Another presentation at TradeTech that I was interested to hear was Larry Tabb’s.

Larry is CEO of TABB Group, a research firm focused on capital markets that Larry founded in 2003 after several years leading TowerGroup’s Securities & Investments Practice.

Due to our involvement in TowerGroup – I co-created TowerGroup Europe – Larry’s one of the interesting guys for me, as he has grown his firm to around thirty people today and has a strong knowledge of all things in the investment markets.

So what was he talking about?

The Flash Crash, a subject I’ve blogged about extensively.

Larry has spent some time on the subject and forensically analyses it in depth in various research.

As we all now know, the flash crash began when one mutual fund group, Waddell & Reed, put in a large sell order for e-Mini futures.

This was on May 6th 2010 and it is important to remember that this was when there was a lot of economic uncertainty, with Greece imploding a lot of nerves in the markets.

Larry reckons that Waddell & Reed put in a sell order for 75,000 eMini contracts worth over $4 billion at 14:32 that day through their algorithmic trading machines.

The result was that Liquidity Replenishment Points (LRP) kicked into the NYSE index as algos started selling massively with other algos, and high frequency trading (HFT) systems were trading futures and eMinis among themselves looking for any systems out there that would trade.

Internaliser engines stopped trading and stub quotes - absurdly priced quotes that acts as placeholders when trading firms don't want to trade – were being issued for a cent each.

By 15:00, over two billion shares were being traded during a ten-minute period. Normally, you wouldn’t see that sort of volume of trading in a whole day.

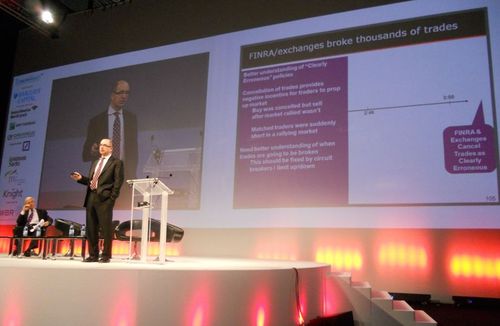

Making matters worse, FINRA cancelled most of the trades that were placed at that time, describing them as ‘erroneous’, causing a huge reconciliations backlog of work.

What a mess.

Since the flash crash, the markets have seen some activity picking up to regulate this.

There are short-selling limits, circuit breakers and a tightening of market thresholds on NYSE and NASDAQ. There’s some other ideas about circuit breaker rules for limit up and limit down to ensure that trades are only executed within a range tied to recent prices for a security, as well as other direct access rules.

What was more interesting in Larry’s presentation is what’s also under discussion.

For example, having the algorithms used by trading firms checked and vetted by a competent authority or regulator.

- How do you define what is an algorithm?

- Do the authorities have the resources to fully investigate such systems?

- Do they have the competence?

There’s a view that “time in force” rules need to be introduced for non-market makers. This rule ensures that buy orders stay in the markets long enough to be filled, as many buy orders are used to potentially lift prices using ‘flash orders’.

Flash orders appear in a short burst and are cancelled just as fast in order to change prices on exchange to the traders’ favour. Hence, the idea of flash orders causing the flash crash is in the regulator’s heads.

However, this rule is viewed as inappropriate by the markets, as exchanges queue orders at their servers and process them sequentially. Therefore, cancelled orders pose no threat to the exchanges. In particular, time in force is a problem as it would allow market makers to pick off the non-market makers and get market gains as a result.

There are other views in this area also, such as reallocating the cost of market infrastructure based upon order cancellation rates on a pro rata across trading firms. Again, sounds good in principle, but any reallocation of costs will simply get passed through to clients, so that’s not good either.

There’s also a long discussion about an SEC Consolidated Audit Trial.

The Consolidated Audit Trial should allow regulators to track information related to orders received and executed across the securities markets and, similar to the FSA’s view, should allow date-time stamping and order flow to be monitored and audited.

This sounds good in principle, although Tabb estimates that this will cost over $4 billion to build and $2 billion per annum to maintain.

Sounds costly.

Finally, things like a Central Limit Order Book (CLOB), a ban on stub quotes and concentration rules to bring order flow back onto exchanges are all being mooted.

All of these have issues, particularly the last which has not only been eradicated in Europe recently (MiFID reversed the national exchanges’ ‘concentration rule’) but it also would force orders from dark pools into lit markets. That’s not good for liquidity.

So what should be done?

Larry split this into four buckets.

First, the easy stuff such as co-ordinated circuit breakers.

This is a good move as part of the flash crash issue was uncoordinated markets. As the flash crash began, CME hit the circuit breakers but NYSE hit the LRPs. This meant that CME indexed products stopped trading, but cash products carried on so, while NYSE stopped trading in the cash markets, other markets didn’t.

Co-ordinated market breakers is an easy thing to bring in under regulatory process as it would just ensure all markets are consistent in approach.

Slightly harder but do-able is the Consolidated Audit Trail, already discussed. Add onto this an increase in collateral held with the CCP for HFT firms, new pre-trade and post-trade risk rules, and this may all help.

Tabb sees it as being really harder to do things like CLOB, which is probably why this has been discussed for over a decade but still not happening.

And it is impossible and undesirable to even think of going down the route of algo vetting or introducing market maker incentives, transaction taxes or other rules, according to Tabb.

All in all, a great overview of a complex subject and something that is still under wide debate across the industry.

It will be interesting to see how the debate concludes and, going back to my regulatory DUPE discussion, how the market is squeezed and the resultant bubble that forms.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...