Everyone wants to avoid double-dips and market issues, we want to talk up the economy and feel good, we want our glasses half-full and capital secure. And after this week’s bank results, you could be forgiven for thinking everything was back to normal:

Even state-owned bank Northern Rock reports a return to profit during the first half of the year.

Then we have all of these new bank start ups including Metro, Virgin and Tesco, along with Santander becoming one of the largest banks in Britain as they take over the branches RBS have had to sell.

So things are all good aren’t they?

Yea ... but maybe no.

You see, I’ve got a little bit of worry as we read the signs in the tea-leaves of economists and financiers. Those signs make it sound like times ahead aren’t quite so good.

First, most of the profits have been delivered as a result of the 2010 losses on debts being lower than anticipated. In other words, 2009's losses due to reserving capital to cover 2010's bad debts have not been realised. That won't happen again.

Second, we had the leader of the world’s markets – the Federal Reserve and Ben Bernanke – saying that times are too uncertain to withdraw fiscal stimulus. In fact, Bernanke is seriously worried about life as house prices are still tanking whilst unemployment insurance claims are still rising.

He claimed that things should get better as consumer spending would turn things around.

I don’t think so.

A day after Ben Bernanke said rising wages would likely spur household spending, a range of very weak American economic reports paint an entirely different picture.

In fact, the question everyone is now asking is whether the USA can handle a lost decade of deflation, like Japan did during the 2000’s.

Mmmm ... I don’t like that.

That’s why Mervyn King was so dour the other week, saying that “the wider economic problems around the world underline the fact that we cannot be confident that the recovery in demand, output and employment here in the UK will be sustained.”

Why’s he so worried?

I guess because if the USA takes a dive, what does that mean for Europe?

Which brings me to my third point.

Europe is still suffering from stress. The stress tests may have distressed the situation for a while, but the underlying stress is still there.

The PIIGS are still an issue and their debt and sub-AAA grading are still a problem.

This is why so many are saying Europe still has a problem. Here’s just a couple of comments that show the flavour of things:

“It is getting very, very difficult for us to make a forecast about where we'll end up at the end of this year. There clearly has been a substantial decline in confidence. Europe is making people nervous.” Nicholas Moore, Chief Executive, Macquarie

“We've got a coalition government in the UK (that) may or may not hang together. We've got Angela Merkel in Germany doing the right things but under a lot of heat from a lot of people because they don't like what she's doing, so I mean, I think that there is a lot of uncertainty around.” Tim Pistell, Chief Financial Officer, Parker-Hannifin Corp

Then I sit down with regulators and policymakers here in London and they’re worried.

You see, their real worries start with the government’s policies of reducing spend and increasing taxation.

Sure, the rise in VAT from 17.5% to 20% will have an impact of increasing inflation in the short-term, but come 2011, the austerity measures will begin to bite and, in 2012, will really hurt.

Although George Osborne defends his budget, the idea that we can cut to growth just doesn’t stack up.

How can you take out £6 billion a year from the public services and expect the economy to grow?

And if you want any proof of the wheels coming off that trolley, just look at last night’s Evening Standard:

“Research today from the Chartered Institute of Purchasing and Supply showed the dominant services sector — which includes hotels, restaurants, estate agents and stockbrokers — grew at its weakest pace for a year in July.”

You may think exports may save us, but it’s no better in our major export markets – Europe – as Europe is also following the austerity route of cutting for growth. That’s bad news as, bearing in mind that the UK exports less to the BRIC economies combined than it does to just Ireland, this means we won’t see growth through balance of trade.

Maybe that’s why some say this means buy dollars.

Not sure about that myself, as Macquarie’s CEO Nicholas Moore went on to say that the USA makes him nervous. It should. From the latest publication of the American:

“Europe’s PIIGs are in a poke, but U.S. states and municipalities risk their own sovereign debt crisis, with a huge liquidity risk from short-term debt. According to the Federal Reserve, at the end of the first quarter of 2010, state and local governments had $2.8 trillion in outstanding debt.”

No wonder Business Week leads this week with the front page headline “The New Abnormal”: “Americans are broke and depressed—and also swilling $3 lattes and waiting in line for iPhones. Welcome to the schizophrenic economy.”

Finally, the banks tell me that 2011 and 2012 will be challenging because the government and central bank’s policy of fiscal stimulus and quantitative easing has come to an end.

Now I blogged in April about the UK bank’s trillion dollar maturing debt mountain.

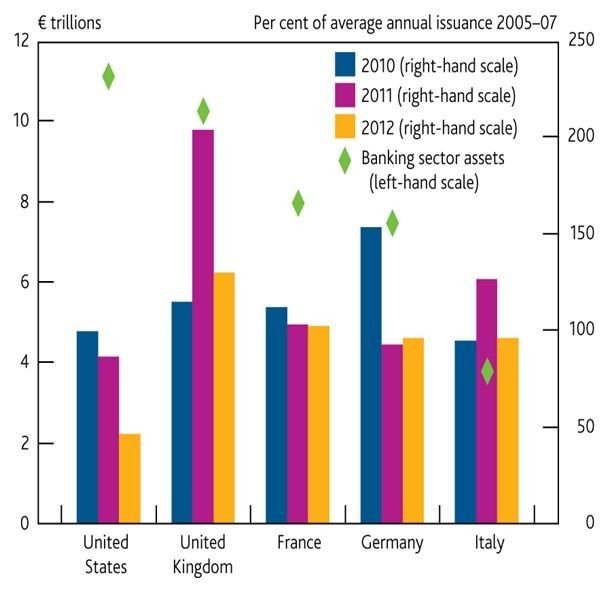

Since then, the Bank of England has produced an updated financial stability report with several telling charts. Here’s Chart 9 that outlines Bank refinancing requirements internationally:

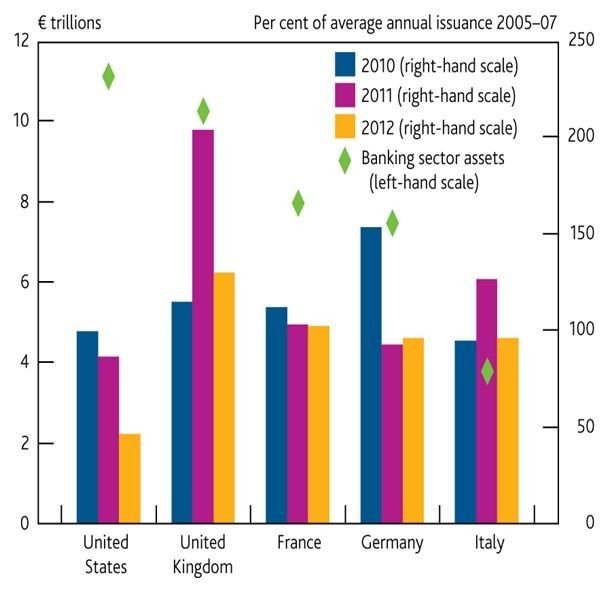

And Chart 4.16 that shows the maturing debt mountain updated:

Now you could remove the Residential Mortgage Backed Securities (RMBS), according to some (see discussions at end of last blog item), but everyone believes the cost of refinancing UK bank debt is going to be an issue.

“Morgan Stanley says UK banks have to refinance £450bn of funding across 2011 and 2012. To do so, the Bank of England believes, this means raising £25bn a month – a historic high. As the markets are not as open as they once were, the funds will be expensive. The Bank estimates refinancing will cost the industry as much as £10bn above current costs. The crisis is twice as severe for UK banks, particularly Lloyds and RBS.”

So you have a storm of issues still to come: American stagnation and then deflation; European contraction, spending cuts and depression; the end of financial stimulus and access to central bank generated liquidity; and the possibility that all of this leads to consumer and business contraction.

For example, in Lloyds Banking Group’s results yesterday, CEO Eric Daniels noted that customers had been repaying loans faster than it was able to grant them, as its overall loans and advances to customers fell to £612bn from £627bn the same time last year.

The trouble there is that if you add in a business investment contraction and consumer spending downturn, then everything moves towards a double dip in 2011.

Mmmm ... best tip: move to Hong Kong.

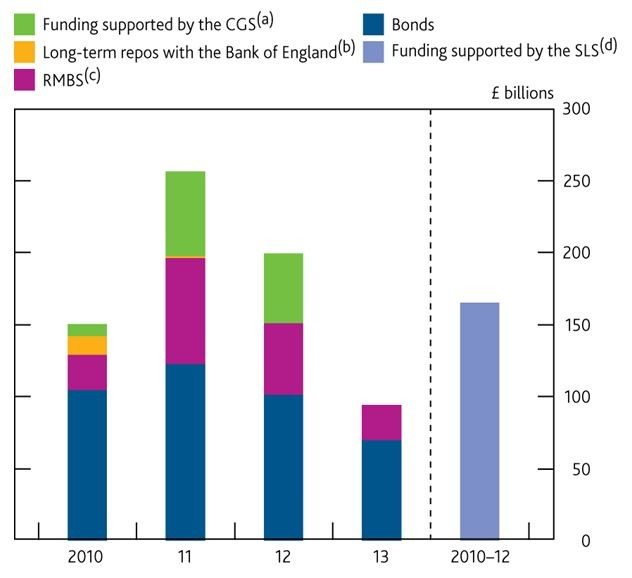

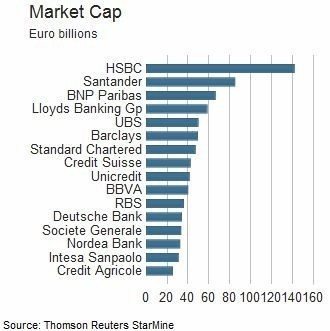

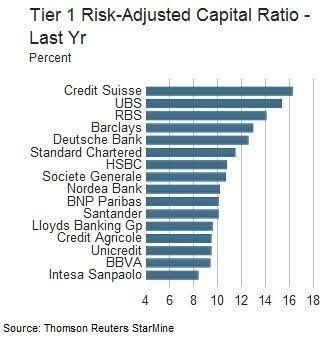

p.s. found these great charts from Reuters whilst researching this ...

EU Banks' First Half 2010 Profits

EU Banks' Market Capitalisation

EU Banks' Tier 1 Risk-Adjusted Capital Ratio

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...