So, there are a lot of things we’re juggling around with in the payments arena, from real-time to TARGET2 to SEPA to SWIFT ISO20022 to mobile to contactless to biometrics and more.

I guess I can summarise this area best by using the results from this year’s payments survey because the last section of the survey asked people what's hot, hot, hot in payments this year.

EUROPEAN PAYMENTS

What was not hot is the world of the Single Euro Payments Area (SEPA) and the Payment Services Directive (PSD). Interest in these areas due to stagnation and indecisiveness had, to be honest, become flatter than the Flat Earth Society's annual party. In fact, an indication of how much euro interest exists was articulated well in an insight article on CNBC that claims that: “The European Union Is Over”.

I wouldn’t go that far but, in reviewing the developments of this year, I would say that everything in the Eurozone got a bit tired, tainted and tense.

Thank goodness therefore that the SEPA end-date is in sight, with the European Commission approving the forced migration of national instruments to SEPA credit transfer and direct debit schemes 12 and 24 months after the new regulations for migration are approved.

So that puts SEPA to bed (lol), and leaves me to hone in on other key areas such as mobile and contactless payments.

MOBILE CONTACTLESS

Often breathed in the same breath, these are distinctly different areas even though they are converging as we speak.

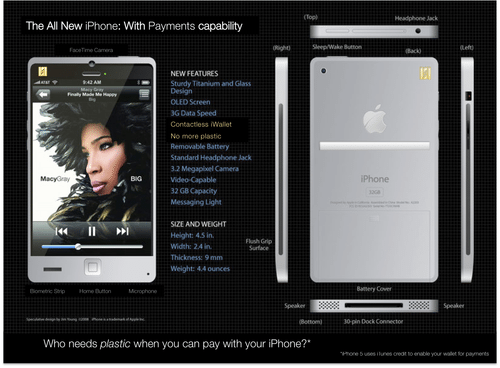

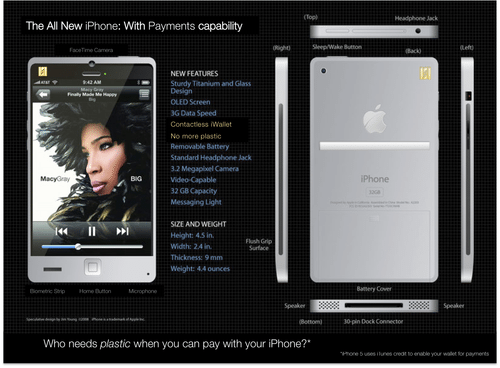

For example, Orange has just committed to rollout contactless payments and NFC capabilities across all of their European network next year, whilst Google and Apple are committed to incorporate NFC into Android and iPhones.

Picture stolen from Brett King

So we’re definitely in the era of simple mobile payments.

This was voted the #1 item of interest amongst those responding to the survey this year, and is top of mind with everyone.

What’s surprising is that mobile contactless may be top of mind, but it’s transient.

We’re already into using NFC tags everywhere and the mobile operators’ movements will simply decimate the NFC stick-on tag business (sorry taggo, bling nation et al).

Meanwhile, the fundamental issue is still not addressed: where can you use an NFC chip?

Barclaycard have been pushing Visa Paywave for a couple of years now, and yet I hardly ever get a chance to use it.

Sure, we may now have a few London taxi’s wirelessly enabled, but it’s hardly dense terminal acceptance or usability.

And there’s the rub: we need more terminals.

Maybe they could learn something from Zapa in Ireland, where AIB Merchant Services have worked closely with them to rollout terminals that can use the tags.

Half of all AIB’s merchant terminals are now Zapa ready: that’s 40,000 of their 90,000 terminals, with over 1.5 million contactless transactions in the year to September 2010.

Compare that with Barclaycard who have rolled out just 42,500 merchant terminals to date and processing just over a million transactions by November 2010, and you can see the challenging dimensions they face.

Hmmm ... but there’s no doubt that this will grow ... except that by the time it does, technology will have moved on and direct mobile-to-mobile, or M2M payments, will be the order of the day.

Ah well, we always roll out three-year old technologies to meet three-year ahead needs.

Behind mobile contactless, real-time payments is the next big deal.

REAL-TIME PAYMENTS

Real-time payments are big news because everything is moving into real-time, a point I’ve made often.

What real-time really means is real-time information transfer. Information about money moving worldwide in real-time. Not the money itself, which will still be gated and subject to the laws and barriers required to ensure money moves at the pace of AML, KYC, repudiation and revocation needs.

But real-time is a game changer, as real-time information, risk, cash and enterprise management is delivering real differentiation for corporates and clients worldwide.

That’s why banks need to focus upon it.

For example, in corporate treasury, real-time information that consolidates all the knowledge about a corporation's cash positions across all of their operations, geographies and subsidiaries would be invaluable. In fact, it amazes me that most companies do not have this capability.

That is because they are multi-banked and multi-country.

Banks that focus upon aggregation of information in real-time to provide additional knowledge about money will win business.

That's why real-time is important.

OPERATIONAL MANAGEMENT

After these big ticket items, everything becomes a bit more mundane with new pricing models for European payments post-SEPA, SWIFT MX and ISO20022, payments processing hubs, liquidity management and such like being on the ‘must-do’ list.

It’s all about standards, cost reduction and ensuring efficient processing. In other words, good operational management focus.

I could write a lot more about this, but it's covered pretty well elsewhere by SWIFT and other forums, so I'm not going to get all techie today (phew!).

The only point that’s really worth noting on the ‘new for 2010’ model from my side is the fact that there are a lot of new payments institutions appearing out there.

NEW PAYMENTS INSTITUTIONS (PIs)

PIs are new, non-bank payments processors taking out licences across Europe to process payments instead of, or on behalf of, banks.

Funnily enough, when we mention PIs, most people normally think of institutions like PayPal except that PayPal respond by saying: “we are a bank”.

First Data, Western Union, Mobile Telecom firms are also keen PIs, with over 70 licenses registered with EU authorities so far this year to offer payments services in this form.

But the most intriguing new PI for me is Voice Commerce.

Not because they were the first non-bank PI to register with the EU after the implementation of the Payment Services Directive (PSD).

Nor because they were the first PI to become a Visa and, more recently, MasterCard Principle Member.

No, the reason for Voice Commerce being of interest is that they use the idea of the human voice biometric being an identity authentication method.

Bearing in mind that yesterday, all things were moving to mobile and today, all payments are moving to mobile, the idea of using a human voice biometric on mobile seems to be a non-brainer.

And yet, according to our survey, voice biometric fraud management is the least interesting aspect of 2010s innovations.

Amazing how short-sighted we can be when it comes to seeing what may be the most disruptive developments sitting right in front of our eyes or, in this case, right in front of our mouths.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...