Investment banking has had a rocky year all year. Pilloried by politics, public and the media, the investment banker is currently about as popular as a Vampire at a Blood Bank ... not a bad analogy as the refrain all year has been about that giant Vampire Squid that is known as Goldman Sachs.

Goldmans do bring it upon themselves though, as paying $111 million in bonuses this year sits badly with the average Joe. And I must admit that any bank that makes $100 million a day in profit most days, along with an admittance of how they manipulate markets and screw customers, has to be suspect.

The trouble with this is that it brings a whole cloud over the industry, as all banks are now viewed as being casino capitalists, robbing the economies to line their pockets with cash.

Not true.

There are some who might do this, but not every bank is Goldman Sachs.

However, it does mean that most of 2010 has been taken up with regulators and politicians wondering what to do about things like ‘dark pools’ and ‘high frequency trading’.

DARK POOLS

In the case of dark pools, they suspect these of being suspect because of the market manipulating suspicions created by the world’s leading investment bank, Goldman.

It means that regulators have been looking with deep scrutiny at trying to raise the illuminations on dark pools, even though these pools are argued to be good for markets as they increase liquidity by allowing block trading to occur that would otherwise be avoided if such trading was transparent.

Certainly, in Europe, the new revisions to MiFID could damage such trading, as illustrated by this May article from Financial News:

“NYSE Euronext and Deutsche Börse, have argued the regulators should use MiFID II to clamp down on the trading venues, known as dark pools, arguing they lack transparency and are open only to institutional investors, but not retail investors.

“But Rolet, who this week marks his first anniversary as chief executive of the UK exchange, said: ‘The biggest challenge is transparency and the balance between retail and institutional needs. Without institutional crossing networks (the so-called dark pools) some of the latent wholesale liquidity would go unexecuted or be simply more difficult to execute.’

“He said bank dark pools, which enabled customers to trade large orders privately away from the glare of the public exchange order books, served a valuable function in a market where there had been a sharp reduction in average trade size resulting from algorithmic and arbitrage activities.

“He added: ‘Transparency may have diminished in some areas but in formulating a response we should be careful to ensure that the differing needs of wholesale and retail participants are properly recognised.’

“The LSE chief executive and the exchange’s largest investment bank members, believe strict rules on bank dark pools would make it more expensive for institutional customers, such as pension scheme managers and hedge funds, to execute business.”

The result is that the European Parliament took on board a report produced by Kay Swinburne, rapporteur to the Economic and Monetary Affairs committee of the Parliament, during the summer recommending that dark pools be reclassified as multilateral trading facilities (MTFs) or systematic internalisers (SIs), and therefore lit.

The report has now been adopted as part of the MiFID review, and also places limits on order sizes. In other words, it wipes out the very reason for dark pools, as in large block orders placed outside the general exchanges to avoid market movements in advance of the order placement and processing.

HIGH FREQUENCY TRADING (HFT)

Swinburne’s report goes further and recommends a number of other restrictive changes, including:

- Making High Frequency Trading (HFTs) subject to mandatory liquidity provisions;

- An “ongoing regulatory review” of the algorithms used by HFTs;

- Making Multilateral Trading Facilities (MTFs) such as Chi-X Europe, subject to the same level of supervision as Regulated Exchanges.

In particular, there is a focus upon HFT, which has been augmented after the issues in America in May that created the conditions for the ‘flash crash’, something I’ve blogged about too often this year.

Therefore, I won’t do it again, except to say that between targeting dark pools AND HFT, the regulators are doing their utmost to kill any market liquidity and alpha investing strategies that exist.

Is that a good thing?

No, because the regulators are in danger of throwing the baby out with the bathwater.

REGULATORY NIGHTMARES

This was demonstrating by the reactions of the corporates, where they made it clear that the discussions of regulators about ‘systemically important’ and ‘commercial activities’ was purely speculative wording with no practical implementation ability.

In fact, it is concerning that the regulations being developed will more likely kill the markets:

- By clamping down on bonuses, investment bankers will all move out into hedge funds and private equity;

- By eradicating risky activity, regulators are also eradicating worthwhile investment activity;

- By locking down trading pools and practices that create liquidity, markets will seize up and cough and die;

- By demanding collateral placement to cover trading exposures, markets will be more restricted to just the largest players with deep pockets; and

- By banning prop trading, market makers will no longer make markets and trade and investment flows that fuel economies will disappear.

And none of the above really addresses the issue anyway, which was how the risk models created by the markets enabled massive risk exposures to be allowable when they were clearly, in hindsight, untenable and unworkable.

Where’s the regulation that addresses this area?

Which part of the regulatory structures of Dodd-Frank in the USA and MiFID II in Europe is addressing the fundamental question: how to eradicate products in banking that fuel risk, if the risk model has not been proven, tested and is comprehensible and comprehensive.

Meanwhile, we have had a few other key areas of regulatory focus, such as how to unravel a major global bank in 48 hours so that we can allow the too big to fail banks ... to fail.

CLEARING AND SETTLEMENT

Finally, there has to be a nod towards clearing and settlement. The whole clearing and settlement field is still a mess, with most of Giovannini’s barriers still unaddressed. That’s because of national market interests and focus.

During SIBOS, this all became clear as we spent so much time discussing interoperability that it became a buzzword, and we all know what you do with buzzwords don’t you?

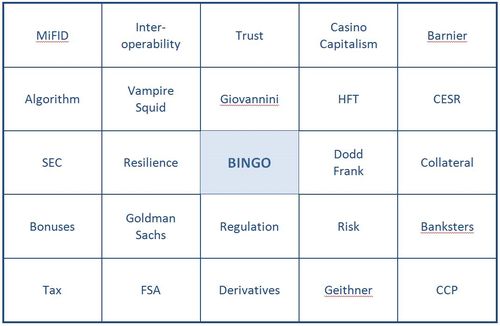

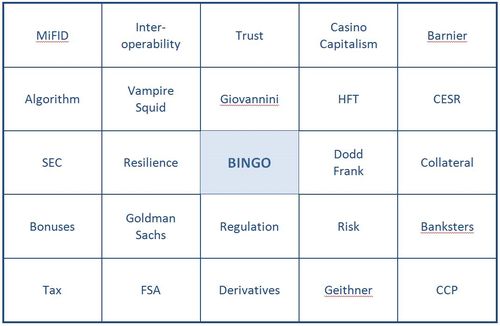

Yep so, to finish the year, here’s a nice little buzzword bingo card for y’all to play with when you get back to the office in January (doubleclick to enlarge) ...

Oh yes, and if you're a real MiFID freak then Dechert produced a nice four-page PDF detailing the revised regulatory regime they anticipate this month.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...