Welcome to 2011 and I hope you all had a lovely, jubbly holiday.

I did ... sitting around eating lots, drinking lots, getting nice presents lots, being with family lots, watching TV lots, not being on twitter or blogging lots ... oh, what fun.

And so back to work ... and being first day back, I guess it’s worthwhile doing a little predictive analysis, as in forecasting.

I’ll spend most of this week forecasting the next year, but have a job to do first ... which is to look forward 100 years to 2111, as I promised to do that recently.

Why bother?

Well obviously it’s useful if you could see a century ahead, for investments and such like, but equally it’s quite fun when thinking about it.

More importantly, it’s critical to the dialogue about the Long Now and Long Finance, a subject close to my heart that may feature even more this year as we seek ways to create long-term markets that are sustainable and as social business features more and more in our conversations.

Unlike others, I’m not going to provide a long list of predictions here, but just a few things that to me are blindingly obvious.

First, most of the businesses that are around today will be in 100 years, but will be doing dramatically different things.

To illustrate this, the firms that comprised the Dow Jones when it first started in 1896 are radically different today to back then.

“The Dow Jones Industrial Average was founded by Charles Dow on May 26, 1896, and represented the dollar average of 12 stocks ... only General Electric is currently part of that index. Most of the other 11 are still around though, just part of something else:

- American Cotton Oil Company, a predecessor company to Bestfoods, now part of Unilever.

- American Sugar Company, became Domino Sugar in 1900, now Domino Foods, Inc.

- American Tobacco Company, broken up in a 1911 antitrust action.

- Chicago Gas Company, bought by Peoples Gas Light in 1897, now an operating subsidiary of Integrys Energy Group.

- Distilling & Cattle Feeding Company, now Millennium Chemicals, formerly a division of LyondellBasell, the latter of which is now in Chapter 11 bankruptcy.

- Laclede Gas Company, still in operation as the Laclede Group, Inc., removed from the Dow Jones Industrial Average in 1899.

- National Lead Company, now NL Industries, removed from the Dow Jones Industrial Average in 1916.

- North American Company, an electric utility holding company, broken up by the U.S. Securities and Exchange Commission (SEC) in 1946.

- Tennessee Coal, Iron and Railroad Company in Birmingham, Alabama, bought by U.S. Steel in 1907.

- U.S. Leather Company, dissolved in 1952.

- United States Rubber Company, changed its name to Uniroyal in 1961, merged with private B.F. Goodrich in 1986, bought by Michelin in 1990.

Interesting list of firms that have mostly disappeared, although maybe Dow was just looking in the wrong places. Where should he have been looking?

Well, if you look at the Fortune 500 today, most of the top 10 American firms are traceable to over a century before:

- Wal-Mart Stores ... is new, the first store opened in 1962

- Exxon Mobil ... founded in 1870

- Chevron ... founded in 1879

- General Electric ... formed in 1892

- Bank of America ... founded in 1874

- ConocoPhillips ... formed in 2002, although Conoco’s origins go back to 1875

- AT&T ... founded in 1885

- Ford Motor ... founded in 1903

- J.P. Morgan Chase ... founded in 1823

- Hewlett-Packard ... founded in 1939

In other words, only two firms are new in Fortune’s list.

In fact, if you compare the Fortune list of 1955 and 2010’s list, then the older firms have been significant for over half a century:

- Exxon Mobile was second in 1955 and still is today;

- General Electric was fourth in 1955 and remains so today;

- Chevron was 18th in 1955, third today;

- Conoco was 30th in 1955, sixth today; and

- AT&T were 15th in 1955, seventh today.

So half of the largest American firms today were in the Top Thirty 55 years ago.

The new entrants are new and emergent firms (Wal*Mart and Hewlett-Packard) and banks (Bank of America and J.P. Morgan Chase).

Interestingly, although the banks have been around for a long time, their first real appearance in the Fortune 100 lists wasn’t until the mid-1990s when Citicorp and Chase Manhattan made their debut.

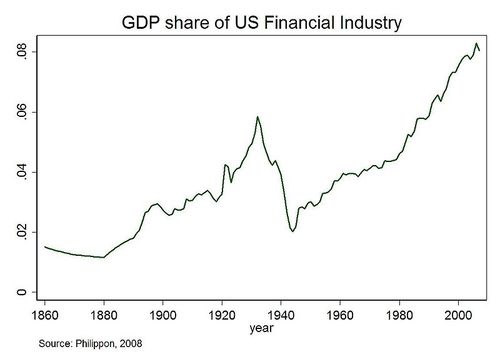

This is a reflection of the rise of banking as a profit vehicle through the Greenspan years:

Even though this was a false illusion.

For example, from 2004-07, the top five U.S. investment banks each significantly increased their financial leverage, reporting over $4.1 trillion in debt for fiscal year 2007 which was almost a third of America’s nominal GDP for 2007.

It is maybe a little strange therefore that, in 2010, seven financial firms feature high on the Fortune 100 (which is two more than in 2007, before the crisis).

All of this shows how the shape of industries changes over time.

How this impacts our investment portfolio is something that was investigated in depth for the Millennium Report by the London Business School and ABN AMRO.

This report made it clear that many industries have risen and declined over the past century.

In the 1800s railroads were the hot stock. These equities were replaced by auto manufacturers in the 1900s. By the end of the century, tech and telecoms stocks were hot.

And often firms in one hot industry will switch to another if they’re clever, such as Wells Fargo which switched from railroads and the Pony Express to banking at the end of the 19th Century.

Give it another century and the banks will no longer be high on the list, nor will the auto firms and oil companies. Like the railroads, these will be replaced by new industries.

And it is these industries that we want to identify now, in terms of where to invest for the next century.

First, space.

A century ago, air travel was hardly even considered.

It was fiction.

Today, we catch planes like buses.

And tomorrow, in hundred years, we shall travel around the earth at light speeds.

We know this from the emergent designs and experiments for space tavel that go mainstream this year, after the recent launch of commercial space company SpaceX's Falcon 9 and Dragon spacecraft, as well as Virgin Galactic successfully running the first glide test of its suborbital spaceliner SpaceShipTwo.

What this tells me is that like the Wright Brothers, Louis Bleriot, Charles Lindbergh and Amelia Earhart, we are at the start of a reformation in travel and tourism which may included space flight but is more likely to result in faster and easier travel around cities, regions and our world.

For example, my first flight to Australia in 1987 took around 30 hours of travel, and required two stops on the way to Sydney.

Today, that trip takes 21 hours, and purely requires one stop.

At the turn of the last century, the same journey took seven weeks using boat power.

In the very near future the same journey will take five hours or less, using space technologies mingled with flight.

All of this is determined not just by advances in our knowledge of tools and techniques for travel, but the fuel and sustainable developments that go alongside such system advances.

For example, the next generation of aircraft is hydrogen powered, and this technology will equally be applied to cars and other vehicles. In fact, hybrid vehicles that mix hydrogen and natural oils and vegetable fats is most likely the direction we’ll be heading towards.

In other words, transport that has no planetary abuse, requires no oil and changes the dynamics of industries and geographies.

Suddenly, the Middle East’s oil reserves become unimportant, sending the region into decline. Equally, Exxonmobil and their kindred become shadow industries of their former selves, a little like the railroad industries, as few truly commit to cannibalise their own but try to keep the oil magic going.

But that’s another story.

The second big area for investment is technology or, more importantly, communication technology.

A century ago, the telephone was seen as a game changer.

Today, it’s the internet.

Tomorrow, it will be transport technologies.

What I mean by ‘transport technologies’ is that they transport us from one place to another in real-time.

In particular, we think that it’s all about social networks through touch screens today ... tomorrow it will still be all about social networks in the best possible Princess Leia format.

The Princess Leia format?

Sure, you know the bit I mean, where Luke Skywalker in Star Wars hits the button and a magical hologram of Princess Leia appears:

In the film it was 1970s technology vision. Today’s it is Cisco’s vision where Holographic Telepresence can be delivered through multicamera angle technologies in High Definition.

Woah, sounds weird.

But it’s not that weird.

Here’s reporter Jessica Yellin demonstrating the technology on CNN recently:

.

And that’s now.

A hundred years from now, pop-up chat with 3D Holographic friends in Hi-Def will be a no-brainer.

The result is that long-haul travel for meetings is far less a pre-requisite than ever, which contradicts the developments in air travel. However, there is far more need for contact and, as with today’s technologies where people are connected remotely and, as a result, want to meet and connect directly locally.

Equally, in the context of these holographic 3D experiences, the ‘transport’ part kicks in as these technologies appear to not only take you physically to the remote location, but can actually transport you completely out of your current environment to new worlds.

This will be phantasmagorical for the gaming worlds, and will allow gaming to be more like the holodeck of Star Trek ...

Between the Star Trek entertainment and communication technologies of 2110, the world and space will feel a whole lot closer.

The third big area of change for the next century will be the whole political landscape.

Bearing in mind how economies have changed and the big battles of the 20th century including four big wars – two World Wars, a Cold War and a War on Terror – the 21st century sees the development of an increasing number of global agreements to create harmony and frictionless commerce.

It may seem strange to think of a global earth operating in harmony from a trade viewpoint, but globalisation over the last two decades has tried to create just that and has been the main driver in the growth of China and India, as well as the logic of drive for a European Union.

Don’t believe it?

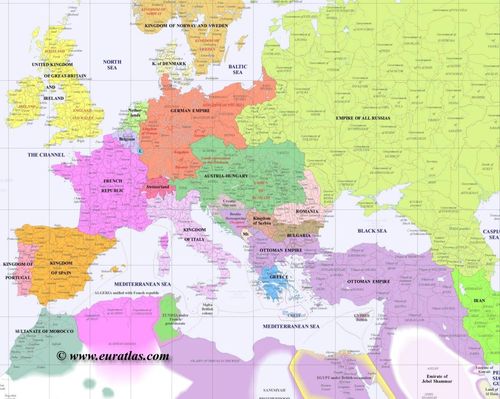

Well, here’s Europe in 1900:

And here it is today:

The biggest difference being the separation of many nations, with the German Empire breaking up into pieces, as has the Russian ... in fact, what we’ve seen is a major separation of country borders to recognise different nationalities, regions, religions and races.

However, the difference between 1900 and 2010 is that you can have that separation of nations by borders recognised to respect religions and races, but harmonise and bind these nations through trade agreements, and that’s where the focus will be for the next century.

Creating global trade agreements through the G8, G20, United Nations and other key councils will be a critical change as, by 2050, the United States and Europe will be joined in economic size by Asian and Latin American markets. According to most research, China will be the world’s largest economy somewhere around 2030, and will grow to be 20% larger than the United States by 2050. Almost 60% of G20 economic growth will come from Brazil, China, India, Russia, and Mexico over the next forty years.

After this period, the increasing importance of Africa will be a major battle ground with China, India, Europe and America all wanting a piece of their action. This is why trade blocs, such as the Southern African Development Community (SADC), the East African Community (EAC) and the Common Market for Eastern and Southern Africa (Comesa), will gain increasing power over agreements and disagreements.

All in all, the battles of the 21st century will be far more geared towards economic supremacy rather than religions, and diplomatic agreements will be the focal point for most countries in gaining or losing power over the trade and commerce landscape.

Bearing in mind that distance is now irrelevant, as you can travel around the Earth in under seven hours and holographically appear anywhere for a chat, a global trade agreement makes even more economic sense.

A fourth major development in the next century will be in the area of life sciences, where nanotechnologies will be transforming our health and longevity.

Sure, we hear people speaking of living to eternity or for centuries, but that’s a fallacy if you ask me because the human genome can only be replicated by cells a finite number of times before the replication becomes too faint to provide the strength required for the cells to continue.

According to my readings therefore, the longevity of human life is limited to around 125 years with the oldest human being recorded to be a French lady, Jeanne Calment, who survived to 122 years old.

If everyone could live to 120 as an average, that would be quite something ... something horrendous maybe, as you would need everyone to live productively for as long as possible.

And that’s what nanotechnology and healthier lifestyles will ensure.

For example, a hundred years ago Otto Van Bismarck, the first Chancellor of the German Empire, introduced a pensionable age of 70 back in 1889. It was later reduced to 65 in 1916 because few people reached the pensionable age. Back then, German life expectancy was 35.6 years for men and 38.4 years for women.

This has changed dramatically a century later, where we now have a world where the average German man can expect to live to 75.6 years and woman to 81.3 years. This will change even more dramatically over the next century, where we now talk of one in five people living to over 100 years of age ...

One particular nuance of such change is that the pension age will rise. To what age? 70? Or 75?

Bearing in mind that the expectation for the average person is that they will live for about 10 years past retirement today, then it would imply the general retirement age will be 80 or more by the end of the next century.

Mind you, this also assumes so much is addressed by medical breakthroughs that Alzheimer’s, Parkinson’s, most cancers and other degenerative and age-related diseases are cured.

A little like typhoid, cholera and small pox a century ago have been cured today.

So there you have it.

Four massive changes to the way we live, work and travel:

- travel anywhere in under seven hours;

- communicate anywhere in physical form in real-time;

- trade anywhere with frictionless capitalism across global borders; and

- we all live long and prosper.

All of these developments have an impact upon banking and financial services, which brings me to the fifth change over the next century: money and capital.

Bearing in mind that we have moved from a world where the right to shelter and not being tortured as basic human rights has moved towards the right to work and the right to education, much of the 21st century will focus upon the world’s population that live on under $2 a day.

Why $2?

Because the World Bank defines extreme poverty as living on less than US$1.25 per day, and moderate poverty as less than $2 a day, and estimates that "in 2001, 1.1 billion people had consumption levels below $1 a day and 2.7 billion lived on less than $2 a day."

What is interesting as part of their analysis is that the absolute numbers of those in extreme poverty has dropped dramatically over the past three decades:

Although the potential to fall into poverty for people in regions most at risk of inequality has increased significantly during this time too:

In reality this means that there will be a continued focus upon raising and protecting those most at risk of poverty as global trade agreements are made and health and fitness improves.

An example of such work will be the production of genetically-modified foods to feed those in areas at most risk of drought and malnutrition. Mass production of cheap food and housing will give those displaced, homeless or starving, a chance to be protected.

This is the work of the Bill and Melinda Gates Foundation and Bob Geldof’s Live Aid and more. Such work will pay off in the 21st century as one of the diseases that kills the most – malaria – will be near eradicated thanks to mosquito nets and injection programs across those countries affected.

What does this have to do with banking?

That there will be a chasm between capitalism and socialism, but not in the traditional sense of communism versus capitalism, but more capitalism with a social conscience.

This is already coming through strongly as an issue early in the century, as evidenced by the rise of social networks and social media.

You cannot have a globe connected socially without a social conscience.

Therefore, social business, social currency, social lending, social saving and social finance will all augment social networking in this globally connected planet.

Microfinance through Facebook credits, or similar currencies, and connecting P2P with B2B will become an interesting overlap in supply chains and commerce, with Pants to Poverty being a good example of how this works in reality today.

So there will be this blurring of lines between social financial services for the good of society and commercial financial services for the good of commerce.

This was a major debating point throughout 2010, and will continue but louder throughout this century.

The likely end result by 2110 is that banks will no longer be transacting messages about finance but will be providing secure transfer for any form of information that has value, whether that be social or monetary.

This is the most dramatic change to retail and commercial banking.

Meanwhile, we’ll still have the voracious trading markets with the Goldman Sachs of this world creating profits of a billion dollars a day, but these markets will now be trading from new centres in Shanghai, Mumbai and São Paulo, alongside London and New York.

OK, I’m biased and still believe that London will be a major trading centre for finance, and there’s nothing out there to indicate this will change in the next century as London has held this position for, oh, four centuries already.

It’s all to do with skills, capabilities and resources, as well as language, ease of doing business and regulations, and the UK is 200% fighting to retain its’ space as the major hub for global, and particularly European trade.

What these guys will be trading will be far more interesting however, as exotic futures will now be exotic future derivatives of derivatives.

Anything and everything will be traded from celebrity futures for wannabees and has-beens to the future pricing of oil and gold, and it will be via electronic platforms nothing like those of today.

This is because the future trading markets will hybrid P2P betting systems like Betfair with traditional trading platforms like NYSE Euronext alongside ultra-low latency systems, such as Chi-X.

A century from now, these systems will operate globally in sub-nanosecond response times and the idea of creating an instant market in the likelihood of a leading football star being caught in bed with a prostitute as front page news will be as tradable as using factoring to fund future investments in developing a corporation’s business.

The issue for the regulator will be that the platforms, connections and creativity of the investment markets have become unfettered and free via technology and globalisation. Therefore, the markets will operate as freely as possible under a global framework of principles which, if contravened, will result in jail.

Capital markets will get away with whatever they want to get away with, as long as there is not a global will to close down their operations. A little like Julian Assange of Wikileaks, the operators will evade the authorities as long as the authorities do not act cohesively to stop them.

So, in closing this short view of the next century, markets will trade freely tomorrow as they do today, in fact more so, but with a social conscience driven by four trends underlying these changes:

- distance is irrelevant, thanks to travel and communication technologies;

- time is irrelevant, as a real-time universe is in play;

- borders are irrelevant, as the planet operates as a cohesive whole for the purposes of trade; and

- age is irrelevant, as most of us will have a century of productive life.

Exciting or scary?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...