I keynoted at the Deutsche Bourse’s annual IT Open Day yesterday, for the second year running.

It’s an interesting event, full of discussions about speeds and feeds, connectivity and interoperability, risk and alpha.

Funnily enough, some of the big news of the day is that the markets haven’t moved that far. For example, last year we were talking about “low latency” ... this year, we talk about “ultra low latency”. Next year we’ll probably be talking about “so latent that you blinked and missed it latency”.

Yep, things just get faster and faster. That’s why the Deutsche Bourse is moving all of their matching engine from inhouse to a colocation centre managed by Equinix in Frankfurt as it is should reduce the order roundtrip times by about 0.12 – 0.15 milliseconds.

It’s a big deal for Equinix, and this was one of the key announcements made by the Deutsche Bourse yesterday.

Another is that they’re dropping their VALUES API and replacing it with completely standardised native FIX connectivity.

All well and good.

Then it was made clear that this meant only FIX 4.2 and 4.4 ... so some folks asked the obvious question: “What about the other FIXs?”

Nothing like eight versions of a standard is there?

Anyways, I’ll probably write up a little of the keynote I gave later in the week, which was all about MiFID2, the Clearing & Settlement Directive, Flash Crashes and HFT. However, after saying yesterday that we need better risk management systems to avoid a future meltdown, I was fascinated to hear the news about Eurex Clearing’s developments.

The presentation was titled: “Innovation in Risk Management”, and I was intrigued from the start.

Innovation and Risk? Surely they shouldn’t be placed together as innovation is risk, isn’t it?

Maybe not.

What Eurex Clearing is introducing is a circuit breaker system for trading firms to avoid over-exposure in the markets intra-day and in real-time.

What is this?

How does it work?

What does it mean?

Here’s the low down.

Eurex is jointly operated by the Deutsche Bourse and Swiss Exchange SIX, and was established in 1998 through the merger of Deutsche Terminbörse (DTB, the German derivatives exchange) and SOFFEX (Swiss Options and Financial Futures). It is Europe’s largest futures exchange and also owns and operates the International Securities Exchange (ISE) in the USA.

Their Clearing House, Eurex Clearing AG, offers central counterparty services for instruments traded on the Eurex exchanges, Eurex Bonds and Eurex Repo, as well as the FWB Frankfurter Wertpapierbörse (the Frankfurt Stock Exchange: Xetra and trading floor) and the Irish Stock Exchange.

Eurex clearing also services the European Energy Exchange and ISE, as well as operating an Electronic Communication Network (ECN) for Bonds and Repos.

Due to the issues of the last couple of years, along with incidents like the Wall Street Flash Crash, Eurex Clearing has been working for the past year or so on some new circuit breakers for their 560 direct exchange members.

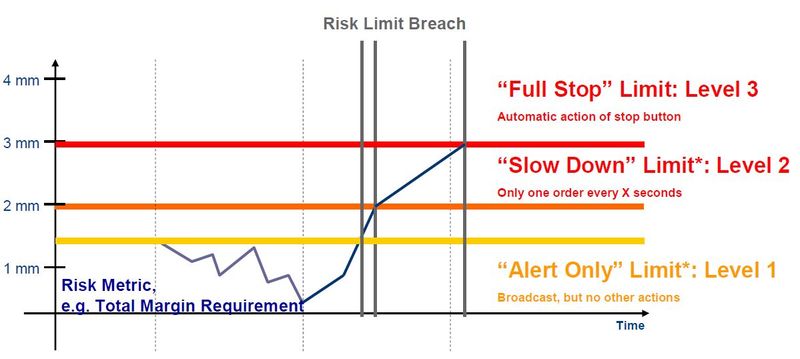

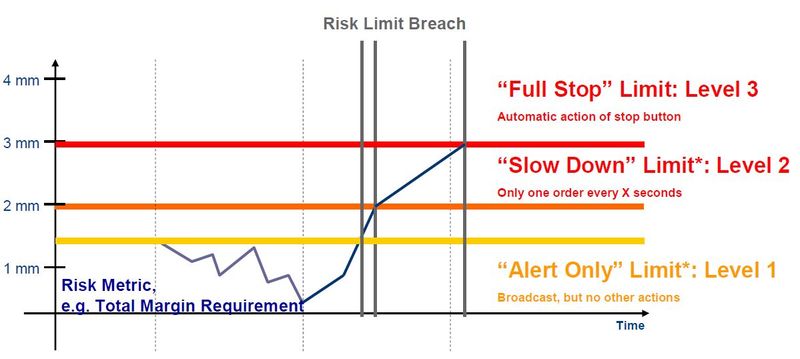

The way these circuit breakers operate is at three levels:

- Level 1: Alerts

- Level 2: Slow-down

- Level 3: Stop

And each trading firm can set up their circuit breakers as they see fit using four risk profile metrics.

The four metrics are:

- Exposure: the total amount a firm has at stake with the Clearing House at any given time;

- Profit and Loss: adding together four indicators – Premium Margin, Current Liquidating Margin, Variation Margin and Option Premium – a firm can calculate the current liquidating value of their positions on the exchange, as in their total P&L;

- Cash: represented by adding together just the Variation Margin and Option Premium, a firm can identify their cash flow due to the Clearing House the following morning; and

- Risk: adding together Additional Margin and Future Spread Margin, a firm can calculate the future potential risks of their derivatives positions.

Based on these four metrics, the firms can setup trading positions on Eurex and Xetra whereby Eurex Clearing will take action when any or all of the three levels are triggered:

- Level 1 broadcasts an Alert Message to the affected trading institution, with the option to set this to clear the existing order book and only allow persistent orders (these are orders the firms have set to trade regardless of any trading interruptions)

- Level 2 limits the firm’s frequency of order and quote entry by enforcing a minimum period between each transaction. Again, firms have the option to set this to clear the existing order book and only allow persistent orders.

- Level 3 stops trading completely by setting a “HALT” on the trading account until the firm resets their position.

In the example above, the firm has set their Level 1 limits at €1.5m, Level 2 at €2m and Level 3 at €3m. In other words, they can choose their exposure, P&L, cash and total risk levels and set up alerts, slow-downs and halts to trading based upon the levels and limits of comfort.

These limit configurations are all set up using VALUES API today or FIXML (FIX Markup Language) which, as mentioned earlier, is going to takeover from the API which is being phased out over time.

The presentation from Eurex went on to show how each trading firm can set their limits and structures according to the cut of their cloth. For example, firm #1 may just use Exposure as their circuit breakers; another may use exposure and risk; a third may use cash only as their control; a fourth may use all four.

All in all this seems like a really neat idea, and is probably going to be endemic across all clearing and trading operations over time.

In fact, one of the other things that came up yesterday is that post-trade transparency is the critical factor for foreseeable future in trading and real-time clearing and settlement with post-trade transparency and high security risk controls seems to be the order of the day.

I like it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...