the highest customer scores for their current accounts (88% and 85% respectively), followed by Cahoot and Co-operative Bank (82%). First

Direct was top with mortgage customers, scoring 90% – 11% more than the

runner up Yorkshire building society – and was just pushed into second

place (with 78%) for savings by the Co-operative Bank (80%).John Lewis and Waitrose scored the highest mark for customer satisfaction with credit cards (90%), followed by Nationwide (87%) and Smile (86%).Abbey, which came bottom in each category – with the exception of mortgages where it came second from bottom – rejected the findings, saying there were "significant issues" with the research.

BBC Watchdog survey of over 13,000 viewers in February 2008:

- First Direct *

- Co-operative Financial Services

- Nationwide Building Society

- NatWest

- Lloyds TSB

- HSBC

- Barclays

- HBOS

- Abbey

60% of Abbey's customers were fed up back then.

I then wondered what this meant to bank's results, as I have a nagging feeling that Santander have been out performing most UK banks in the last two years in terms of customer acquisition.

Therefore this week will be dedicated to assessing the UK's mainstream banks from four dimensions. Today, it's customer service.

Tomorrow, I'll give a shot at employee satisfaction.

Wednesday, investor's returns.

Finally, on Thursday, financial stability and the regulatory perspective.

This could prove interesting ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...